Emerald Insights: Empowering You with Knowledge and Clarity

Timely guidance, educational tools, and curated content to support confident financial decisions.

Wild Horses, Outer Banks, NC

Artificial Intelligence and the Next Phase of the Secular Bull Market

At Emerald Asset Management, much of our day-to-day portfolio work involves distinguishing durable, long-term investment themes from shorter-term market narratives. Artificial intelligence increasingly falls into the former category. While the technology itself often dominates headlines, the more relevant question for investors is how AI is being built, adopted, and ultimately translated into economic value over time.

Choosing the Right Financial Planning Method: Goals-Based or Cash Flow?

Choosing the right financial planning method can shape how confident you feel about the future. Learn how goals-based and cash flow planning work, and how each can help you make smarter choices in a world full of moving parts.

Pairing Roth Conversions with Tax-Loss Harvesting: A Smart Year-End Strategy

The end of the year is a key window to evaluate tax‑sensitive moves. This article breaks down how combining a Roth conversion with tax‑loss harvesting may improve your strategy for retirement and estate planning.

2026 Retirement Plan Contribution Limits: Expanded Opportunities for Savers

Retirement account limits for 2026 are higher across the board: from 401(k)s and IRAs to small‑business plans. This article walks through the new numbers, catch‑up provisions and income phase‑outs so you can adapt your savings strategy.

Catch-Up Contributions Are Changing—Here’s What You Need to Know

The ability to reduce taxable income with pre-tax catch-ups is ending for some. Understand the shift coming in 2026 and what it means for your future savings.

Why Successful Investors Focus on Risk Management, Not Forecasts

When markets turn volatile, it’s natural to look for answers. Is now the time to move to cash? Should I double down on stocks? Predictions can feel reassuring, but history has shown that even experts rarely get them right consistently.

Roth IRAs: Why Tax-Free Growth Could Be Your Most Valuable Asset

Imagine building wealth for decades and never owing taxes on the growth. That’s the unique advantage of a Roth IRA, one of the most powerful tools for retirement planning. While most people naturally focus on how much they’re saving, it’s just as important to consider where those savings go.

Navigating the New Frontier: The Rise of Private Investments in Corporate Retirement Plans

In the world of corporate retirement plans, a significant shift is underway. For decades, the investment options available to participants in defined contribution plans such as 401(k)s have largely been confined to publicly traded securities like mutual funds, ETFs, stocks, and bonds.

What to Know Before Buying an Annuity in Retirement

Retirement planning comes with plenty of options, but few financial products generate as much buzz, or confusion, as annuities.

Why Choosing a Fiduciary Financial Advisor Matters

Many people assume their financial advisor is required to act in their best interest. But surprisingly, that is not always the case. Unless your advisor is a fiduciary—

The Mind Games of Investing: Navigating Emotions for Long-Term Success

Ever feel like your instincts are pulling you in the wrong direction when it comes to money? You're not alone. Even the most seasoned investors can fall prey to emotional decision-making.

Understanding Dividends: How They Can Fit into Your Investment Strategy

Tired of meager returns in a low-interest rate environment? Investing in dividend stocks could be a compelling strategy to earn passive income and capitalize on long-term market growth.

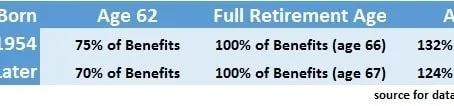

Deciding when to take your Social Security

One of the most common questions I get from people entering the retirement phase of life is, ‘when should I take my social security benefit?’

Five Reasons You Need a Financial Plan

According to Wikipedia, the definition of a financial plan is “a comprehensive evaluation of an individual’s current and future state by using currently known variables to predict future cash flows, asset values and withdrawal plans.”

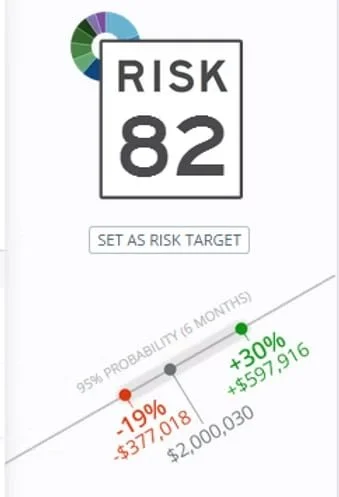

What's Your Risk Budget

Most of my clients have heard me elaborate upon the importance of risk management. The reason that I dwell so much on this particular topic is because nobody knows exactly what the future holds, especially when it comes to investing

Making the Most of Your 401k Distribution--A New Strategy

If you are planning to retire or change jobs and you have an investment in a qualified retirement plan like a 401k, the IRS might have just given you a gift. Or at least they might have made your life a little easier.

Seven Steps to a More Secure Retirement

At Emerald Asset Management, we believe the foundation to building a more secure financial future begins with a plan. But how does one get started?