Emerald Insights: Empowering You with Knowledge and Clarity

Timely guidance, educational tools, and curated content to support confident financial decisions.

Wild Horses, Outer Banks, NC

Third Quarter 2025 Recap: Bullish Trends & Sector Standouts

After a rocky start to the year, markets rebounded in Q3 2025 with broad equity strength and signs of a new bull cycle emerging. Discover what’s driving momentum and which sectors are leading the charge.

Markets Rebound Sharply in Q2 as Investors Look Past Tariff Jitters

After a volatile start to the year, U.S. equity markets delivered a surprisingly strong second quarter, shaking off early concerns over trade tensions and signaling a potential shift toward the next leg up of a longer-term bull market.

Q1 2025: A Quarter of Diverging Market Performances

The first quarter of 2025 presented a complex narrative for financial markets, characterized by significant volatility and varied performances across asset classes.

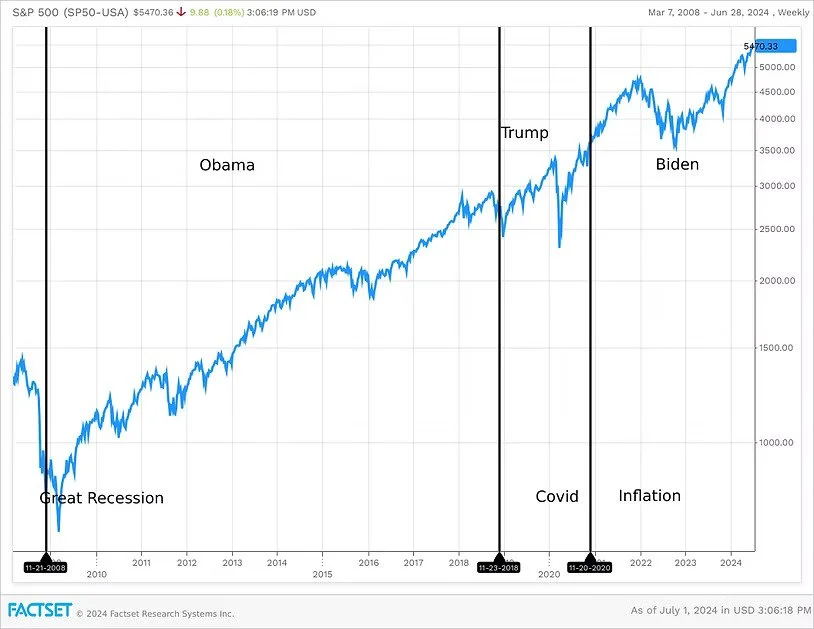

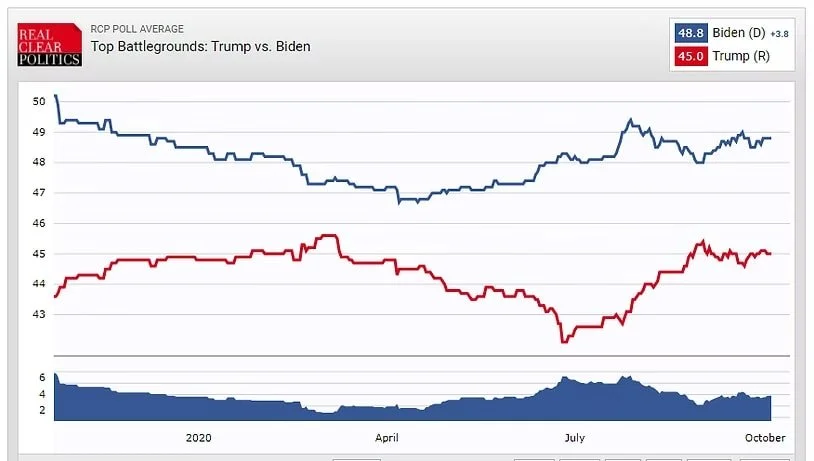

What About the Election – A Few Simple Charts

As we enter the election season leading up to November 5th, I expect increased market volatility and an increase in client inquiries about the election and how it will affect stock and bond prices.

