Somebody Lend Me a Dollar

“I will gladly pay you Tuesday for a hamburger today”

-Wimpy from the classic cartoon Popeye

Making the rounds in the press lately are many stories about the United States Debt Level passing the $22 trillion mark. Some are concerned about the debt level and others argue that deficits don’t matter.

The reason for the complacency about the national debt can in part be attributed to an Australian economist named Bill Mitchell. In 1990, Mitchell coined the term Modern Monetary Theory or MMT (1). MMT as an idea is starting to make a resurgence in economic circles. Once you understand what it means, hopefully you will think this theory is as ill-conceived as we think it is. According to MMT, the United States and other countries that have the ability to print their own money and borrow from foreign governments in their own currency shouldn’t have to worry about running deficits.That’s because, according to MMT, we won’t ever run out of money. We can simply raise taxes or just print more greenbacks.

But money doesn’t grow on trees. There are limits to how much money the United States can prudently borrow or print, in our opinion. If pushed too far, sooner or later the credit of the US Government could be called into question. Keep in mind that in 2011 S&P downgraded US Debt from AAA to AA+. Also, the more dollars in circulation over time (printed money) should equal a devalued currency (read inflation). In order to be compensated for the extra credit risk and the risk of inflation, foreign investors should demand higher interest rates in order to lend to the US. And the cycle would continue and interest payments would increase over time until MMT comes crashing down.

Fortunately, the general consensus in economics right now seems to be that MMT won’t work and that our deficits do need to be corrected at some point. For example, Fed Chair Jerome Powell said during a recent interview that our deficits aren’t sustainable. Going back a few years Alan Simpson and Erskine Bowls famously attempted to craft a bipartisan path to fix the deficit. Unfortunately, the the political will to follow up wasn’t there.

But let’s keep things in perspective. First of all, this is a long-term problem and probably not an immediate threat to the stock and bond markets. Secondly, there is still time to address the fiscal irresponsibility of the past. Hopefully the following charts will illustrate why we don’t think that the debt and deficit are immediate threats to our economy. We do believe that ultimately the good ‘ole USA will figure things out – just like we’ve always done.

(1) Modern Monetary Theory Creates more problems than it solves – Global Economics January 31, 2019

