The Cat is on the Fence - Which Way will he Jump?

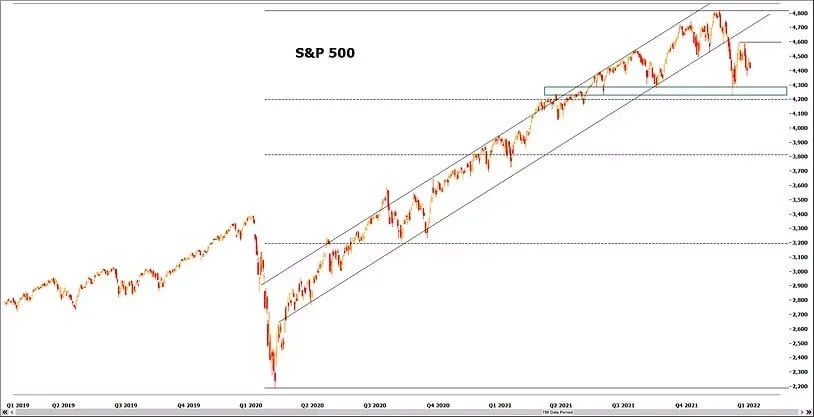

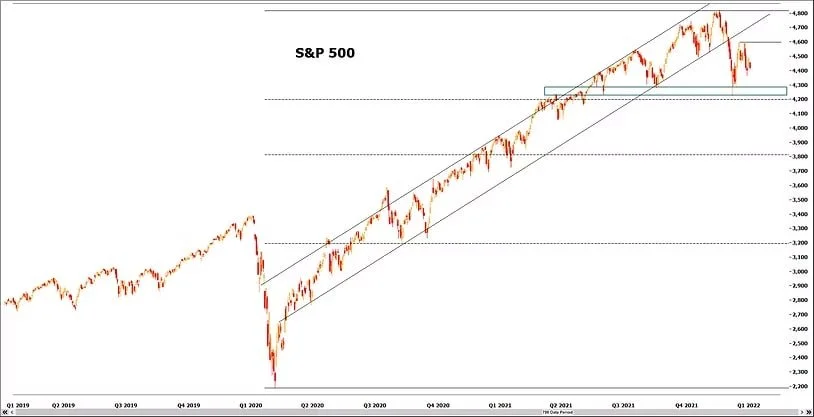

It appears that the bounce off the Covid lows in the S&P 500 that started in late March of 2020 has come to an end, but only temporarily. For now, we expect stocks to trade in a sideways fashion before resuming the secular uptrend as the institutional crowd accumulates shares at the bottom of the range and distributes shares into market strength. IF the recent lows in the roughly 4200 to 4300 on the S&P 500 do not hold, we would look for a drop to the 3800 area which we believe would be an absolute gift to investors waiting to deploy cash into US equities. Possible catalysts for another leg down include overly aggressive Fed action combined with a flatter yield curve and the potential for conflict in Ukraine. For now, we are using $235 as our 2022 estimate on the S&P 500 so a price approaching 3800 - 3900 would give us a forward P/E ratio of around 16 to 16.5 which we think is relatively cheap in this environment. A decisive break of 4600 to the upside would be powerful evidence that the uptrend is back in play.