Deciding when to take your Social Security

One of the most common questions I get from people entering the retirement phase of life is, ‘when should I take my social security benefit?’ That’s because the timing of when one decides to take social security benefits is one of the major factors determining how much income people will receive over which they actually have some control. Basically, waiting will increase the amount of income that will be received and taking the income early will decrease the amount of income received each month. Most people understand this concept. But there are also other factors that need to be considered. For example, the longer one waits to take the benefit in order to increase the amount of that benefit, the more that person might have to tap into their retirement savings to make up for the shortfall before social security income kicks in. So it is important to consider the size of the retirement nest egg along with the expected return on investment of the retirement savings when considering when to take social security. Other factors to consider are life expectancy and additional sources of income like pensions or rental income. Generally, those who can afford to wait (those who do not need the income) should consider doing so and those who do not have an adequate retirement account built up or alternative sources of income will have to forego the luxury of the higher social security amount because unless they work longer they will be forced to lean on their social security benefit earlier than those who do not need to take it early.

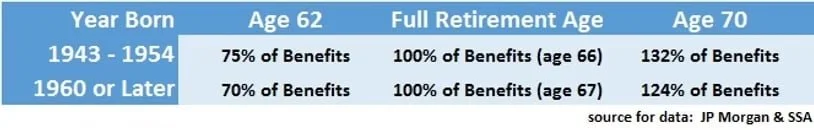

The decrease in benefits for taking an early social security benefit is about 6.25% per year for those born before 1954 and the increase is expected to be about 8% per year for those taking the benefit after full retirement age for both groups. For more on income generating strategies, click here.