Will 2023 Be A Better Year?

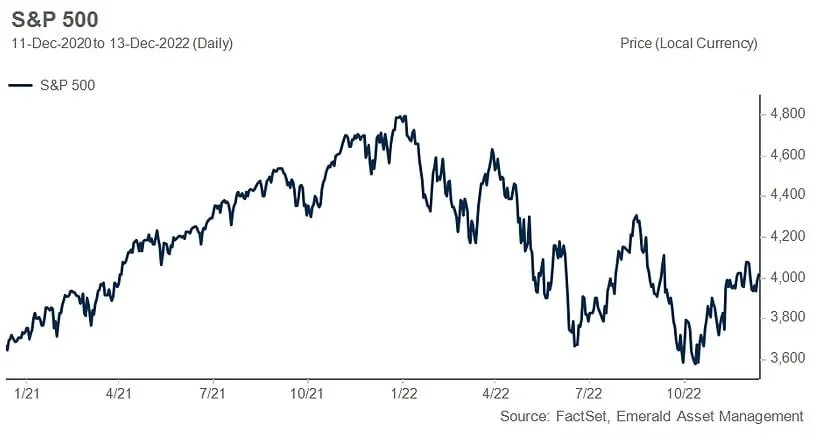

Most people are well aware that stocks have been under pressure this year. The first chart below shows the selloff as most laypeople understand it. However, the following chart shows the Nasdaq Advance / Decline ratio. The average Nasdaq listed stock has been going down for nearly two years. The stock market has probably switched from discounting inflation to discounting the mostly widely telegraphed recession in history.

Nasdaq Advance Decline Ratio

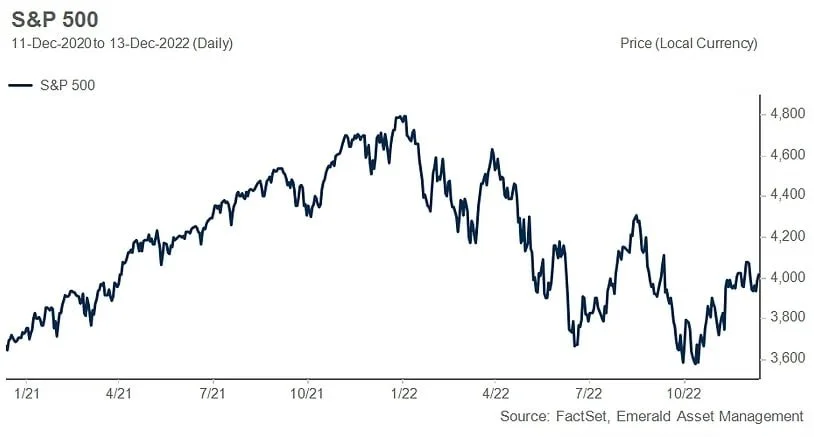

The good news is that the forward P/E ratio of the S&P 500 is back to its twenty year average, taking some of the risk out of the equation for new investments (below).

