Well, It's a Bull Market

I’ve been at the business of investing money for clients and myself for 27 years - almost to the day. I didn’t know it then but after my first five years as a stock broker (now I own my own asset management shop) I really didn’t know as much as I thought I did about the capital markets and after ten years in the business I figured out that I was still just a neophyte. Ten years into my career the tech wreck that started in March of 2000 was well underway. I can make a case that the bear was actually born in April of 1998 but that’s a story for another time. But the point is that I had been conditioned to think that bear markets were a myth or that somehow I would avoid the next one. A great deal of the financial advisers and investors participating in today’s stock market simply haven’t seen a bull market and don’t know how to handle the good times while they last. It’s not enough to know the jargon of traders and a few mathematical calculations to be successful at investing. In order to be successful as an investor one needs perspective and perspective takes decades to develop. What I’m talking about here isn’t market timing. I’m talking about knowing when to play aggressive and when to play cautious. In addition to managing money, at Emerald Asset Management we give financial advice. During this most unloved bull market, I would be willing to bet that on any given day one could find items in the news about the economy, politics or geopolitics that could be used to justify staying out of stocks. But the reality is that U.S. Equities have been and as of this writing still are in a secular bull market. For now our advice, which has been consistent is to enjoy the ride. That’s not to say that there won’t be recessions and stock market volatility—there absolutely will be. But the infamous crash of ’87 and the recession of 1990 didn’t stop the secular bull market that lasted from 1982 to 2000. Cyclical bear markets within the context of secular bull markets tend to be shallow and short lived. Cyclical bear markets within the context of secular bear markets tend to ruin financial lives. Those are the ones you want to avoid. When the character of this bull market changes , so will our advice.

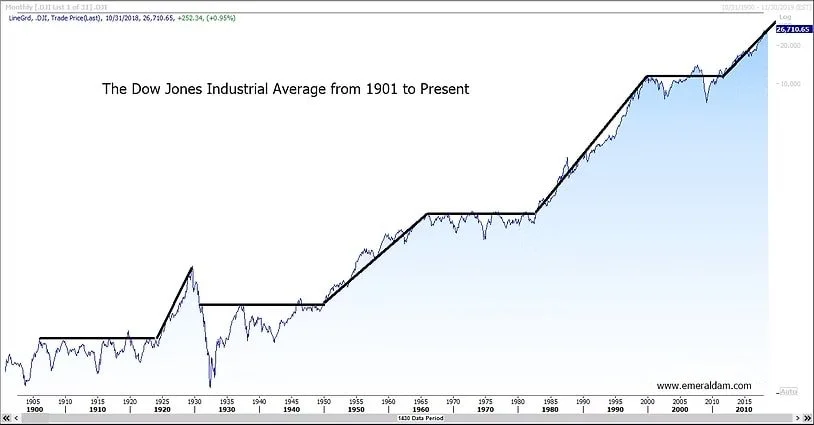

Notice the long term stair step nature of the Dow Jones Industrial Average since 1900. Markets have always been volatile. But the markets that you need to avoid are the ones with a sideways bias. These are the secular bear markets. The markets with the upward bias are secular bull markets and investors are currently enjoying a nice one. Pundits are free to debate the future, but the present is clear. What is...is.