Q1 2025: A Quarter of Diverging Market Performances

The first quarter of 2025 presented a complex narrative for financial markets, characterized by significant volatility and varied performances across asset classes.

Equity Markets

The S&P 500 Index experienced a total return of -4.3%, marking its worst quarterly performance since the third quarter of 2022. This decline was largely influenced by substantial losses in major technology stocks, notably Tesla and Nvidia.

Fixed Income

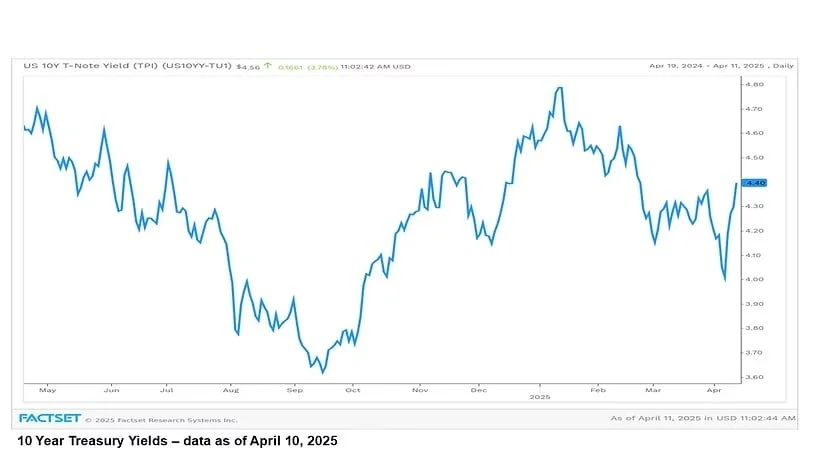

The 10-year U.S. Treasury yield exhibited fluctuations during the quarter, closing at 4.23% on March 31, 2025. This reflects a modest decrease from earlier in the quarter, indicating shifting investor sentiment and adjustments in Federal Reserve policy expectations.

Click image to enlarge

Commodities

Oil: Brent crude oil prices declined during the quarter, closing at $74.79 per barrel on March 31, 2025. This decrease was influenced by escalating trade tariffs and unexpected production increases by OPEC+.

Gold: Gold prices surged to record highs, reaching $3,123.98 per ounce on March 31, 2025. This increase was driven by investor concerns over inflation and economic slowdown resulting from new tariffs.

Economic Indicators

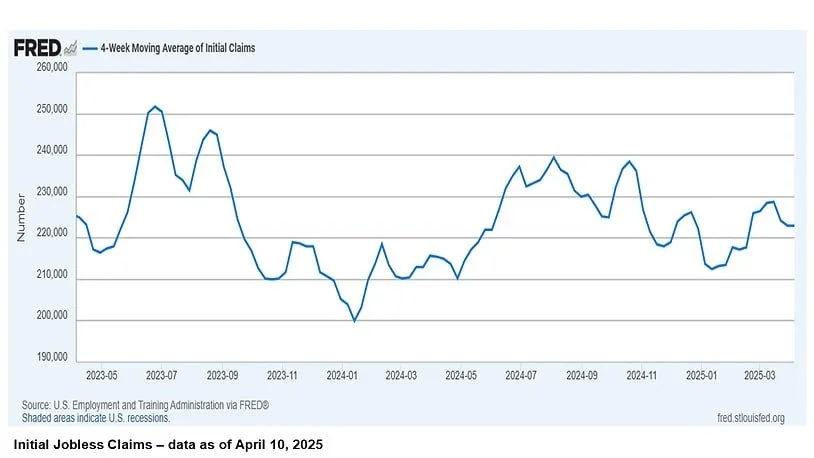

The labor market remained robust, with initial jobless claims totaling 223,000 for the week ending March 29, 2025, an increase of 4,000 from the previous week. This indicates continued strength despite broader economic concerns.