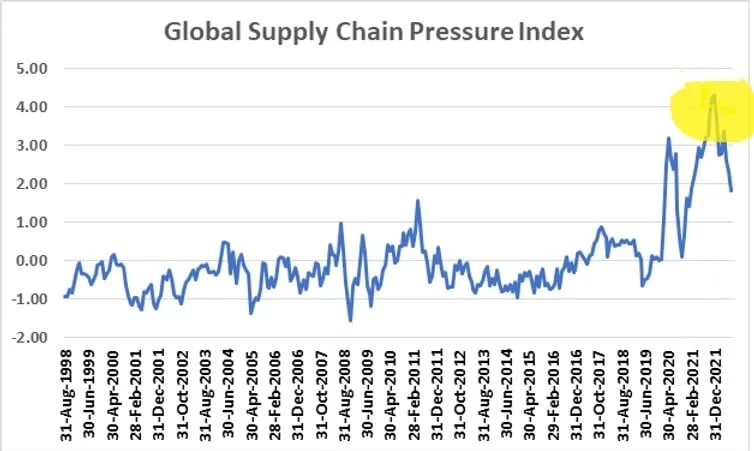

Headwinds Should Become Tailwinds Soon

The total return for the S&P 500 for the 3rd quarter was a minus 3.27% although the major index has returned a positive 13.07% year to date. Large cap stocks generally outperformed small caps while the 10-year Treasury Yield touched 4.6%.

