Building a Better Bond Portfolio

A well constructed bond portfolio can stand-alone as a total portfolio or as part of a broader asset allocation strategy. There are many reasons that an investor might choose to allocate some or all of their investment capital to fixed income securities. Investors usually invest in bonds to either provide a predictable stream of income, fund a known liability at a known future time or as part of an overall asset allocation strategy that is designed take the volatility out of an equity portfolio. In today’s low interest rate environment a high quality properly structured bond ladder can be a great alternative to investing in CDs. Municipal Bonds can also provide tax benefits.

One very big concern that investors need to face when structuring a bond portfolio is called interest rate risk. A general rule is that bonds tend to fluctuate in the opposite direction of interest rates. Since interest rates have been falling since 1982 and since interest rates appear to be low relative to the recent past, it’s no wonder that interest rate risk is at the forefront of bond investors’ minds in today’s current low interest rate environment.

What’s a conservative investor to do? By simply understanding your bond investments you can potentially avoid some of the pitfalls that exist. Investors in bonds generally want safety. But if you don’t understand and properly manage the risk that one is assuming by investing in bonds, then what was supposed to be ‘safe money’ could end up not being so safe. Remember, bonds have a maturity date. So except in the event of a default, there is a known amount of money that will be paid to the investor at a known date. It is important to note that bond mutual funds do NOT have a stated maturity date. Therefore, there is no known date when an investor can expect to receive a known dollar amount. If you do choose to invest in individual bonds, remember that bonds with longer term maturities tend to be more sensitive to changes in interest rates, all else being equal. Fortunately there are strategies that can help fixed income investors take the guesswork out of future interest rate movements. The best known and easiest of these strategies for most people to implement is called a bond ladder.

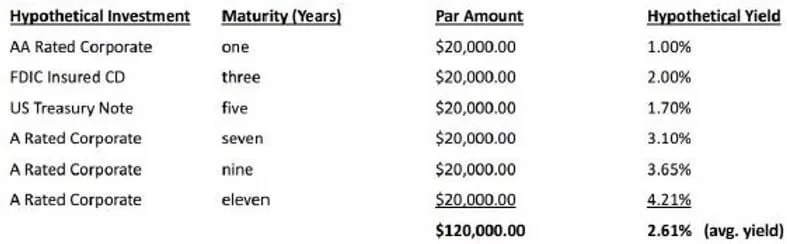

A bond ladder works as follows. The portfolio is built by purchasing bonds with differing maturities such as one, three, five, seven, nine and eleven year maturities (two year intervals in this example). Or, if you are managing a portfolio for liquidity you might purchase bonds that mature in six, twelve, eighteen and twenty four months (six month intervals in this example). As each bond matures, the proceeds are reinvested into new bonds at the long end of the ladder which is where the highest yielding securities in the portfolio are typically found. The key is that you periodically have securities maturing and you keep reinvesting at the longer term end of the chosen maturity spectrum to keep the average yield on the portfolio up. Put another way, as the lower yielding short term bonds mature then all future investments are made at long term interest rate levels. If interest rates are rising then proceeds will presumably be invested at higher interest rates. If rates are falling then principal and interest reinvested will be at lower long term rates than previously available but the rest of the ladder will be locked in to the rates previously captured. Below is an example to illustrate the point of how an investor might use this strategy to invest in taxable bonds in an IRA. Investors in a high marginal tax bracket investing in taxable accounts might consider using municipal bonds for the potentially tax free income they can generate.

In one year, this is what the portfolio would look like keeping a similar maturity and quality schedule if interest rates remained roughly the same. Investing at a lower long term interest rate actually caused the yield to maturity on the portfolio to rise. Notice that the one year AA rated corporate bond from the first example has been replaced with a twelve year AA rated corporate bond. Although the new twelve year bond has a lower yield than the previous eleven year bond, the yield on the portfolio has increased.