Emerald Insights: Empowering You with Knowledge and Clarity

Timely guidance, educational tools, and curated content to support confident financial decisions.

Wild Horses, Outer Banks, NC

Catch-Up Contributions Are Changing—Here’s What You Need to Know

The ability to reduce taxable income with pre-tax catch-ups is ending for some. Understand the shift coming in 2026 and what it means for your future savings.

What We Can Learn from History’s Greatest Investors

What do a mathematician, a value investor, and a trend follower have in common? Learn how Simons, Buffett, and Livermore approached investing, and what their strategies can teach us today.

Why Successful Investors Focus on Risk Management, Not Forecasts

When markets turn volatile, it’s natural to look for answers. Is now the time to move to cash? Should I double down on stocks? Predictions can feel reassuring, but history has shown that even experts rarely get them right consistently.

Roth IRAs: Why Tax-Free Growth Could Be Your Most Valuable Asset

Imagine building wealth for decades and never owing taxes on the growth. That’s the unique advantage of a Roth IRA, one of the most powerful tools for retirement planning. While most people naturally focus on how much they’re saving, it’s just as important to consider where those savings go.

How Qualified Investors Access Private Equity: A Practical Guide to Today’s Entry Points

Behind many billion-dollar success stories is a private equity firm that got there first—quietly, strategically, and well before the headlines. Private equity isn’t about chasing quick wins.

Seeing the Market Clearly: How Relative Strength Guides Smarter Investment Decisions

Strong performance isn’t always obvious at first glance. But with the right lens, you can see where trends are quietly taking shape. Relative strength helps investors do just that—by comparing performance across assets to uncover consistent momentum.

Rethinking Diversification: Why Private Equity Deserves a Place in Your Portfolio

At Emerald Asset Management, we have long believed in the power of U.S. equities as the core engine of portfolio growth. Few markets in the world can match the resilience, innovation, and wealth-building capacity of American businesses. That conviction has not changed.

The Mind Games of Investing: Navigating Emotions for Long-Term Success

Ever feel like your instincts are pulling you in the wrong direction when it comes to money? You're not alone. Even the most seasoned investors can fall prey to emotional decision-making.

Understanding Dividends: How They Can Fit into Your Investment Strategy

Tired of meager returns in a low-interest rate environment? Investing in dividend stocks could be a compelling strategy to earn passive income and capitalize on long-term market growth.

Alternative Investments: Beyond the 60 / 40 Portfolio

At Emerald Asset Management, our primary focus is managing stock portfolios for our clients. Our flagship strategy, called the Global Rising Dividend Strategy, is designed to generate returns through capital appreciation and dividend income.

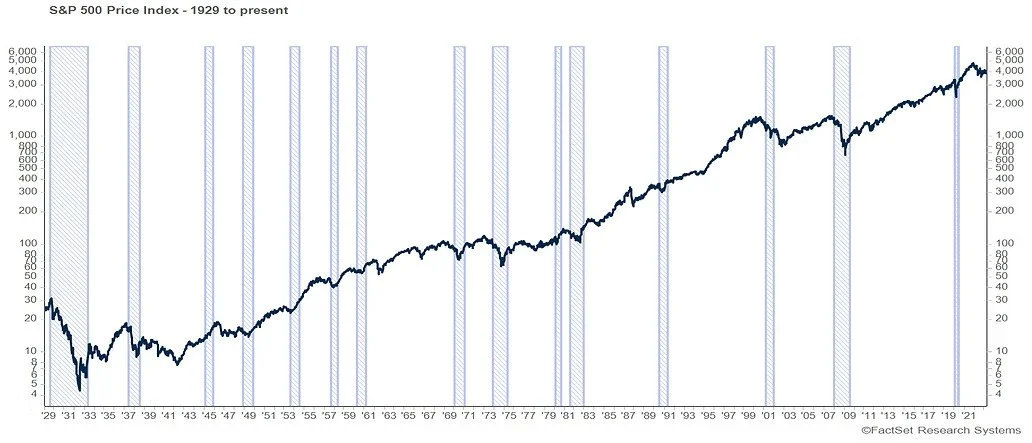

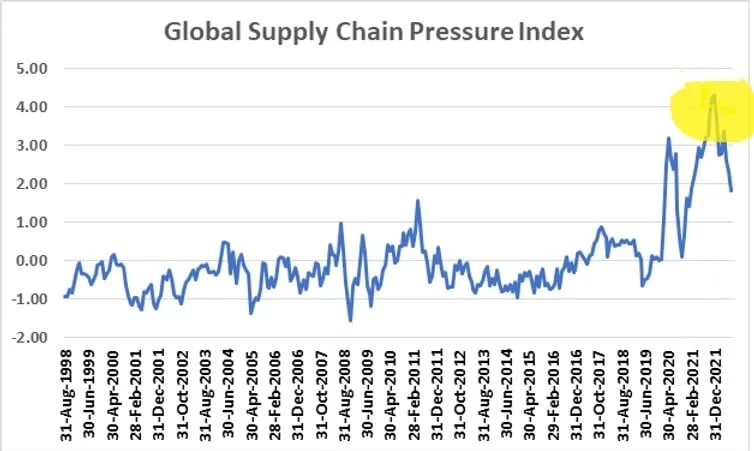

The Best Opportunities Usually Appear During Recessions, Not After

We believe that the economy is currently in or about to be in a mild recession. Most of the indicators that we monitor indicate that the economy has weakened.