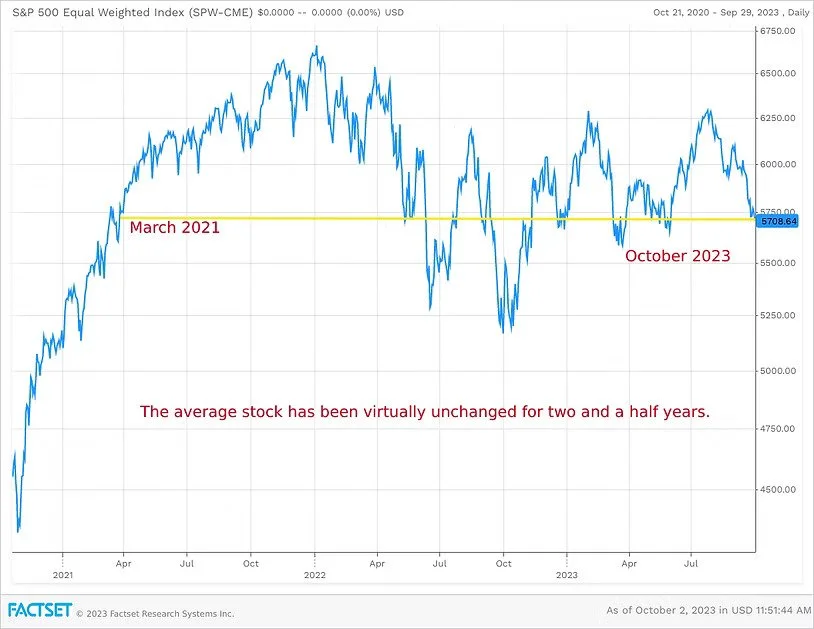

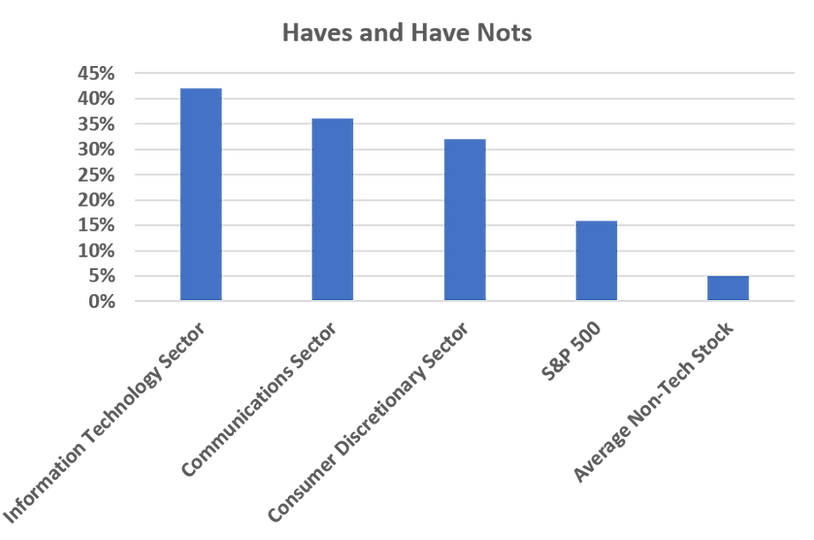

A Tale of Two Markets

The first half of 2023 is done and over and to the novice investor, the stock market looked incredibly strong. The S&P 500 booked a total return of 8.3% for the 2nd quarter and 15.9% for the first half of the year.

The Best Opportunities Usually Appear During Recessions, Not After

We believe that the economy is currently in or about to be in a mild recession. Most of the indicators that we monitor indicate that the economy has weakened.

Will 2023 Be A Better Year?

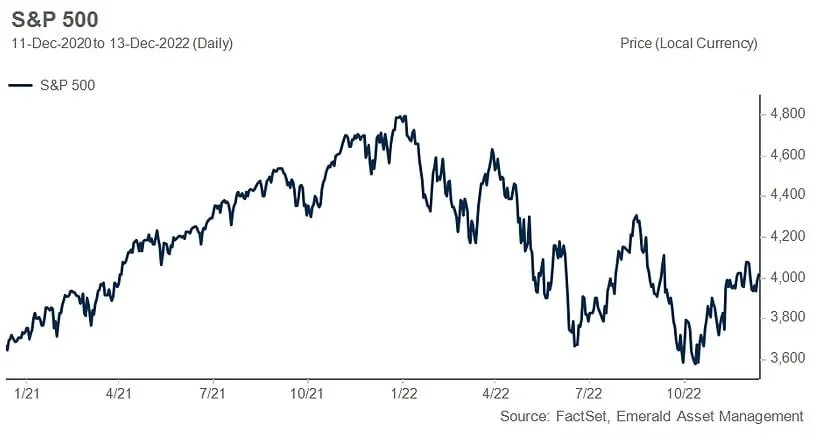

Most people are well aware that stocks have been under pressure this year. The first chart below shows the selloff as most laypeople understand it. However, the following chart shows the Nasdaq Advance / Decline ratio.

Watching the Fed

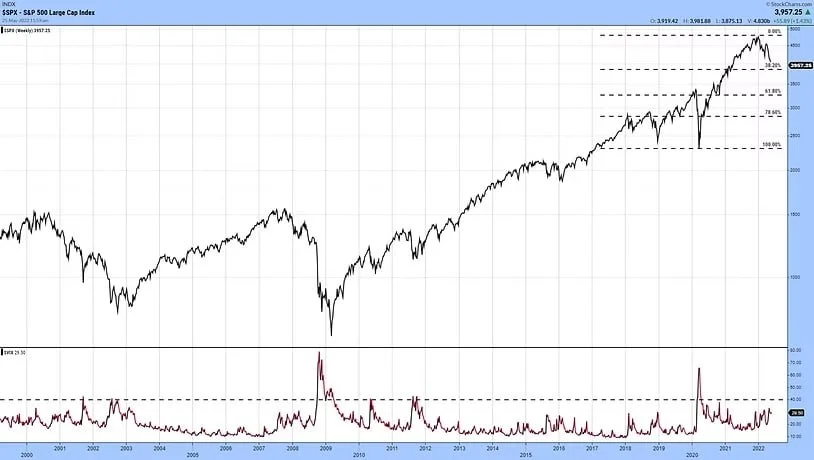

The broad US stock market indices finished down for the third quarter in a row with the S&P 500 coming in at minus 24.77, the Nasdaq down 32.40% and the Russell 2000 down 25.19% year to date. In bear markets, surprises tend to be to the downside so we do expect some elevated volatility in the short term,

Rule Number Two

The first three rules of investing in the stock market are: 1) the trend is your friend, 2) don’t fight the Fed, and 3) beware the crowd …