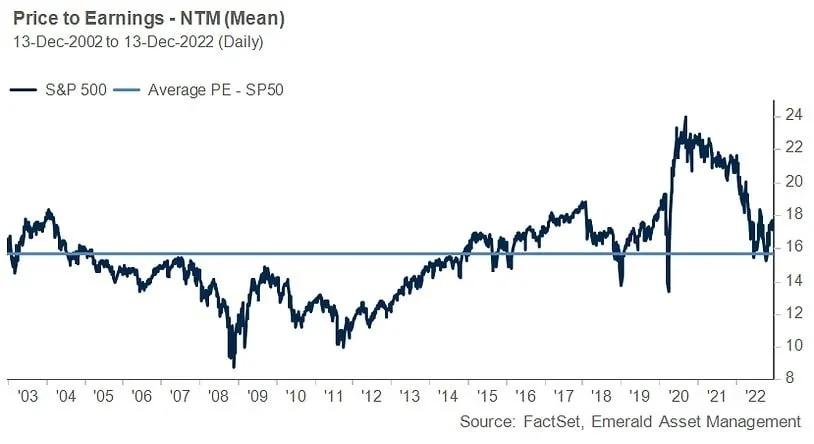

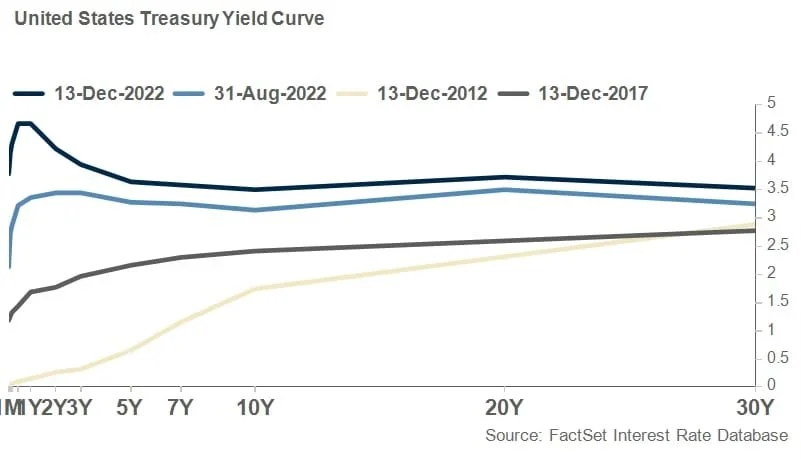

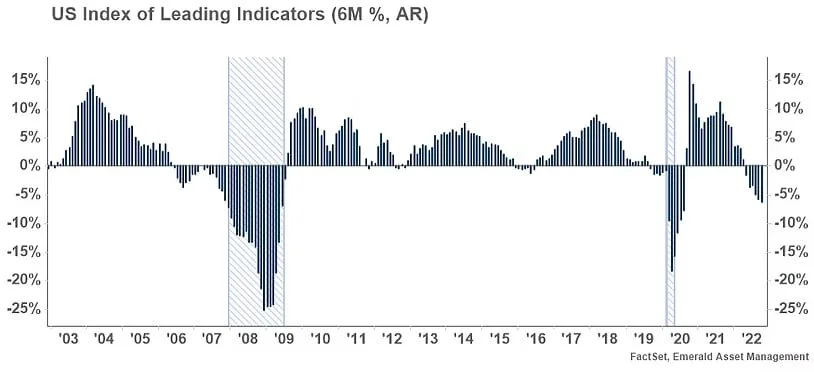

Going Forward – On the negative side of the ledger are two very reliable indicators of recessions flashing red light signals. The yield curve is extremely inverted and......

......the Index of Leading Economic Indicators has dropped into warning territory. The ISM Manufacturing Index (below) shows that the manufacturing sector of the economy is already contracting. The good news is that stocks don’t generally wait for recessions to end before bottoming. Things generally look their darkest at market bottoms and we seem to be getting there. In short, we think that while it might be too early to buy, its way to late for long term investors to sell. Now is probably the time for investors to work on their buy lists.

But we think the impending recession will be shallow and this bear market will be over soon

