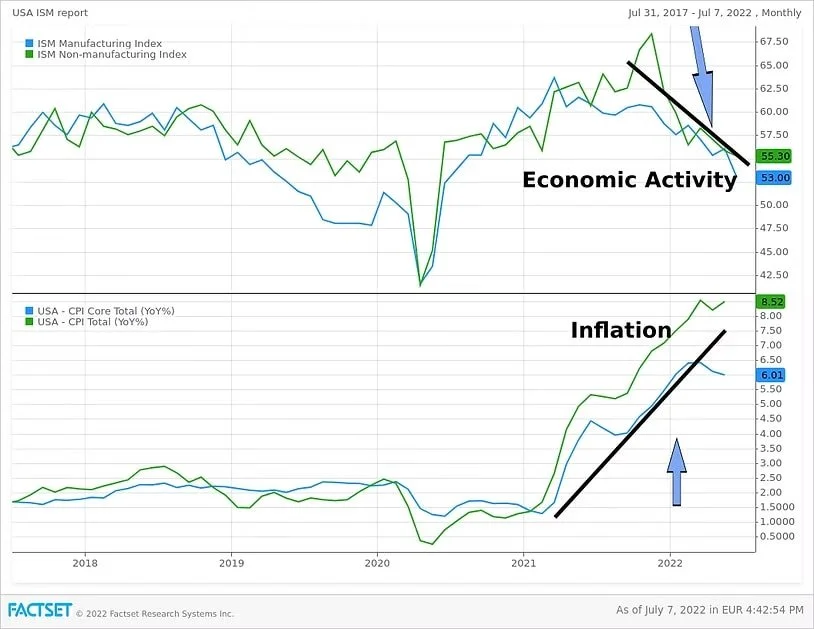

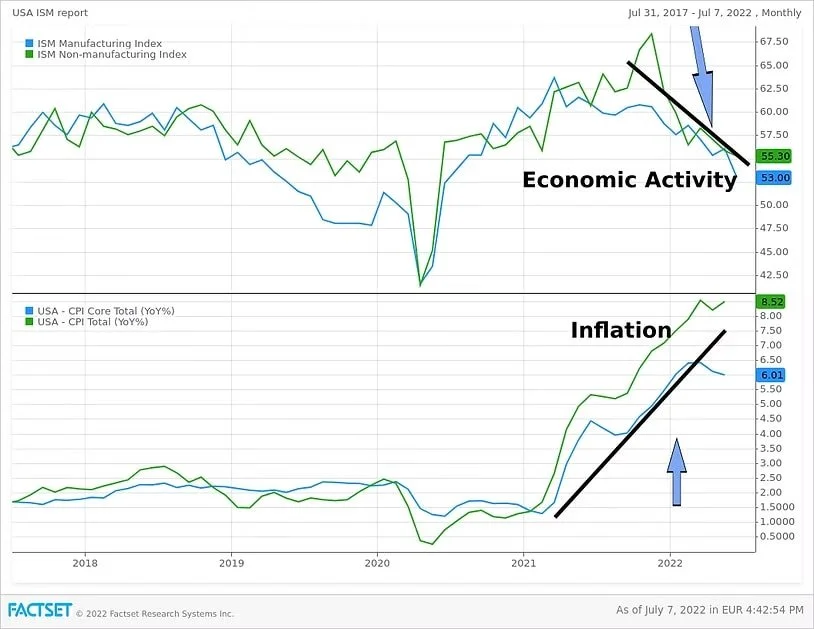

Slowing Economic Activity and Rising Inflation - A Dangerous Combination

You’ve undoubtedly heard by now that the S&P 500 just had its worst six month start to any year since 1970 coming in at minus 20.58%. The Nasdaq finished the 2nd quarter down 29.51% YTD while the small caps as measured by the Russell 2000 were off by 23.93%. And to make matters worse, there was nowhere to hide other than cash. Bonds as measured by The Barclays Intermediate Government Corporate Index were off by 7.21%. The picture was much the same in equity markets globally. At the sector level, energy stocks were up 29.22% with all other sectors negative year to date. Fortunately, at EAM, we spent most of the first half of 2022 overweight Energy and cash heavy in our flagship Global Rising Dividend Portfolio as well as multiple other strategies that we manage. Our alternatives allocation generally helped qualified investors gain an edge as well.

The story of the day is inflation and a potential recession.Blame it on who or what you want – the Ukraine invasion by Russia, supply chain issues, bad fiscal policy, The Fed; it doesn’t matter. At the end of the day what is important is that the Fed has a really tough job ahead of it as it attempts curb inflation without causing a recession.

The loose definition of a recession is two consecutive quarters of negative GDP growth and it appears that we already have that in the bag. While the technical definition of a recession as stipulated by NBER, the official last word on dating recessions, is a little different, we think stocks have been discounting a drop in economic activity for some time. The good news is that we think that in terms of magnitude that somewhere between two thirds and 100% of the damage to stocks has already been done. We are comfortably holding excess cash and waiting for evidence of a stock market bottom before putting all that dry powder to work. Stocks should bottom and start the next leg up well before the economic bottom is apparent to the general public. Stay tuned.