Rule Number Two

The first three rules of investing in the stock market are: 1) the trend is your friend, 2) don’t fight the Fed, and 3) beware the crowd …

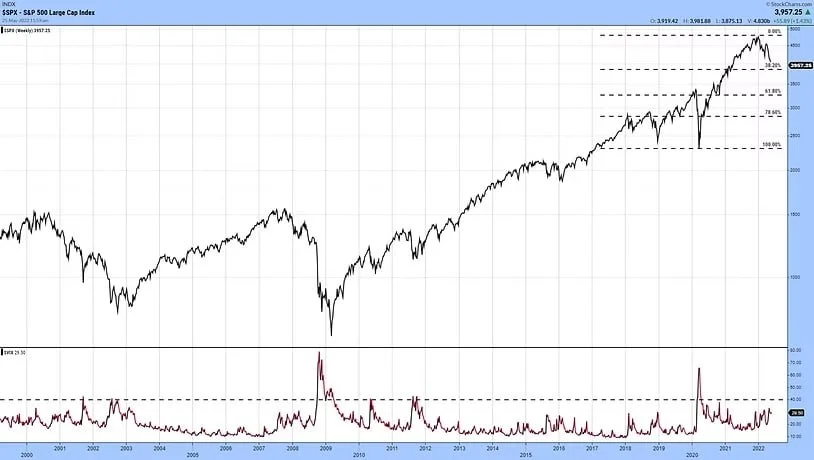

Stock Market Bottoms Don't Require Capitulation but it Sure Does Help

One of the advantages of getting older is experience and the wisdom that (supposedly) comes with it. I would say that over 30 years of playing 'The Greatest Game' would qualify me as an experienced investor.

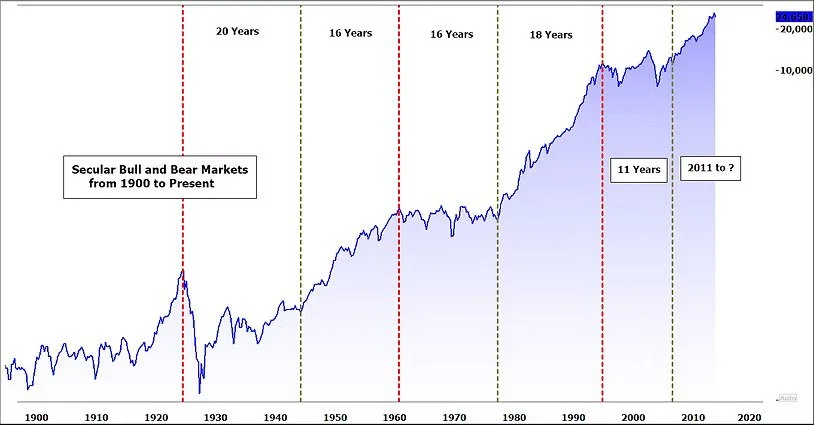

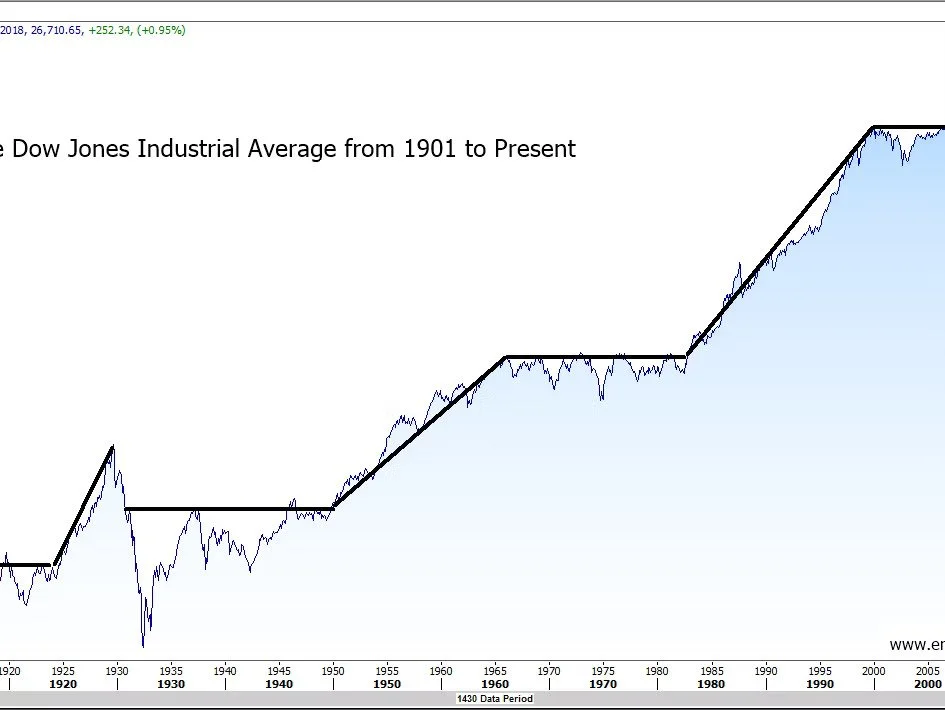

Hold Your Positions, it’s a Bull Market (duh)