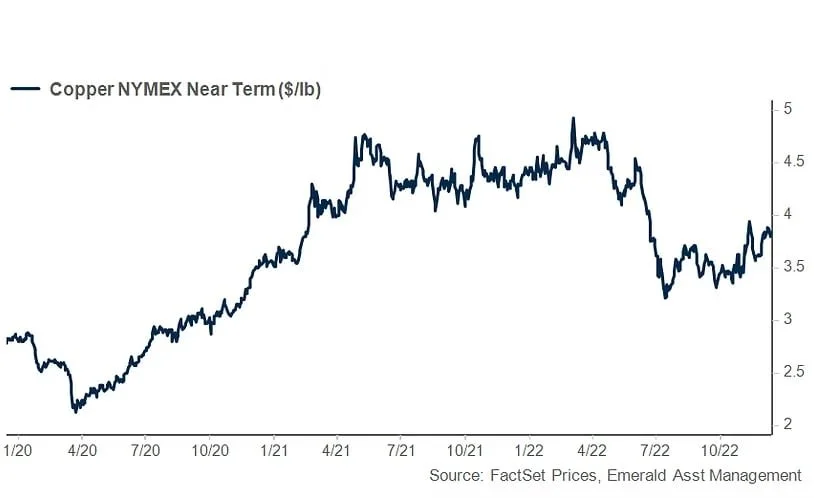

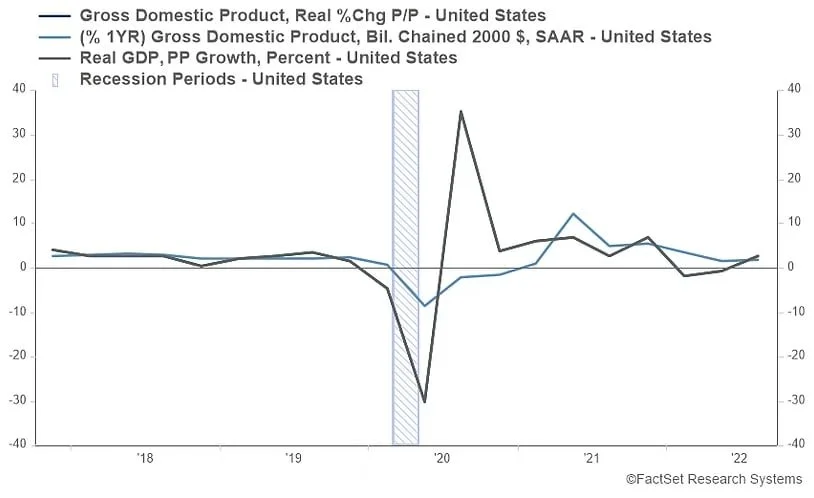

Copper prices, which are a useful barometer of economic health are holding up relatively well and GDP hasn’t exactly started to plunge. Investors who wait for the obvious end of a recession haven’t historically been rewarded as well as those who buy into the time of maximum pessimism.

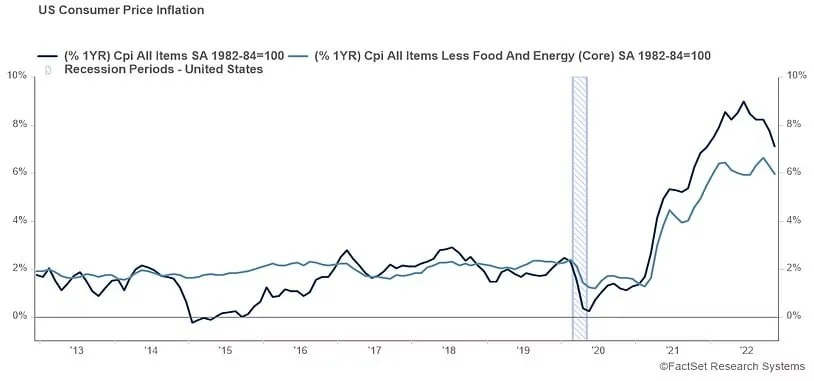

It looks like with this week’s CPI numbers that we might be able to claim peak inflation is in the rearview mirror. That’s good news because it could mean that the latest round of Fed tightening is nearing an end, although Fed language has been particularly hawkish as of late. We think that, with the information we have today, the 50 basis point hike in December and potential 25 basis point hikes in February and March could be the end of this brutal rate hiking cycle.

Our main calls this year have been to underweight equities with an emphasis on high quality names and an allocation to alternative investments including real estate. More recently we have taken advantage of the inverted yield curve by aggressively buying short term treasuries.