Headwinds Should Become Tailwinds Soon

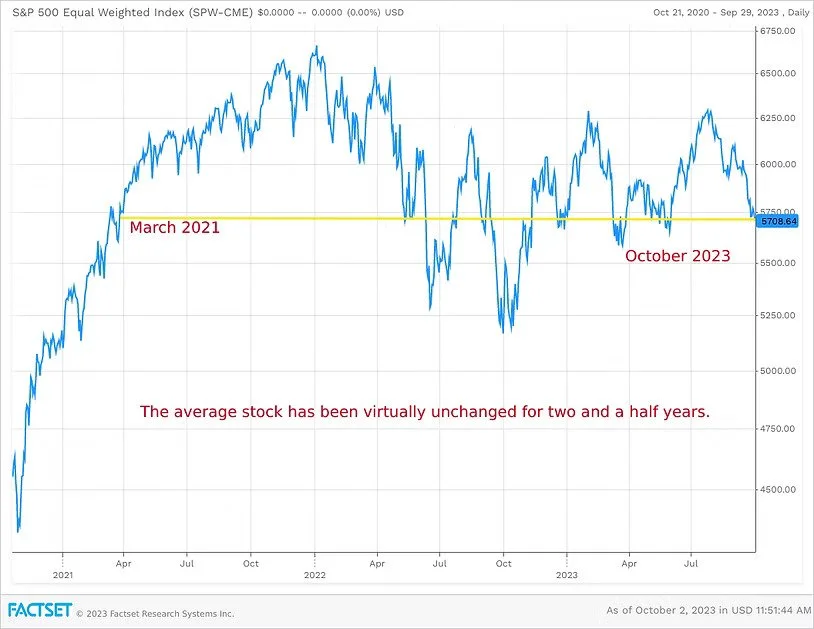

The total return for the S&P 500 for the 3rd quarter was a minus 3.27% although the major index has returned a positive 13.07% year to date. Large cap stocks generally outperformed small caps while the 10-year Treasury Yield touched 4.6%. It is noteworthy that the average stock has not made any progress in two and a half years. The chart below is of the Equal Weighted S&P 500, which is a good indicator of what the average stock is doing.

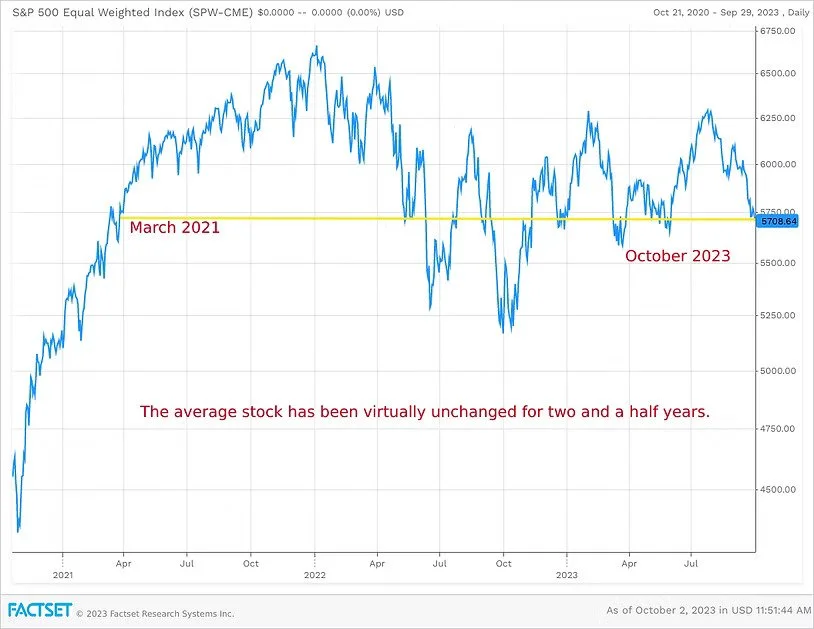

Over time, stock prices are determined by expectations about the direction of earnings and interest rates. The stock market generates earnings from the economy and companies generally make more money in a strong economy than in a weak economy. That is why stock market strategists place so much effort on predicting the state of the economy. The Federal Reserve sets the Fed Funds Rate in order to stimulate growth or slow the rate of inflation while market participants set longer term rates like the 10-year treasury yield based on longer term expectations of economic growth and inflation. When it became apparent that COVID was going to be a real event in the US, stocks dropped like a rock in anticipation of poor earnings as the economy shut down. But the bear market did not last very long because Central Bankers around the world including the Fed dropped rates and provided liquidity at an unprecedented rate. The excessive stimulus helped economies around the world rebound.

