What about the Election?

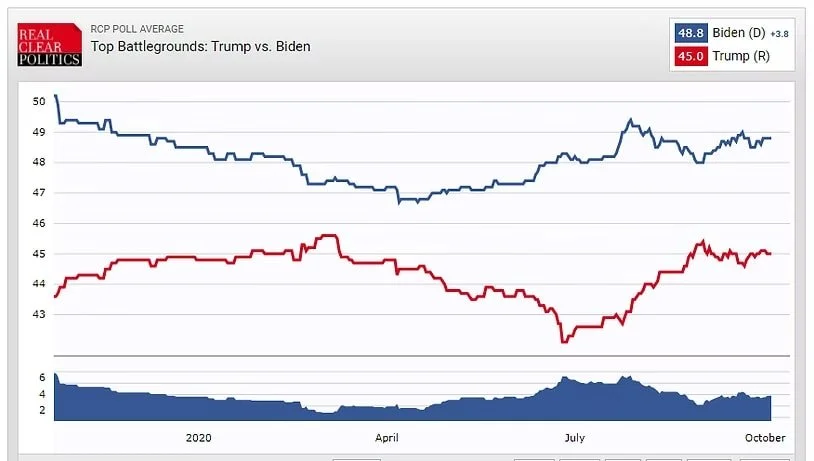

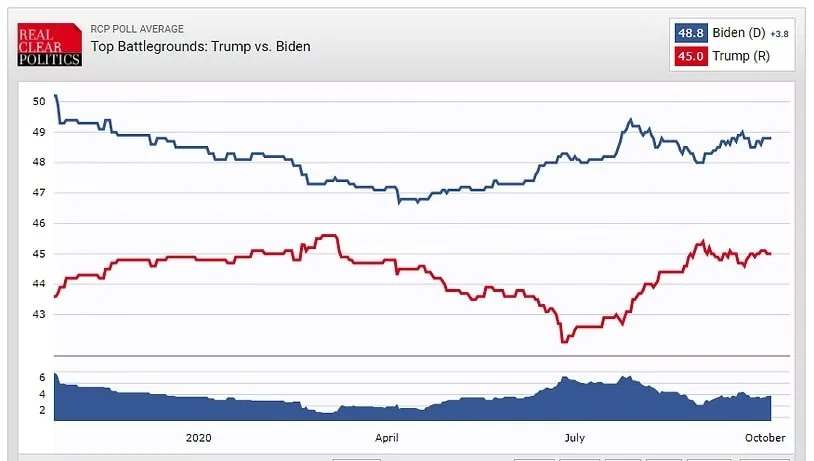

If you are already tired of the election ads everywhere you’re not alone. I’m tired of them too and we still have about a month to go. As people become numb to the effects of the Corona-virus, the main question that I am hearing from clients lately is some form of “what effect will the election have on my investments?” My response is always the same. Political bets are almost always bad bets, at least in my opinion. First of all, this race in particular seems to be too close to call. Joe Biden has a slight lead in the polls but the polls were generally wrong during the last election cycle. More importantly though, markets have a way of discounting the obvious before the said event occurs. What I mean by this is that market participants place their bets ahead of time based on what they expect to occur in the future - typically by about six months. By the time election day gets here, stock market valuations should be reflecting events expected through roughly the Spring of 2021. Unless the results of the upcoming election are a big enough surprise to affect expectations about the economy and earnings next spring, then the outcome of the election should already be priced in. As opinions and facts on the ground change, markets will adjust in anticipation. In 2016, most polls predicted a Clinton win. When Trump won, the markets exploded higher because it wasn’t the outcome markets expected.

Reported results as of October 5, 2020

Andrew Adams of the Saut Strategy Newsletter writes “I think the stock market’s resiliency also supports our view that it isn’t as concerned by the election as most investors appear to be, as recently the stock market has risen along with Joe Biden’s odds of winning according to betting markets. My stance on the election’s impact on the market remains the same – we should respect the market’s opinion above all others and let it do our thinking for us. You will likely have much more success making investment decisions based on the market rather than speculating what it might do depending on the election’s outcome. “

Please don’t take our words to mean that now is the time to be complacent. That’s never a good idea. While some volatility spikes around the election are to be expected, we are more concerned with the news flow around the Corona-virus Pandemic. At the end of the day, stocks need earnings growth to appreciate in value over the long term. To the extent that a closed economy keeps businesses and consumers from conducting commerce, we do see the potential for the rare double dip recession. Keep in mind that the expectation for a double dip recession is not our base case scenario but we do see it as a risk that investors should consider. For now though, the long term trend of US equities remains up and we still believe that stocks are in a long term bull market with years left to run. Our advice is that investors should stay the course within the context of their predefined tolerance for risk.

The Conference Board Leading Economic Indicators Index appears to suggest that the US economy is on the verge of a comeback. Hopefully we don’t get a repeat of the 1980 - 1982 double dip recession.