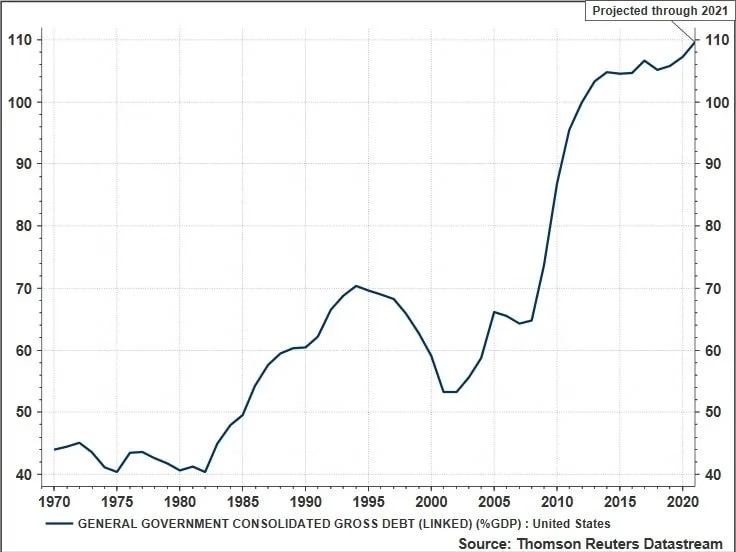

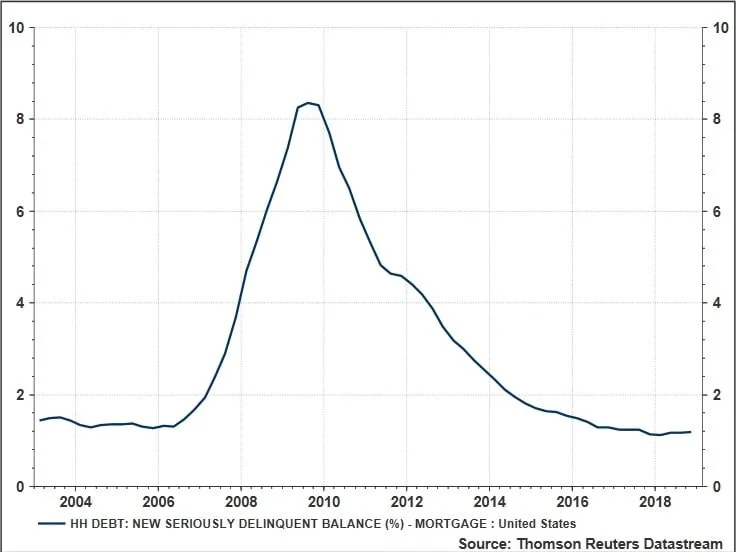

In their best-selling book Ken Rogoff and Carmen Reinhart demonstrate empirically that when a nation’s debt reaches 90% of GDP then there tends to be a 1% drag on economic growth. This phenomenon occurs across a diverse sample of countries, government philosophies and even centuries. The chart below shows that the US Government has already surpassed the 90% debt to GDP ratio.

The rate of increase of Public Debt Outstanding has come down.But we still have a long way to go to balance the budget.

The Consumer is about 70% of the US Economy so let’s see how Mom and Pop are doing.

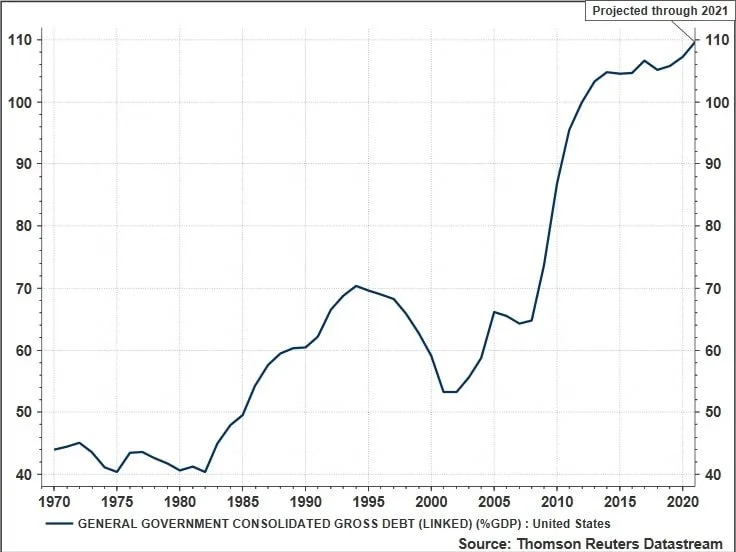

1) Subprime loans appear to be in check since the Great Recession…...

