A Tale of Two Markets

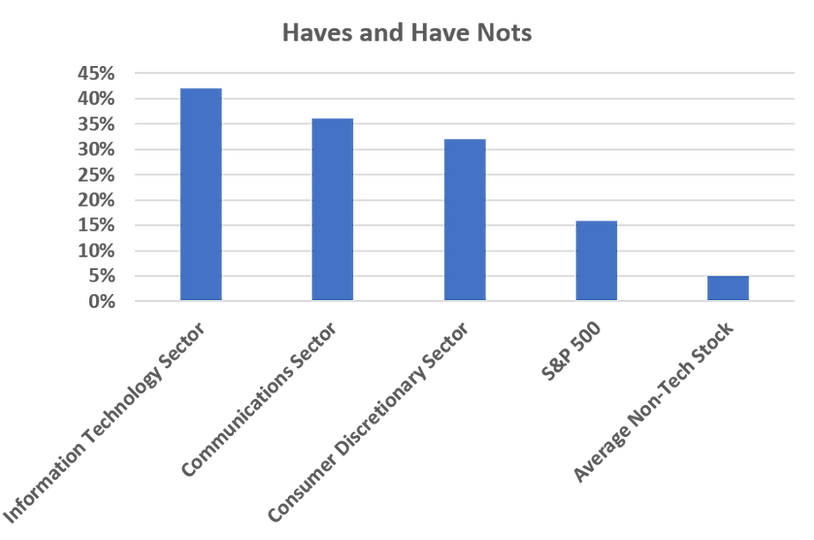

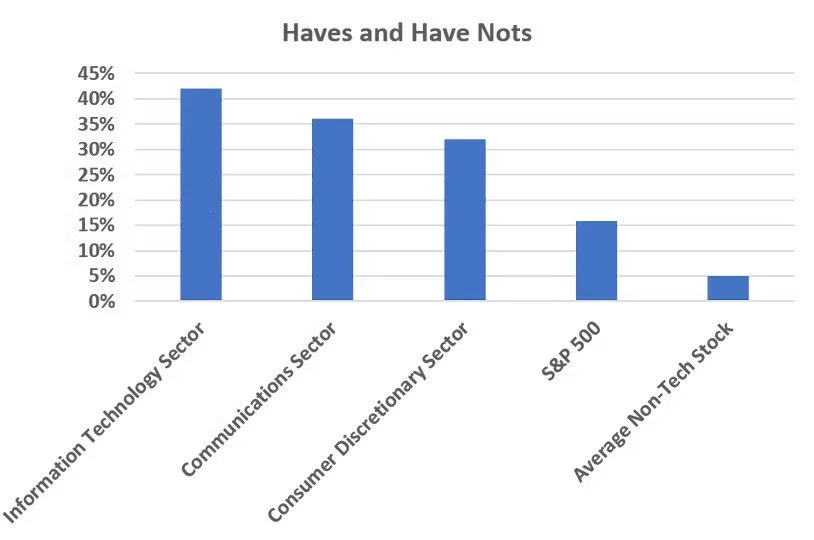

The first half of 2023 is done and over and to the novice investor, the stock market looked incredibly strong. The S&P 500 booked a total return of 8.3% for the 2nd quarter and 15.9% for the first half of the year. But a look beneath the surface shows a more bifurcated market of haves and have nots. The average non-technology related stock was up just 5% so far this year (which isn’t bad) while the Information Technology Sector was up 42%, Communications Services were up 36% and Consumer Discretionary Stocks (dominated by names like Tesla and Amazon) were up 32%. Although we generally manage conservative diversified portfolios at EAM, we were fortunate to have our fair share of these issues in client accounts.

Well diversified conservatively managed portfolios had a tough time participating during H1.

The most difficult part of Q1 and Q2 of 2023 was that the stock market (mainly large cap tech-oriented names as previously noted) has been sending a message of good things to come as stocks rallied from their October lows, while a lot of the economic data continues to point to higher interest rates, inflation, and recession. To further obfuscate the investing outlook, smaller and mid cap stocks did not fully participate in the rally.

