Rethinking Diversification: Why Private Equity Deserves a Place in Your Portfolio

At Emerald Asset Management, we have long believed in the power of U.S. equities as the core engine of portfolio growth. Few markets in the world can match the resilience, innovation, and wealth-building capacity of American businesses. That conviction has not changed.

What has changed is what is available to accredited investors who want to go a step further.

In recent years, private equity has become more accessible—and more relevant—as a supplement to public market exposure. For high-net-worth investors, adding private equity to the equity portion of a portfolio can introduce meaningful diversification, smoother volatility, and strong long-term return potential without replacing the tried-and-true role of U.S. stocks.

What the Last 20 Years Tell Us

From 2005 through 2024, private equity delivered compelling results. Over that period, it:

Outperformed public equity markets in most years, including international and emerging markets.

Produced comparable or slightly better long-term returns than the S&P 500.

Experienced smaller drawdowns during market crises and provided a more stable ride overall.

Generated a better risk-adjusted return, meaning more reward per unit of volatility.

These trends not only reflect private equity’s strong performance but also its ability to hold steady during turbulent markets, when public equities can swing sharply.

What Is Private Equity?

Private equity refers to ownership stakes in companies that are not publicly traded on stock exchanges. Instead of buying shares on a platform like the NYSE or NASDAQ, investors commit capital to private investment funds that directly acquire, improve, and grow businesses over several years, typically in industries ranging from technology and healthcare to manufacturing and services.

Unlike public equities, which can be bought or sold daily, private equity investments are illiquid. Capital is committed for longer periods—often 7 to 10 years—and returns are realized gradually through company sales, recapitalizations, or initial public offerings. This longer horizon is a tradeoff for access to potentially higher returns and more stable valuations, especially during periods of public market volatility.

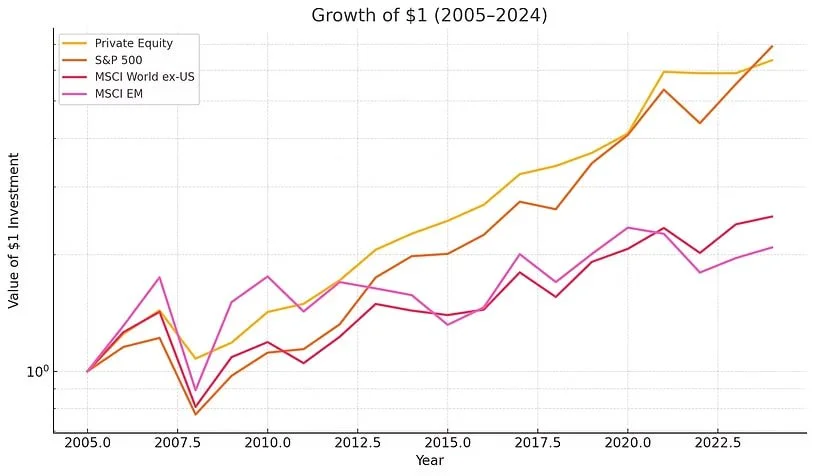

Visualizing the Advantage

To illustrate this, here is a look at how $1 would have grown in each asset class over the last two decades:

Sources: Cambridge Associates, MSCI, Standard & Poor’s, Blackstone, Morningstar, and Emerald Asset Management.

Data as of 12/31/2024.

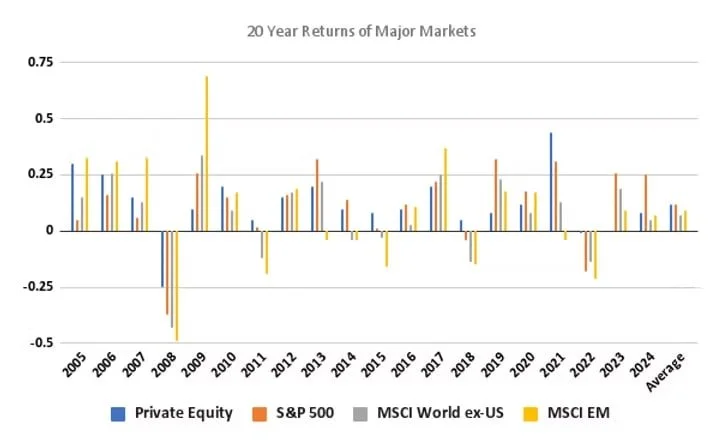

And here is how the leadership of each asset class shifted from year to year:

Sources: Cambridge Associates, MSCI, Standard & Poor’s, Blackstone, Morningstar, and Emerald Asset Management.

Data as of 12/31/2024.

A Complement, Not a Replacement

At Emerald Asset Management, we do not view private equity as a substitute for public equities. Instead, we offer it as a supplement for qualified investors—a way to broaden opportunity sets, reduce portfolio whiplash, and pursue enhanced outcomes through diversified growth.

We continue to believe the S&P 500 remains a vital cornerstone for long-term investors. But by layering in private equity thoughtfully, it is possible to strengthen the overall structure of a portfolio, especially for those with the time horizon and risk profile to benefit from its long-term nature.

Ready to Explore?

If you are an accredited investor curious about what private equity might add to your portfolio, we would love to talk. As fiduciaries and equity portfolio managers, our role is to guide you toward opportunity without compromising your strategy or exposing you to unnecessary complexity.

Private equity is not for everyone, but for the right investor, at the right time, it can make a meaningful difference.

Emerald Asset Management is an independent, boutique Registered Investment Advisory firm based in Rocky Mount, NC, serving successful executives, business owners, and high-net-worth individuals across Raleigh, Durham, and Chapel Hill. As a fiduciary-led firm with over 30 years of experience, Emerald provides research-driven investment management and strategic financial planning. The firm specializes in individually managed stock and bond portfolios, alternative investments, and risk management strategies. With a disciplined approach and a commitment to clarity, Emerald helps clients navigate complex financial decisions with confidence. They can be reached at (252) 443-7616 or on the web at www.emeraldam.com.

The information presented is based on sources believed to be reliable and accurate at the time of publication. This material is for educational purposes only and does not necessarily reflect the views of the author, presenter, or affiliated organizations. It should not be construed as investment, tax, legal, or other professional advice. Always consult a qualified professional regarding your specific situation before making any decisions.

Emerald Asset Management is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Emerald Asset Management's investment advisory services can be found in its Form ADV Part 2 and/or Form CRS, which is available upon request.