Why Value Investing is Under Performing Growth Investing

Nobody can predict the future with absolute certainty – nobody. However, in this business, we deal in probabilities, then we monitor and adjust. Therefore the astute analyst should be able to explain the situation on the ground and form an educated opinion about the future. The chart above shows the return of the Dow Jones US Value Index relative to the return of the Dow Jones US Growth Index. When the line in the top pane is rising then the value index is outperforming the growth index and vice versa. This concept is known as relative strength and its robustness is supported by numerous academic studies. Interestingly, the value index underperformed the growth index during the housing crisis, partially because the financial sector (traditionally a value sector) of the economy was ground zero for the collapse. But there’s a lot more to the story – read on.

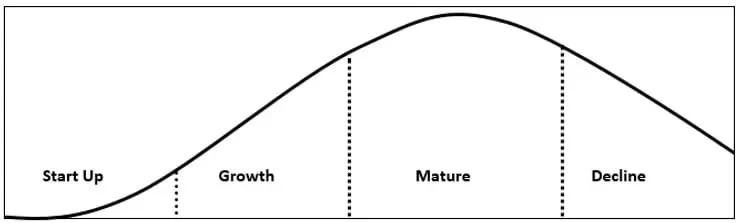

It might be helpful for the uninitiated to understand the difference between growth stock investing and value stock investing. In order to understand this difference, it’s important to understand that there is a typical lifecycle that most companies eventually follow. There are lots of different semantics and different ways to break it down but companies typically go through a cycle that consists of some form of start-up, growth, maturity and declining phases of their existence. Of course some companies that eventually go into decline are able to reinvent themselves and renter the growth or maturity phase. Other fortunate companies sometimes get acquired by a stronger company to be given a new lease on life or as part of the corporate strategy that was developed at their inception. The graphic below should illustrate the point.

Taking this concept one step farther, I need to borrow from a concept that was created by Bruce D. Henderson of the Boston Consulting Group in 1970 1 called the growth-share matrix. The growth-share matrix was originally developed to help companies analyze their portfolio of products and where each product is in its current lifecycle. By understanding each product’s place in its lifecycle, companies should be better able to make effective decisions about how to manage their product lines. However, I have seen the growth-share matrix used to effectively serve the same purpose when applied to a portfolio of stocks 2.

The Stars and the Cash Cows are typically in in the High Growth or Maturity categories or somewhere in between illustrated in the lifecycle graphic above. While one never really knows until after the fact where any given company is in its lifecycle, some examples of Stars in today’s environment are Starbucks, Facebook and Google (now called Alphabet). Some examples of Cash Cows are Exxon, Johnson and Johnson and Cisco Systems. Cisco was a Star in the tech boom but it has graduated to being a Cash Cow, in my opinion.

Question Marks are typically operating in industries with good growth but for some reason they have stumbled or not yet made it into the Star or Cash Cow categories. Maybe there is a new management team in place or a new product in the pipeline. A Question Mark could be a biotech company waiting on FDA approval for a promising new drug or it could be a turnaround situation. The Question Mark in question might be headed for Dog status in what is known as a ‘value trap’. But there is hope for a shot at Star or Even Cash Cow status one day.

Dogs are slower growing companies in slower growing industries. Sometimes a Dog can make the leap to one of the other categories but they are generally in the declining phase of their lifecycle. A good example of a Dog would have been almost any of the auto manufacturers during the Great Recession.

While growth stock investors and value stock investors can cross category lines, classically value investors operate in the Question Mark category while growth stock investors operate in the Star category. Both tend to operate in the Cash Cow category. Dogs can sometimes make good hunting grounds for value investors.

So why am I telling you this? Well, there is one irrefutable law of Economics – the Law of Supply and Demand. It’s really simple to explain with an example. Let’s suppose you have one apple that you want to sell. The apple is so perfect that it looks like it belongs on a magazine cover. Furthermore, you are locked in a room with thirty hungry people with lots of cash in their pockets. You can probably sell that apple for a really high price if they don’t attack you and steal it first – a really high price. Those people really want that apple and you don’t have to sell it (because you brought security). This is an example of what happens when demand is high and supply is low.

Now let’s change the situation. This time let’s suppose you are on the side of the road way out in the middle of nowhere and you’ve set up a fruit stand. For some strange reason there are fruit stands every few miles on this long stretch of highway, which by the way doesn’t have very much traffic. Your apples have been in the sun for a while but they still look ok – not great but ok. You’re probably going to be better off eating the fruit than selling it for an upgrade to steak and lobster. This is an example of what happens when demand is low and supply is high.

The Law of Supply and Demand also applies to the valuations that people will pay for stocks. When investors buy stocks they are buying a claim on the future earnings that they think will be generated by those companies (growth and value investors alike). When earnings growth is scarce or slowing as it has been lately, investors have historically been willing to pay a higher multiple for high quality growth stocks that they perceive can deliver on future earnings growth. Since value stocks by their very nature are the stocks of companies that are temporarily out of favor because of some issue or perceived issue with their earnings (Question Marks, Dogs or out of favor Cash Cows), they should be expected to underperform the companies that are presently delivering on earnings expectations in a weak economic recovery (Stars and Cash Cows that are delivering on earnings). In a strong economy, when even troubled companies are thriving, the reverse should be true.

Sooner or later though, the long term underperformance of value stocks relative to growth stocks should reverse itself in one of two ways, in my opinion. The first path to a turnaround in the massive underperformance of value stocks as an asset class would require a much stronger economic recovery than we have seen so far. That would be the most desirable situation. This could help the Dogs and Question Marks recover. Or the recovery underway could morph into a recession. If this scenario were to occur the result should be bad for both growth and value stocks but growth stocks could suffer more since they have been dominating for so long.

So which strategy is best? The answer depends upon the investor. Investment personality and the economic environment that unfolds – a known unknown – generally turns out to be the key to personal success in investing. Fortunately for clients of Emerald Asset Management, when the preponderance of the evidence demonstrates a potential change in the trend currently favoring growth over value (primarily via relative strength) we can capitalize on it because at Emerald Asset Management, we are style box agnostic.

2 Value Stock Guide October 22, 2012