What's Your Risk Budget

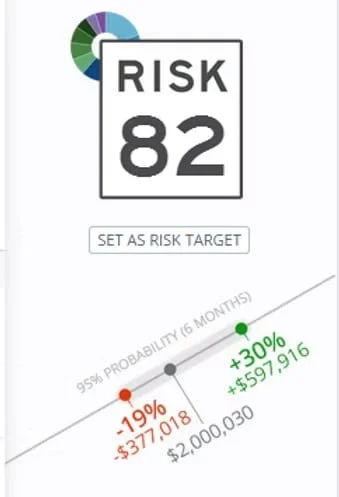

Most of my clients have heard me elaborate upon the importance of risk management. The reason that I dwell so much on this particular topic is because nobody knows exactly what the future holds, especially when it comes to investing. A good place to start the risk management process is to decide how much risk you are emotionally willing and financially able to assume. While that might seem simple enough on the surface, ask yourself a couple of questions and be honest with yourself. Have a you ever tried to quantify in measurable terms how much risk you are willing to assume in order to strive for a certain level of investment returns? How much in dollar or percentage terms would you describe as a 'devasting loss'? If the stock market goes through a correction - or worse a true bear market, when would you throw the towel in and call it quits? Furthermore, do you know if your portfolio is aligned with that ‘risk number’ or how much risk you need to take in ordr to meet your goals?

The main reason that I believe that so many people are prone to buy stocks at the top and sell at the bottom of each market cycle is that they don't understand how much risk they can realistically handle (or need to take on) and furthermore they generally don't understand how much risk they are actually taking. If you don't know the answers to the questions above, then you might benefit by working with an experienced financial advisor to set up a risk budget. Setting up a risk budget is kind of like setting up a savings budget. By properly quantifying how much risk an investor can assume and by matching that level up with what is necessary in order to reach certain goals, an investor should be able to sleep better at night having confidence that their portfolio should have a high probability of remaining within their comfort zone - even in tough market conditions. But unless you are extremely wealthy, you are probaly going to have to assume some financial risk in order to reach your savings goals. That's where a good financial plan can help.

The process of risk budgeting doesn't have to be difficult and it's a process that every investor should go through. This one simple exercise could help many investors avoid panicking during corrections while staying on track to reach their investment goals.