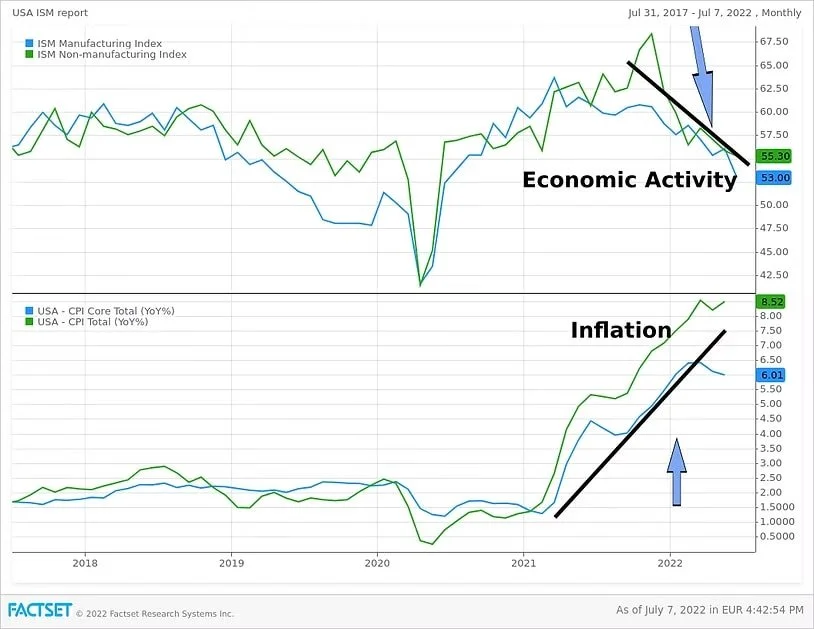

Slowing Economic Activity and Rising Inflation - A Dangerous Combination

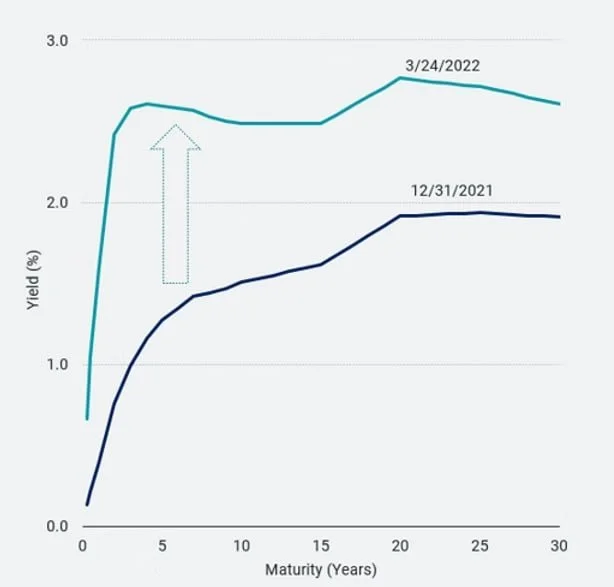

You’ve undoubtedly heard by now that the S&P 500 just had its worst six month start to any year since 1970 coming in at minus 20.58%. The Nasdaq finished the 2nd quarter down 29.51% YTD while the small caps as measured by the Russell 2000 were off by 23.93%. And to make matters worse, there was nowhere to hide other than cash.

Stock Market Bottoms Don't Require Capitulation but it Sure Does Help

One of the advantages of getting older is experience and the wisdom that (supposedly) comes with it. I would say that over 30 years of playing 'The Greatest Game' would qualify me as an experienced investor.

In Case you Haven’t Heard

I hate to be the bearer of bad news but…various parts of the yield curve have started to invert. If I haven’t already lost you, please read on. This is important.

