Markets Rebound Sharply in Q2 as Investors Look Past Tariff Jitters

After a volatile start to the year, U.S. equity markets delivered a surprisingly strong second quarter, shaking off early concerns over trade tensions and signaling a potential shift toward the next leg up of a longer-term bull market.

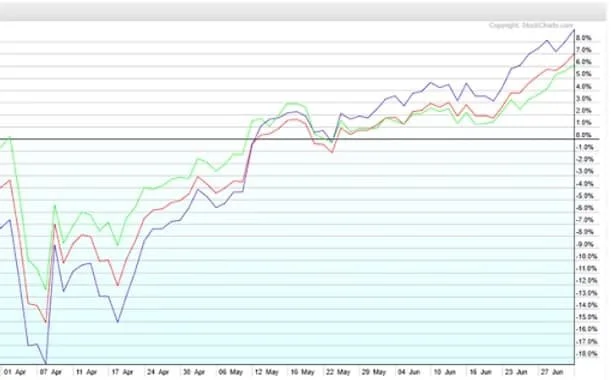

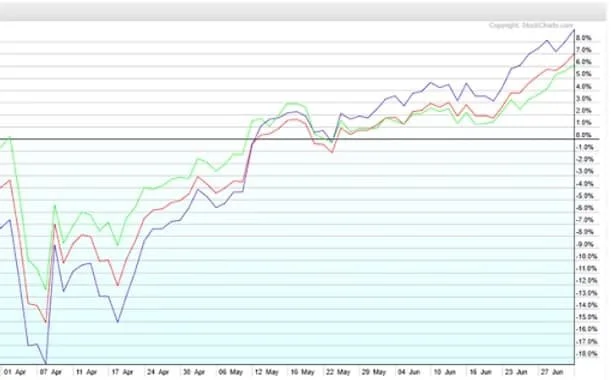

The S&P 500 rose 10.8% in the second quarter, while the tech-heavy NASDAQ-100 surged 16.9%, buoyed by strong earnings from mega-cap technology names and renewed enthusiasm around artificial intelligence. The rally came despite a steep drawdown in April, when newly announced tariffs triggered a brief but intense bout of risk-off selling. For the first two quarters of the year, the S&P 500 returned 6.4%, while the NASDAQ-100 gained approximately 8% with the Equal Weighted S&P 500 Index lagging at +3.8%.

Source: StockCharts.com. Data as of 7/14/2025.

We think there was a real risk of stocks falling into a secular bear market in response to the Liberation Day Tariffs. However, the S&P 500 never violated its 200-week moving average, which is one of the primary criteria we use at Emerald Asset Management to distinguish between secular bull and secular bear markets. We now believe the risk of a new bear market has been taken off the table.

Sector Leadership Shifts as Growth Regains Momentum

Market leadership during the quarter was notably broad, but with a distinct tilt back toward growth. Communication services and consumer-facing tech stocks—names tied closely to AI, advertising, and streaming—led the way.Financials, which had struggled in the first quarter, bounced back sharply as expectations for falling interest rates gained traction. We believe financials are also likely to benefit from an expected pick-up in M&A activity. In particular, we have been investing in the stocks of select alternative investment managers. Cyclical sectors such as industrials and small caps also found buyers late in the quarter, reflecting improving sentiment around the economy’s durability.

Meanwhile, traditional defensive sectors like utilities, staples, and health care lagged. Energy was the biggest underperformer over the six-month period, down more than 13% as oil prices retreated from early-year highs.

Source: Schwab Sector Views. Data as of 7/28/2025.

The Fed Holds Steady, But Easing Expectations Build

The Federal Reserve kept interest rates unchanged in its June meeting, maintaining the federal funds target range at 4.25% to 4.50%. But the tone has shifted. Policymakers now project two rate cuts by year-end, signaling a more dovish stance in the face of moderating inflation and weakening economic momentum.

That shift helped fuel the market rally in May and June, even as inflation data showed a modest uptick—largely attributed to new tariffs announced in April. Those tariffs, which affected a wide range of imports including steel, aluminum, and certain electronics, raised concerns about a potential trade war. But a 90-day implementation delay appeared to calm investor nerves, and the market treated the policy more as a negotiating tactic than a structural shift.

What This Means for Investors

The strong first-half performance underscores growing investor confidence and supports the idea that we may be entering a new cyclical bull phase. That said, late summer and early fall are often seasonally weak periods for the market and we wouldn’t be surprised to see some near-term volatility. But rather than viewing that as the start of a new downturn, we believe any pullbacks should be seen as potential buying opportunities, not signs of a return to a secular bear market. In short, we believe the secular bull market is still alive and well.

Emerald Asset Management is an independent, boutique Registered Investment Advisory firm based in Rocky Mount, NC, serving successful executives, business owners, and high-net-worth individuals across Raleigh, Durham, and Chapel Hill. As a fiduciary-led firm with over 30 years of experience, Emerald provides research-driven investment management and strategic financial planning. The firm specializes in individually managed stock and bond portfolios, alternative investments, and risk management strategies. With a disciplined approach and a commitment to clarity, Emerald helps clients navigate complex financial decisions with confidence. They can be reached at (252) 443-7616 or on the web at www.emeraldam.com.

The information presented is based on sources believed to be reliable and accurate at the time of publication, but accuracy and completeness cannot be guaranteed. The opinions expressed herein are those of Emerald Asset Management as of the date of publication and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. This document may contain certain information that constitutes “forward-looking statements” which can be identified by the use of forward-looking terminology such as “may,” “expect,” “will,” “hope,” “forecast,” “intend,” “target,” “believe,” and/or comparable terminology. No assurance, representation, or warranty is made by any person that any of Emerald Asset Management’s assumptions, expectations, objectives, and/or goals will be achieved. Nothing contained in this document may be relied upon as a guarantee, promise, assurance, or representation as to the future. The S&P 500 measures the performance of the 500 leading companies in leading industries of the U.S. economy, capturing 75% of U.S. equities. A 10-year U.S. Treasury note is a debt obligation issued by the U.S. Treasury Department that has a maturity of 10 years. It is not possible to invest directly in an index. Emerald Asset Management is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Emerald Asset Management's investment advisory services can be found in its Form ADV Part 2 and/or Form CRS, which is available upon request.