Click image to enlarge

In summary, Q1 2025 was characterized by significant market volatility, with equities facing headwinds from trade tensions and sector-specific challenges, while commodities like gold benefited from their safe-haven appeal amid economic uncertainties.

Emerald’s View: Secular Bull, Cyclical Pause

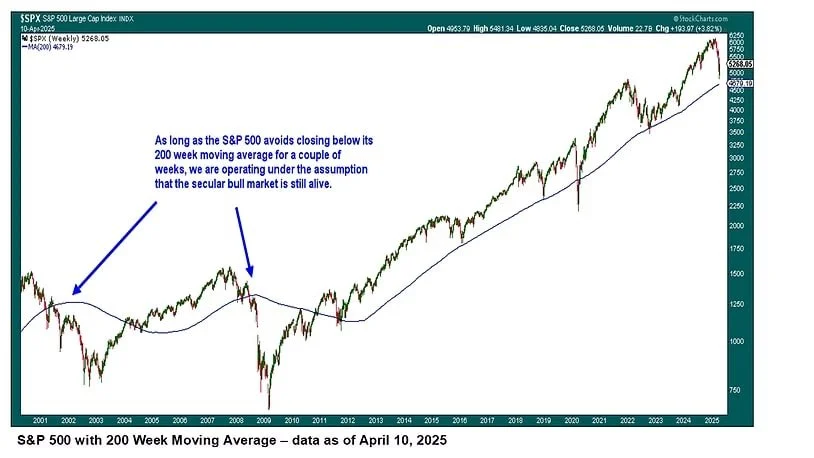

At Emerald Asset Management, we have long held the conviction that we are in the midst of a secular bull market—a view we have maintained consistently through the noise, volatility, and narrative shifts over the years. We have not wavered on that call, and Q1 has not changed our position.

That said, we are realists, not romantics. What we are experiencing now has the hallmarks of a cyclical bear market—a correction within a longer-term uptrend. But we are also clear-eyed about the fact that the risk of this evolving into something more structural—a secular bear—is not zero.

To that end, we are watching key technical levels closely. The 200-week moving average remains our line in the sand. If the market breaks materially below that level, it would force us to reassess, not because our core beliefs have changed, but because price is reality, and discipline matters.

Until then, we remain constructive over the long term, but vigilant in the short term.

Click image to enlarge

Emerald Asset Management is an independent, boutique Registered Investment Advisory firm based in Rocky Mount, NC, serving successful executives, business owners, and high-net-worth individuals across Raleigh, Durham, and Chapel Hill. As a fiduciary-led firm with over 30 years of experience, Emerald provides research-driven investment management and strategic financial planning. The firm specializes in individually managed stock and bond portfolios, alternative investments, and risk management strategies. With a disciplined approach and a commitment to clarity, Emerald helps clients navigate complex financial decisions with confidence. They can be reached at (252) 443-7616 or on the web at www.emeraldam.com.

The information presented is based on sources believed to be reliable and accurate at the time of publication, but accuracy and completeness cannot be guaranteed. The opinions expressed herein are those of Emerald Asset Management as of the date of publication and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. This document may contain certain information that constitutes “forward-looking statements” which can be identified by the use of forward-looking terminology such as “may,” “expect,” “will,” “hope,” “forecast,” “intend,” “target,” “believe,” and/or comparable terminology. No assurance, representation, or warranty is made by any person that any of Emerald Asset Management’s assumptions, expectations, objectives, and/or goals will be achieved. Nothing contained in this document may be relied upon as a guarantee, promise, assurance, or representation as to the future. The S&P 500 measures the performance of the 500 leading companies in leading industries of the U.S. economy, capturing 75% of U.S. equities. A 10-year U.S. Treasury note is a debt obligation issued by the U.S. Treasury Department that has a maturity of 10 years. It is not possible to invest directly in an index. Emerald Asset Management is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Emerald Asset Management's investment advisory services can be found in its Form ADV Part 2 and/or Form CRS, which is available upon request.