Smart Money Versus Dumb Money – Which are You?

According to Investopedia “The basic efficient market hypothesis posits that the market cannot be beaten because it incorporates all determinate information into current share prices.” As of this writing we don’t think that anybody with half a brain can argue that the stock market is behaving completely rationally lately. In fact, stocks are trading, in our opinion, purely off of fear and greed at this point. In the long term the fundamentals determine price levels but in the short term it’s all about emotion and right now we think this market is getting very emotional. Benjamin Graham, and later his famous student Warren Buffett, have both been credited with the following quote: “In the short run, the market is a voting machine but in the long run, it is a weigh machine.” Yes, there are rational reasons to be concerned and there are also rational reasons to be optimistic. That’s what makes markets. Some investors are buying and some are selling. It’s as simple as that. But sometimes fear and greed can take market sentiment to extremes.

But what is an investor to do with this concept? Well, at Emerald Asset Management we want to measure it and use it to our advantage. That measurement is known in the investment community as sentiment and when sentiment is negative on main street it has historically marked important bottoms in stock prices. Those bottoms are where professionals become optimistic and separate themselves from the amateurs.

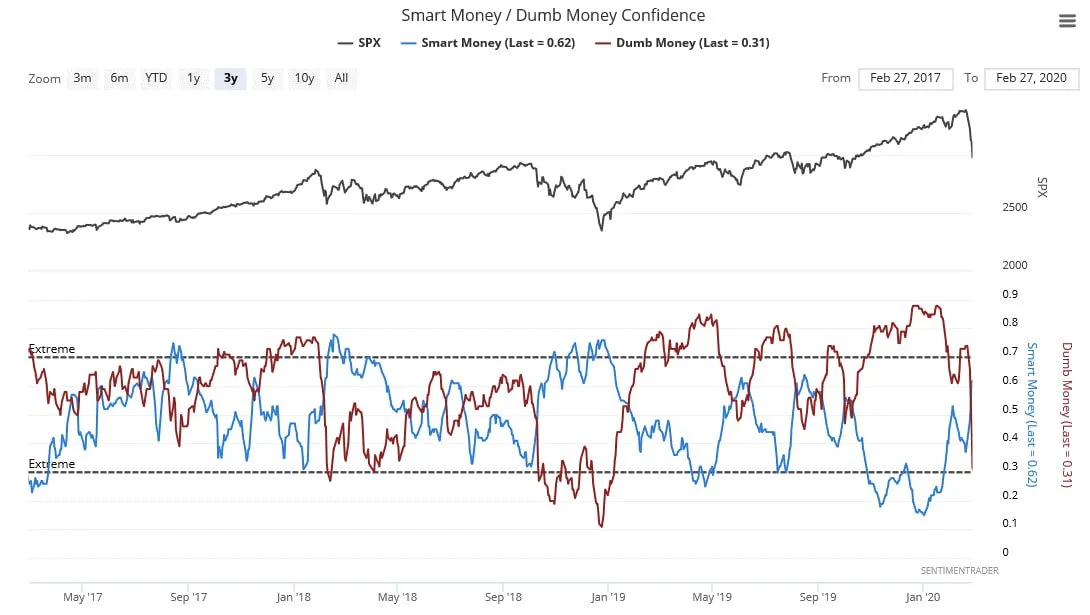

Chart courtesy of SentimentTrader.com

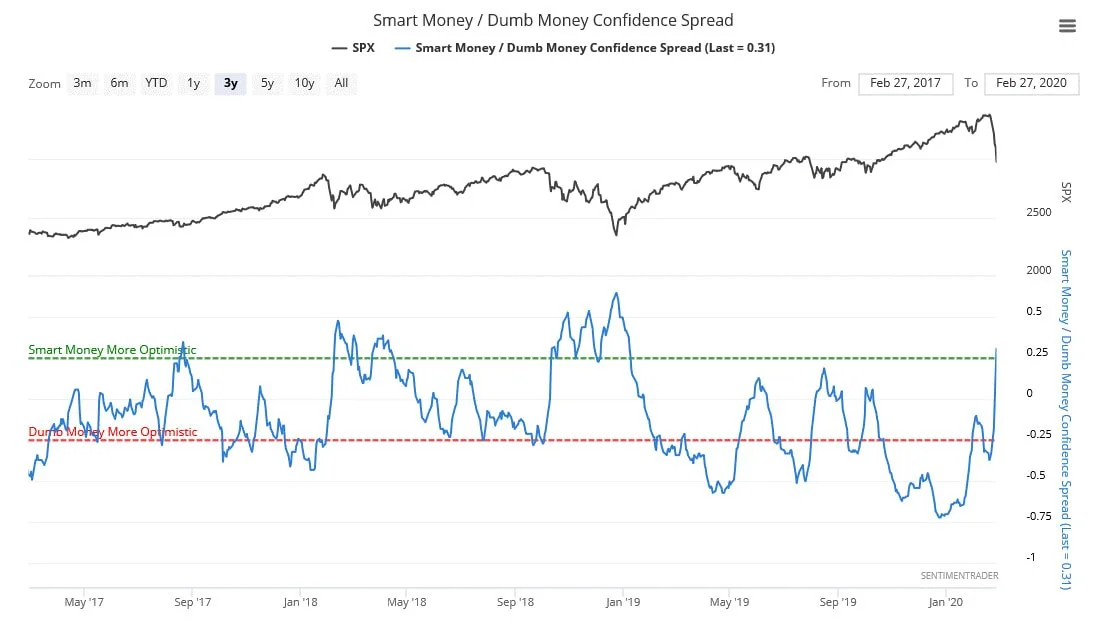

The chart above plots the sentiment of the general public (red Line) against the sentiment of the professional investor (blue line). The line at the top is the S&P 500 and the time frame is the trailing three years. What should be obvious is that main street has been generally hopeful at market tops and fearful at market bottoms while the opposite has been true for professionals. The chart below shows the spread between the two readings plotted above and a quick glance at the chart should show that the indicator has been quite reliable. While we don’t think sentiment has completely washed this market out yet, we do think we are getting close. If you have any questions about your portfolio or if you want to discuss strategies to take advantage of what we see as a setup for a wonderful buying opportunity, please call or email us.

Chart courtesy of SentimentTrader.com