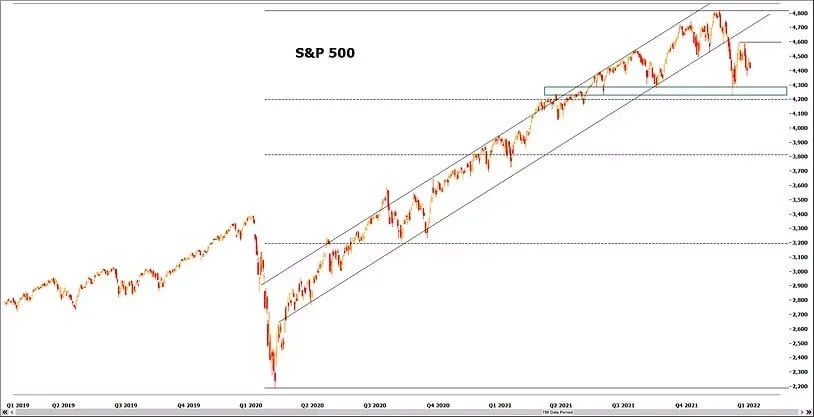

The Cat is on the Fence - Which Way will he Jump?

It appears that the bounce off the Covid lows in the S&P 500 that started in late March of 2020 has come to an end, but only temporarily. For now, we expect stocks to trade in a sideways fashion before resuming the secular uptrend as the institutional crowd

A Few Charts Worth Watching

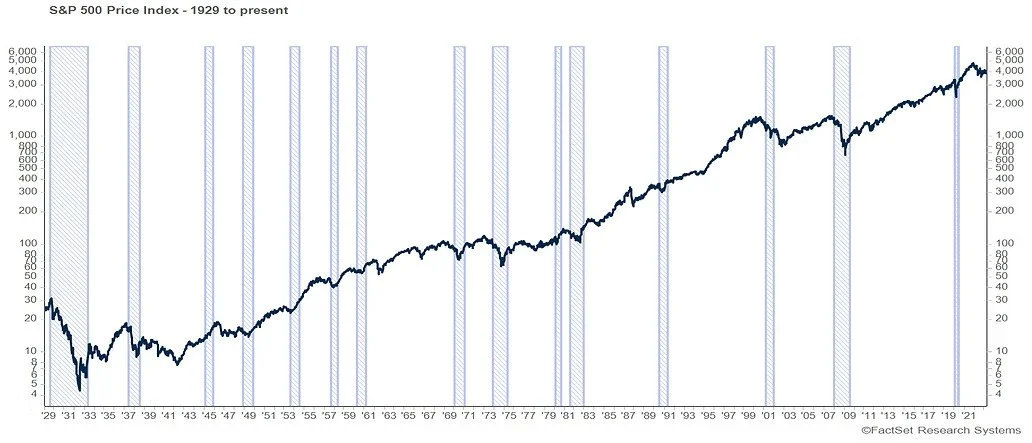

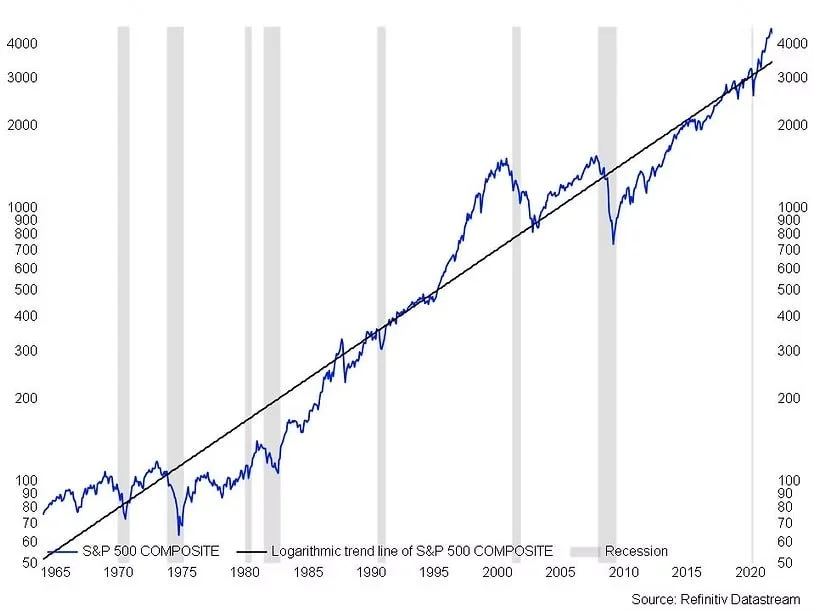

The S&P 500 is above its long-term trend line going back to the 1960’s reflecting the post Covid rally.