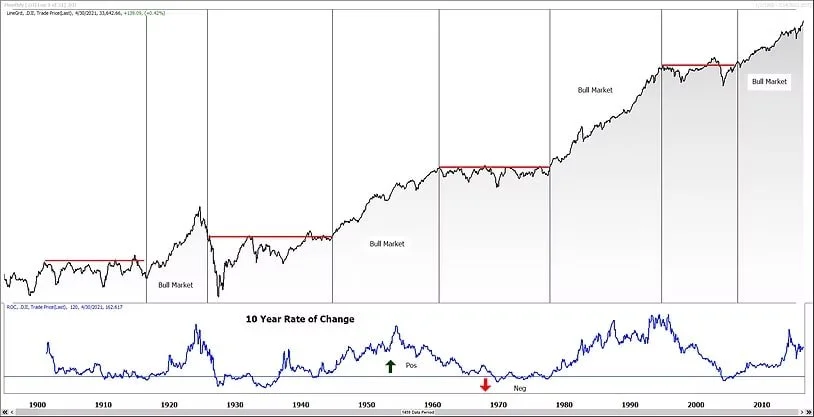

As long term investors, which most of our clients are, the goal is to buy high quality equity investments and hold onto those investments until something changes with the company or until it is apparent that an existing bull market has come to in end. Its not possible,

Smart Money Versus Dumb Money – Which are You?

According to Investopedia “The basic efficient market hypothesis posits that the market cannot be beaten because it incorporates all determinate information into current share prices.”

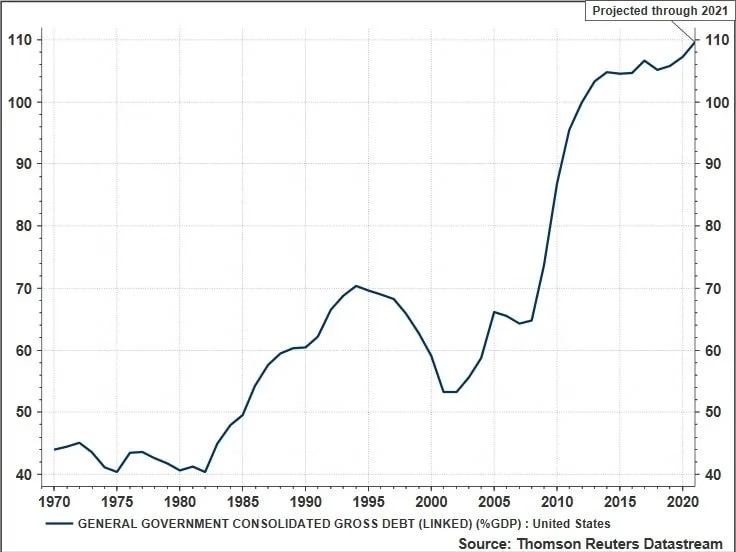

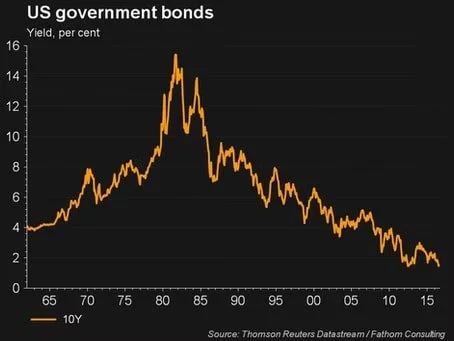

Somebody Lend Me a Dollar

Making the rounds in the press lately are many stories about the United States Debt Level passing the $22 trillion mark. Some are concerned about the debt level and others argue that deficits don’t matter.

2019 - More Turbulence Ahead?

The stock market flew through the 2018 clouds with plenty of turbulence. We wouldn’t necessarily term 2018 as a bad flight but we’ve certainly had more pleasant experiences in the friendly skies.

Well, It's a Bull Market

I’ve been at the business of investing money for clients and myself for 27 years - almost to the day. I didn’t know it then but after my first five years as a stock broke

Building a Better Bond Portfolio

A well constructed bond portfolio can stand-alone as a total portfolio or as part of a broader asset allocation strategy. There are many reasons that an investor might choose to allocate some or all of their investment capital to fixed income securities.

The Valuation Bears Have it Wrong

In today’s low return environment, investors are scrambling to find higher yielding investments in order to fund future or a current liabilities like retirement, the purchase of a second home, or a college education.