S&P 500 vs Russell 2000

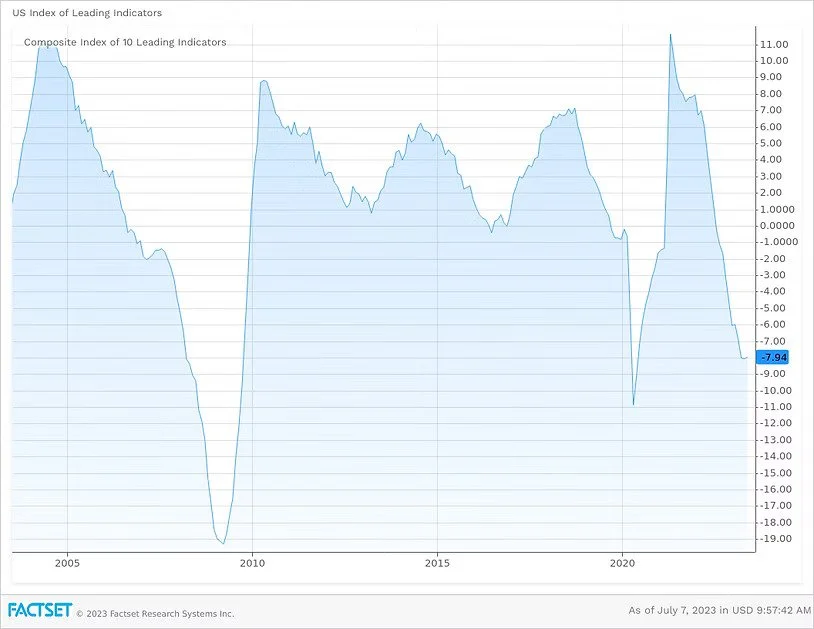

So, what now? First and foremost, we think that all investors should have a sound financial plan and stick to that plan. For the immediate present, stocks seem to be getting stretched and the risk / reward is not especially attractive in the short term. We are still participating in the rally and adding to equities opportunistically. But we are aware of the signposts bearing warnings. Some of the standouts include the inverted yield curve, the Index of Leading Economic Indicators and rising short term interest rates. On the positive side of the ledger the stock market is clearly in an uptrend and the jobs market continues to hold up better than expected. Either the stock market will eventually reflect the economic data or the public will soon find out that stocks are discounting brighter days right around the corner. As earnings season kicks into gear, we should have some clues as to the ultimate resolution of this economic tug of war. For those who do not want to participate, treasuries and money markets are offering substantial yields not seen in years. Private credit looks great for more conservative accredited investors. But as of this writing, the trend of stocks up. We have found that it is usually best to listen to the message of the market.

Above - Readings below zero are indicatative of contraction (recession)

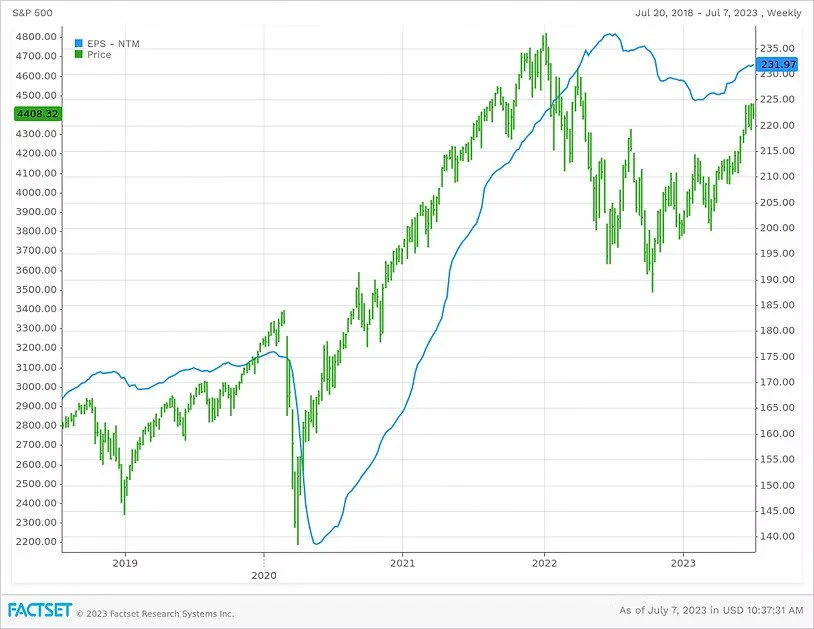

The blue line in the chart above is twelve month forward earnings estimates for the S&P 500. The green line is the price of the S&P 500. Notice how earnings expectations lead the market. Also, notice that the blue line appears to be attempting a rebound.