Rule Number Two

The first three rules of investing in the stock market are: 1) the trend is your friend, 2) don’t fight the Fed, and 3) beware the crowd at extremes. Right now, stock market conditions are being dominated by Federal Reserve action and expectations for inflation, so a basic understanding of where the Fed is in the current interest rate hiking cycle might help investors navigate the terrain.

The classic definition of inflation is too many dollars chasing too few goods. The inflation that is currently causing havoc in the stock market lately is probably rooted in both sides of that equation. The hope and substantial probability, in our opinion, is that when these supply and demand forces begin to normalize, the Fed can stop tightening and the stock market will have started the recovery process.

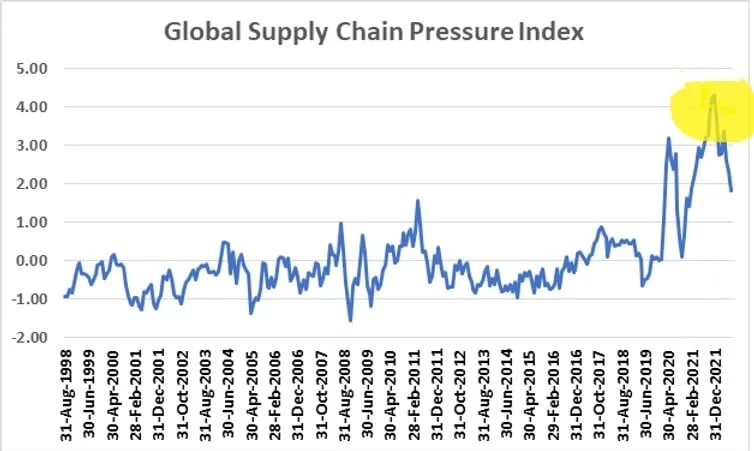

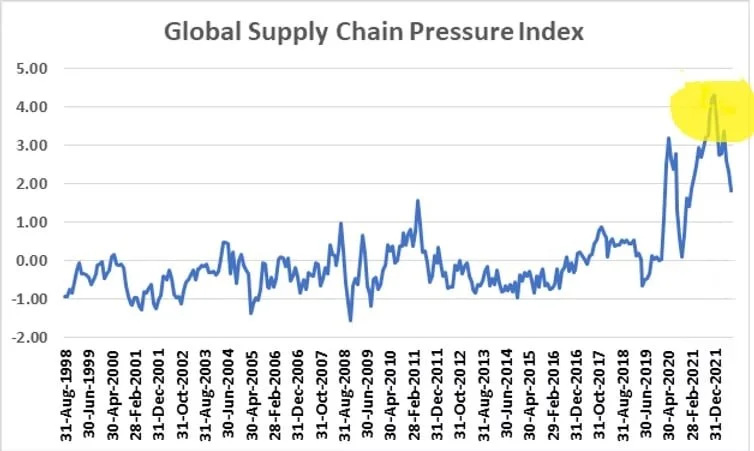

First let’s take a look at the supply side of the issue. The Federal Reserve Bank of New York recently created an index to measure supply chain conditions called the Global Supply Chain Pressure Index. According to their website, “Our index integrates transportation cost data and manufacturing indicators to provide a gauge of global supply chain conditions.” A chart of that index is below. While it appears, there is still some work to be done fixing supply chains, it looks like the log jam might have peaked in December of 2021 if the index is indeed a valid measuring stick.

Federal Reserve Bank of New York, Global Supply Chain Pressure Index, https://www.newyorkfed.org/research/gscpi.html

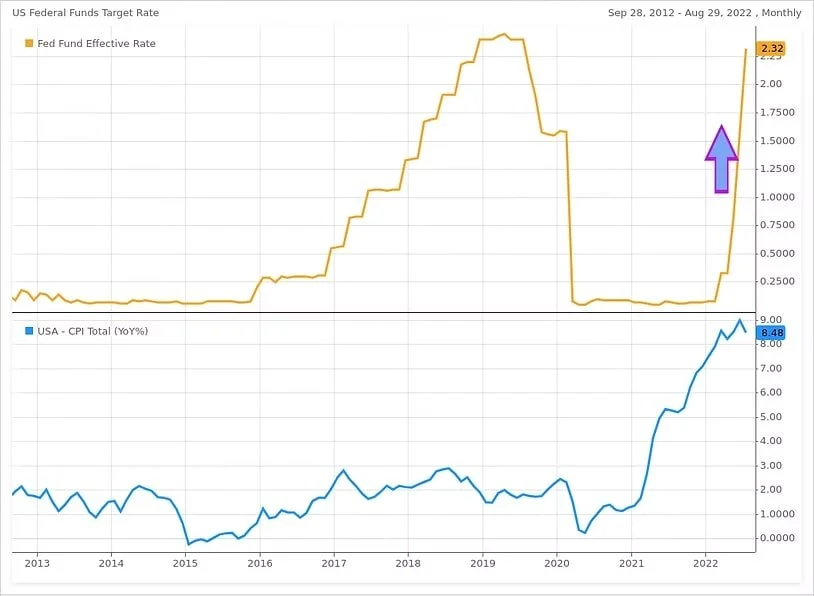

The Fed’s tool box is better suited to handle the demand issues that we currently face than the supply chain issues. Powell and Company might have started out behind the curve on raising interest rates but once they started, they got out of the box fast. This rate increase has been historically rapid. In fact, this time it looks like rates are actually going up faster than they went down during COVID. Hopefully this unprecedented action has caused inflation to peak or at least start the process. That’s important because we don’t think the Fed will stop hiking until inflation has been tamed. See rule number two above.

Fed Funds Rate (Top) and CPI (Bottom)

So, what’s the playbook? Our view is that stocks and the economy have held up relatively well given all that’s happened over the last two years but the market still has some work to do before the all-clear sign is given. We expect continued choppy trading with a better than 50% chance that the lows on the S&P 500 are in. Right now, we are holding elevated levels of cash and plan to only selectively buy stocks into periods of weakness. While picking exact numbers is a fool’s errand, logical levels for the S&P 500 to hold and potentially reverse are 3900 and 3600 which is near the old lows and we see 3200 as a possible worst-case scenario if the 3600 area doesn’t hold. As of this writing the major index stands at 4056. If it can trade for a few days above 4350 then we will consider the secular bull market to have resumed.