Time to Make a Few Trades?

Retirement planning comes with plenty of options, but few financial products generate as much buzz, or confusion, as annuities.

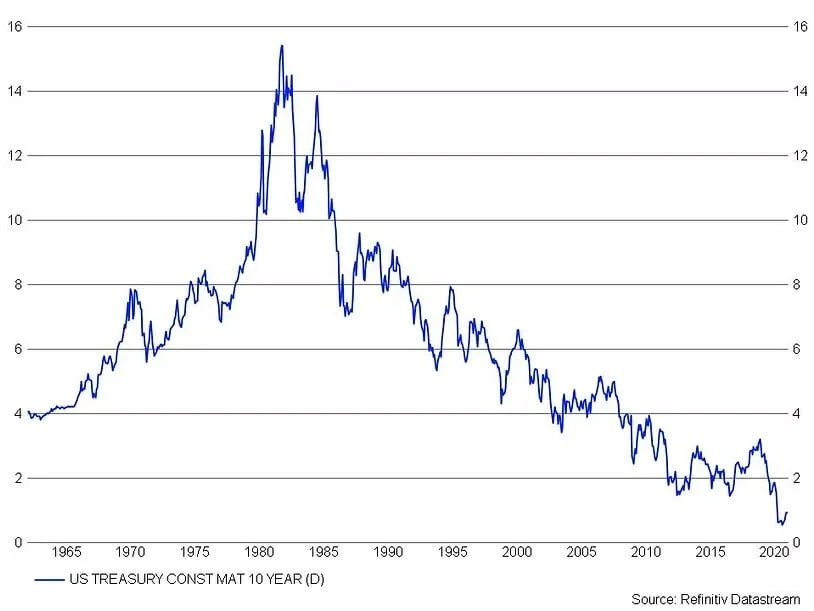

From 1950 to 1981 to 2020 - The Big Picture

After nearly thirty years in the investing game, I’ve seen a lot of changes. I’ve seen great companies and even entire industries be born and disappear. Keeping up with current events and the news of the day is really one of the biggest parts of my job. The

What about the Election?

If you are already tired of the election ads everywhere you’re not alone. I’m tired of them too and we still have about a month to go. As people become numb to the effects of the Corona-virus,

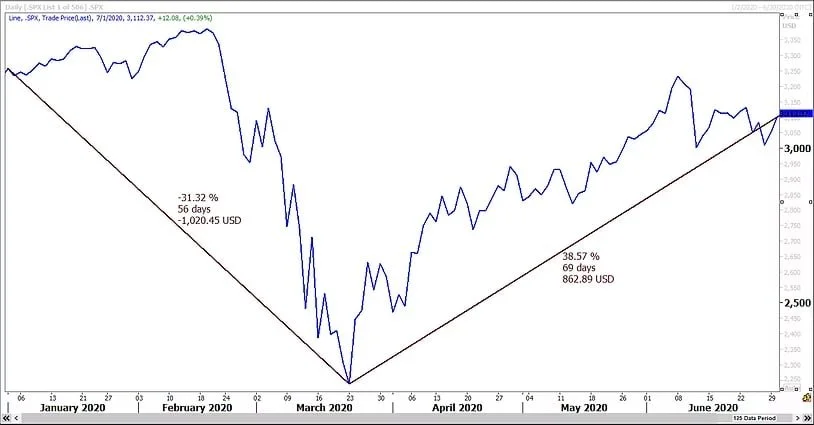

Second Quarter Review

Somehow it just doesn’t feel like the S&P 500 had its fourth best quarter since 1950, but it did. The S&P 500 started this year at 3244.67 and closed out the second quarter out at 3100.29.

The Roaring '20's?

I think the last thing anybody needs right now is a recap of the first quarter. Unless you’ve been living under a rock, and I guess that’s what we’re supposed to be doing now, you already know all about the second biggest story to sink the stock market in my nearly thirty year investment career.