Why U.S. Debt Still Matters for Investors

When Moody’s downgraded its rating on U.S. Treasuries from AAA to AA1 on a Friday night in May, I expected my phone to be ringing first thing Monday with concerned clients - and for the markets to show it. But the stock market barely reacted, and while there was some movement in 10-year Treasury yields, the overall response was muted, at least initially.

I’ve always enjoyed Wall Street history, especially how different events have shaped the stock market. But when I did a little research on the downgrade, I found myself learning a few new things about the broader debt picture and its impact on markets.

The United States has had a debt problem since before it was even a country. In 1790, not long after the ink dried on the Constitution, Treasury Secretary Alexander Hamilton made a bold proposal: the federal government should take on the Revolutionary War debts of the states and issue bonds to pay for it. It wasn’t just about settling old accounts. Hamilton saw debt as a tool - a way to establish trust, build credit, and tie the country together financially.

Ever since, America’s relationship with debt has followed a familiar rhythm: borrow big in times of crisis, slowly work it down in times of peace and growth, then repeat.

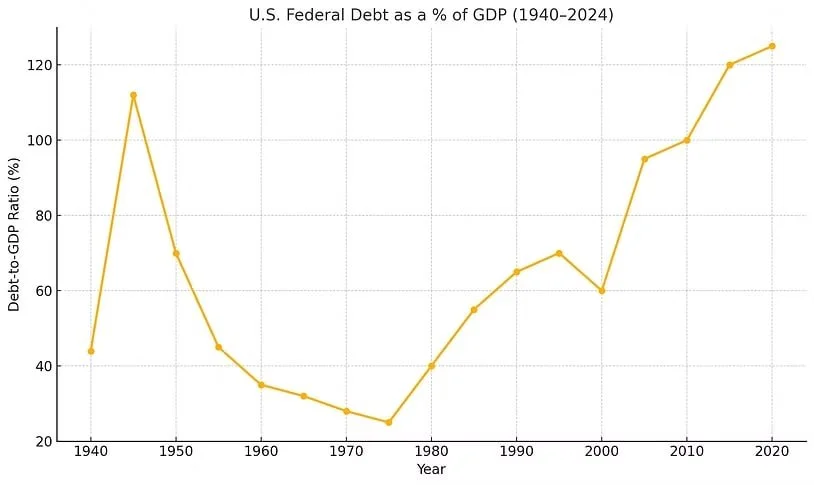

Until recently, the highest level of U.S. debt relative to the size of the economy was just after World War II. In 1946, it stood at about 112% of GDP. Yet within a generation, we had cut that figure by more than three-quarters. The country didn’t do it through painful austerity or massive paydowns. We grew our way out of it. The post-war economy expanded, inflation helped erode the real value of what we owed, and government budgets, while not perfect, were relatively restrained. By the mid-1970s, debt had fallen to less than 25% of GDP.

That may feel like ancient history now, because in recent decades, debt has done something it wasn’t supposed to do: it’s grown steadily, in good times and in bad times. Beginning in the 1980s, deficits widened on the back of tax cuts, rising defense spending, and a couple of early recessions. The 1990s brought a brief reversal as strong growth and budget agreements led to short-lived surpluses. But after 2001, debt picked up again and never looked back. The 2008 financial crisis poured fuel on the fire. And then came 2020, when COVID-related spending pushed the debt-to-GDP ratio back above 100%. Today, it hovers around 120%.

Sources: FRED and Emerald Asset Management.

Data as of 12/31/2024.

That number matters. Economists and investors don’t just look at how many trillions we owe, but rather, they care about how the debt stacks up against the size of the economy. When debt grows faster than GDP, it raises questions about sustainability. It also means a growing share of tax dollars goes toward interest payments—money that could be used for infrastructure, defense, healthcare, or tax relief instead.

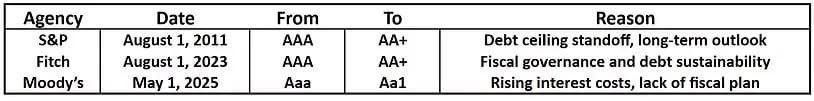

In 2023, Fitch Ratings downgraded U.S. government debt from AAA to AA+, citing long-term fiscal concerns. That came more than a decade after S&P made a similar move during the 2011 debt ceiling standoff. And most recently, Moody’s followed suit. For the first time in history, all three major credit rating agencies have placed U.S. debt one notch below perfect.

That doesn’t mean the U.S. is at risk of default anytime soon. The government continues to borrow in its own currency, and the Treasury market remains the most liquid and trusted bond market in the world. Still, the credit rating agencies have sent a clear message: what matters isn’t just how much we owe, but whether it’s being managed responsibly over time.

This is where the investment implications begin to take shape. Rising debt levels require more Treasury issuance, which can put upward pressure on interest rates. That, in turn, can affect bond prices, especially for long-duration bonds, and increase borrowing costs for businesses, weighing on equity valuations. The cost of servicing the debt is also climbing. In the past year, the federal government paid over $500 billion in interest, and that figure is still rising. We’re approaching the point where nearly one out of every five tax dollars goes to interest payments. That’s not just a warning sign, it’s a spotlight on the importance of sound fiscal stewardship.

For stock investors, high debt doesn’t always spell doom, but it adds complexity. If higher rates are needed to attract buyers to all this new government debt, that raises the hurdle for equity returns. Valuations can compress, growth can slow, and companies with heavy debt loads could find themselves squeezed.

At Emerald Asset Management, we do not believe the United States is at risk of default, nor do we expect the current debt environment to derail the long-term secular bull market in equities. The U.S. still enjoys structural advantages, including a resilient economy and a deep and liquid bond market, and the dollar is the world’s reserve currency. That said, the trajectory of federal debt and interest costs is becoming a more important macroeconomic variable.

While this may not demand immediate portfolio shifts, it does underscore the value of thoughtful asset allocation, risk management, and long-term planning. We’ll continue to monitor these developments and help clients navigate the opportunities and risks that arise in this evolving environment.

Emerald Asset Management is an independent, boutique Registered Investment Advisory firm based in Rocky Mount, NC, serving successful executives, business owners, and high-net-worth individuals across Raleigh, Durham, and Chapel Hill. As a fiduciary-led firm with over 30 years of experience, Emerald provides research-driven investment management and strategic financial planning. The firm specializes in individually managed stock and bond portfolios, alternative investments, and risk management strategies. With a disciplined approach and a commitment to clarity, Emerald helps clients navigate complex financial decisions with confidence. They can be reached at (252) 443-7616 or on the web at www.emeraldam.com.

The information presented is based on sources believed to be reliable and accurate at the time of publication. This material is for educational purposes only and does not necessarily reflect the views of the author, presenter, or affiliated organizations. It should not be construed as investment, tax, legal, or other professional advice. Always consult a qualified professional regarding your specific situation before making any decisions.

Emerald Asset Management is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Emerald Asset Management's investment advisory services can be found in its Form ADV Part 2 and/or Form CRS, which is available upon request.