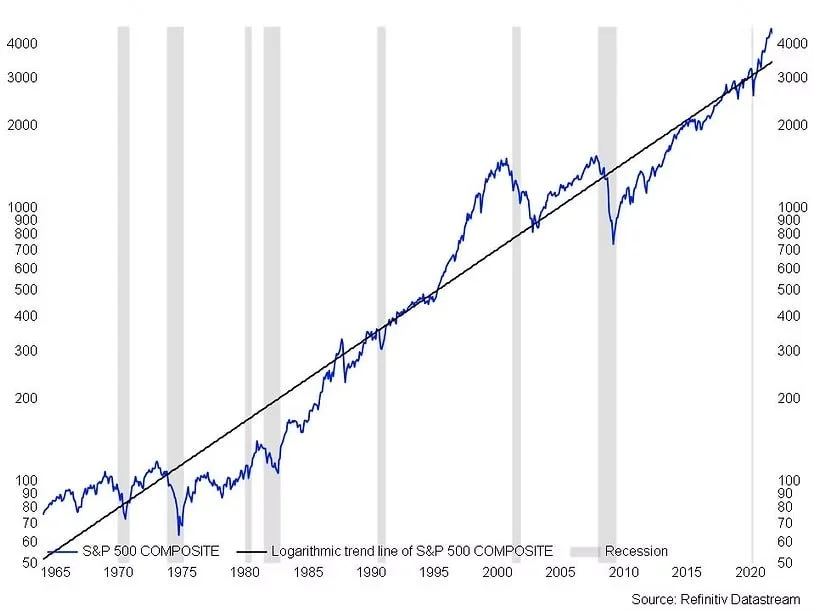

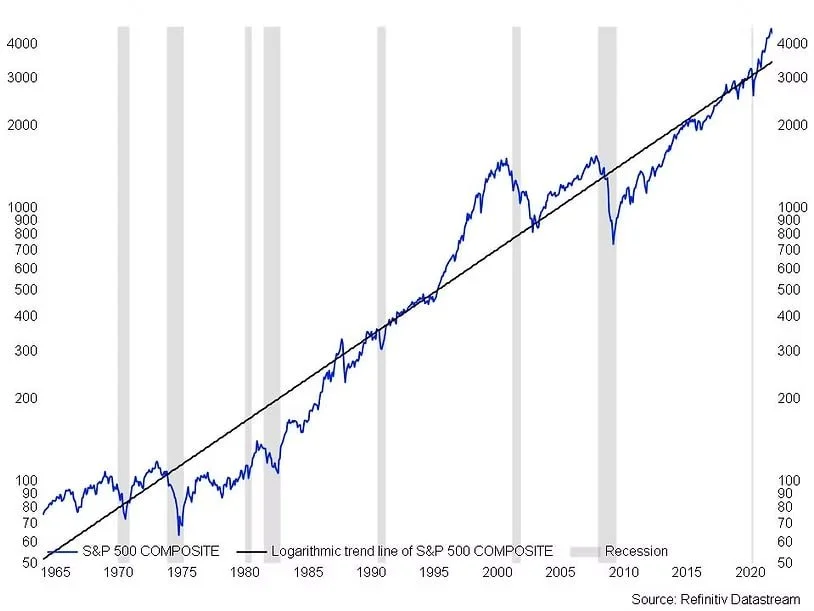

A Few Charts Worth Watching

The S&P 500 is above its long-term trend line going back to the 1960’s reflecting the post Covid rally.

As we have written in the past ad nauseum, interest rates are still low but rising. We think that THE low in long term interest rates is in. While we aren’t overly worried that inflation will get out of hand anytime soon, we do think that the path of least resistance is higher as the Great Reopening continues.

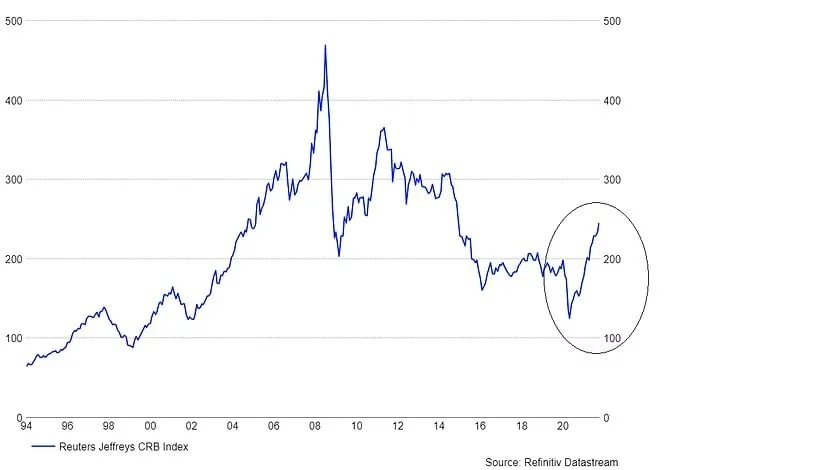

Commodities appear to be in at least a cyclical bull market if not a secular bull market. Time to get long the ‘rising interest rates / inflation’ trade?

The longer-term trends in the housing market remain strong. The recent pullback in select housing equities could present a potential buying opportunity, in our opinion.