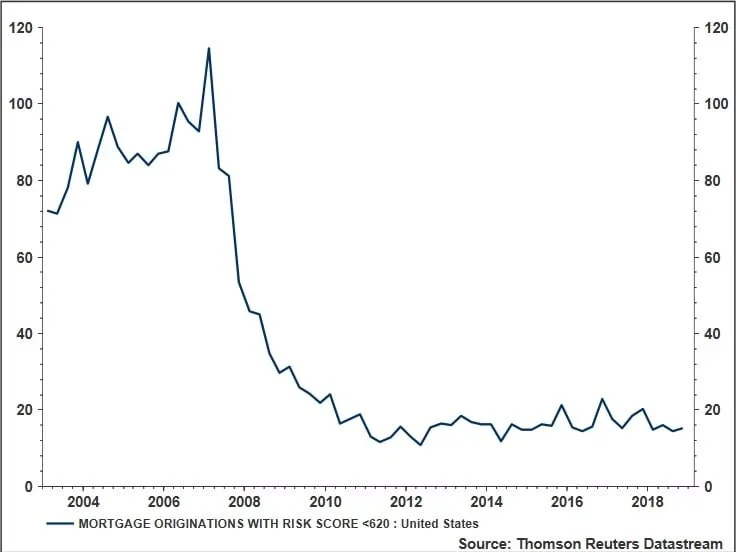

2) and mortgage delinquencies seem contained……

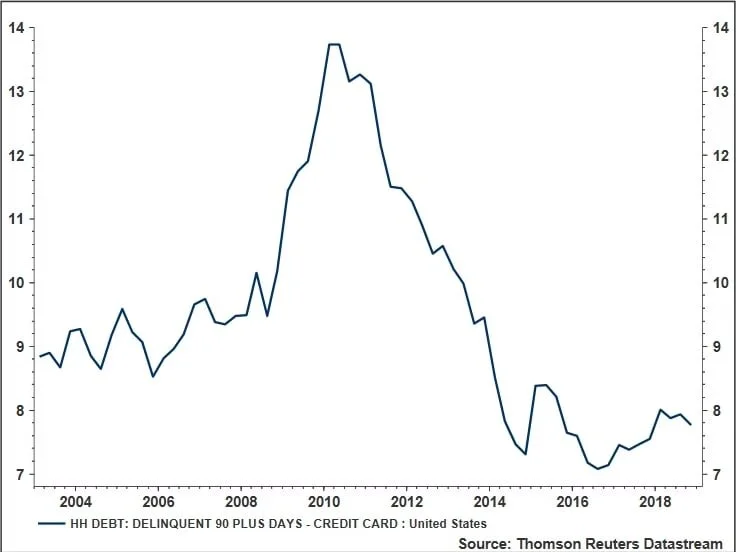

3) Credit Card Delinquencies are below pre-recession levels and appear to be stabilizing…...

4) The delinquency rate on Student Debt looks like the chart above – credit card debt. But this is an area to watch for future signs of trouble.

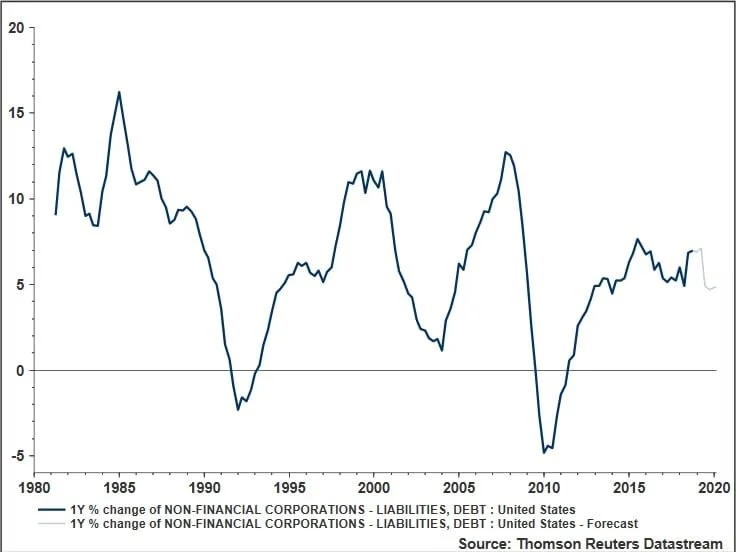

So how about Corporate America? The much-advertised binge on corporate debt doesn’t appear so bad and it could be moderating.

Conclusion: MMT is an economic theory that we believe is bunk. To think that a country can just print, tax and spend indefinitely is the height of absurdity. However, much of the evidence in the previous charts suggests that the day of reckoning is some ways down the road. Hopefully we as a nation will fix the issue while we still can. But for now, we think the national debt is a back-burner issue.