The chart below shows the Fed Funds Rate compared to the S&P 500 for the last five years. The target rate dropped to the zero bound and stocks rebounded in dramatic fashion. By the same token, stocks have had trouble getting in gear since the Fed began withdrawing some of the excess liquidity in order to fight inflation.

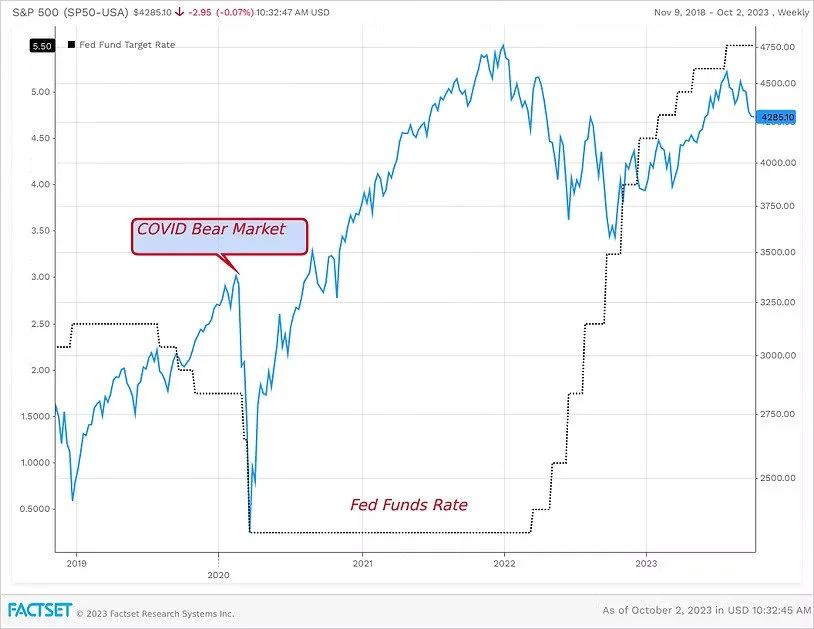

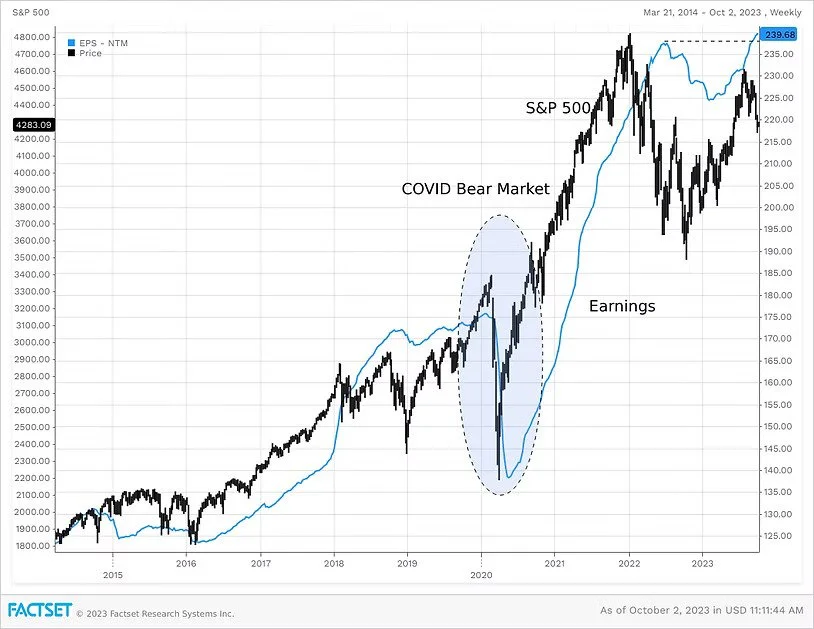

So, what will it take for stocks to get back into gear? Since the two primary drivers of stock prices are earnings and interest rates, some combination of higher earnings and lower interest rates is probably the best recipe for stocks to resume the Secular Bull Market that began in 2009. Right now, forward estimates are for earnings to make new highs. We think that if the Fed can engineer a soft landing or if we have a mild recession (our base case) good earnings and higher stock prices will follow by the second half of 2024. As of this writing the CME FedWatch Tool forecasts a 69.1% chance that the target Fed Funds rate will remain at 5.25% to 5.50% and just a 30.9% chance of one more quarter point rate hike. We are in the camp that thinks there will be one more hike and then the Fed will be done. It could take a couple of quarters from the last hike until we see the first rate cut.

The next chart shows how stock prices tend to lead earnings and estimated earnings are making new highs. That is a strong positive for investors. While the last couple of years has been trying for investors, we do still think the secular bull market remains in place. We think that the winds are starting to shift but acknowledge that it could take time. Perhaps patience is the rarest commodity on Wall Street for a reason.