The Best Opportunities Usually Appear During Recessions, Not After

We believe that the economy is currently in or about to be in a mild recession. Most of the indicators that we monitor indicate that the economy has weakened. That’s the bad news. But the good news is that inflation appears to be coming down and the labor market remains strong. Hopefully, the Fed Funds rate will have peaked at the May Fed meeting with one last quarter point increase. That should set the stage for the next bull market in US equites.

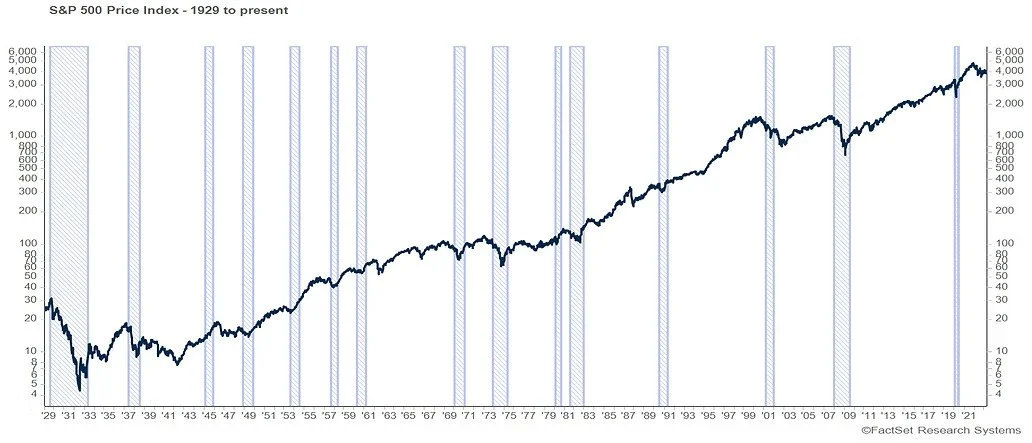

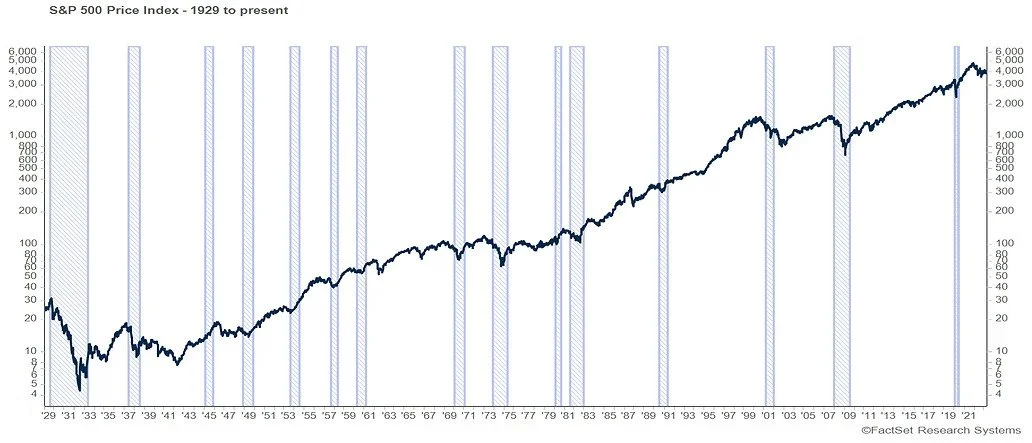

The shaded areas on the chart below represent previous recessions going back to 1929.A cursory glance shows that in most cases, stocks have bottomed during past recessions as opposed to after those recessions are finished.That’s because the stock market discounts the future, not the past.Those who wait for the all clear sign are usually late getting their fair share of the next bull market.We think that aggressive investors should accumulate select names opportunistically now and conservative investors should be making their buy lists.