The Valuation Bears Have it Wrong

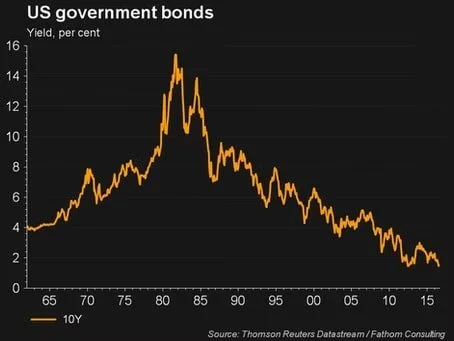

In today’s low return environment, investors are scrambling to find higher yielding investments in order to fund future or a current liabilities like retirement, the purchase of a second home, or a college education. A quick glance at the chart above should point out the obvious to anyone who doesn’t already know it yet. Interest rates are low by historical standards. To make matters worse, many investors are still licking their wounds from the tech wreck and the bursting of the housing bubble of the first decade in the new century. The broken clock bears are pointing at valuations as the ultimate rationale for the next Financial Armageddon. What they are overlooking in our opinion though, is that stocks might actually be cheap, considering the low interest rate environment. The simple arithmetic of the time value of money says that the present value of a future stream of earnings is worth more if interest rates are low – all else being equal. Some conservative investors who fear the equity markets have been reaching for yield by extending maturities or by taking on more credit risk in the bond market, which we think is a bad idea. We think equities should be the cornerstone in some portion of all long term investors’ portfolios. Equities can help to counteract the eroding effects of inflation and can offer some tax advantages over taxable investments like CD's and taxable bonds.

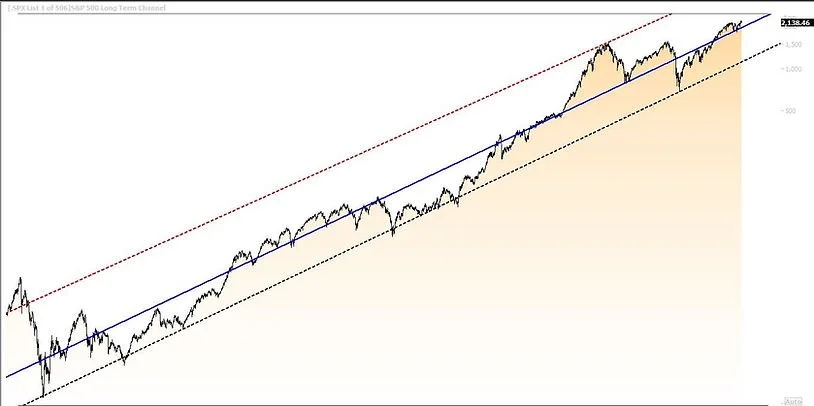

S&P 500 Long Term Trend Channel 1929 - September 15,2016

source: Emerald Asset Management, Inc.

The chart above shows that U.S. stocks are currently near their long term trend line. As pointed out previously, stocks probably should be above trend, considering the low interest rate environment. While the futures markets are currently forecasting an interest rate hike in December (and low odds of a September hike) we don’t think one interest rate hike out of the Fed will derail the now seven and a half year old bull market as it relates to valuations.

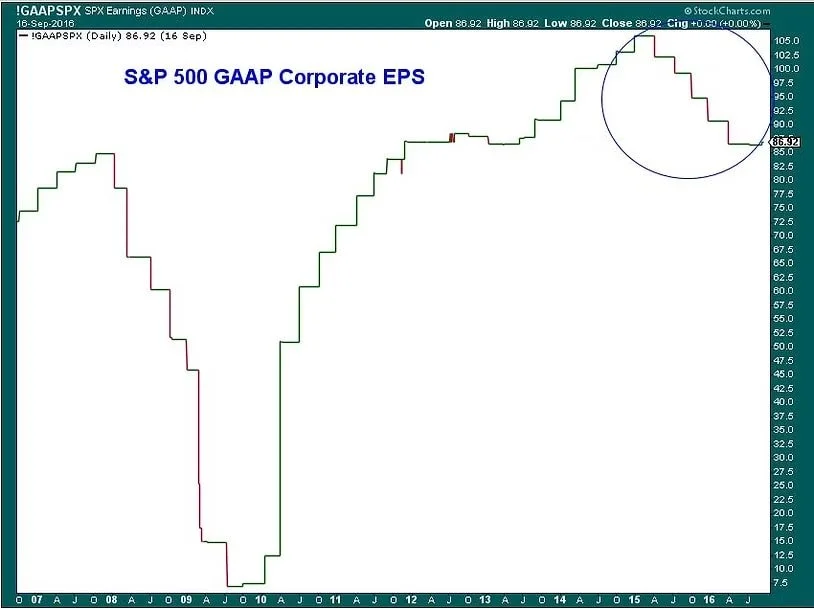

What we are watching with concern though, is the poor pace of corporate earnings growth. The S&P 500 has delivered declining earnings for the last six quarters. Hopefully, the bar is getting low enough for a rebound in the coming quarters.