From 1950 to 1981 to 2020 - The Big Picture

After nearly thirty years in the investing game, I’ve seen a lot of changes. I’ve seen great companies and even entire industries be born and disappear. Keeping up with current events and the news of the day is really one of the biggest parts of my job. The reason that understanding the news is so important is that the constant in life we call change has a way of showing up in the financial markets. I’m not saying that predicting the future is essential to investing success or that it’s even possible. I don’t think that it is. But as events that move markets unfold, it is of paramount importance that the successful investor adapt to new realities in real time.

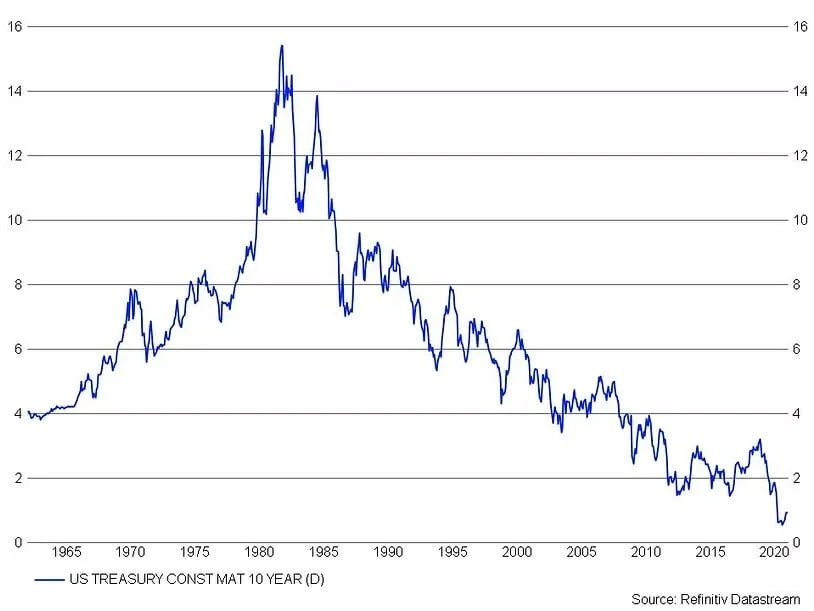

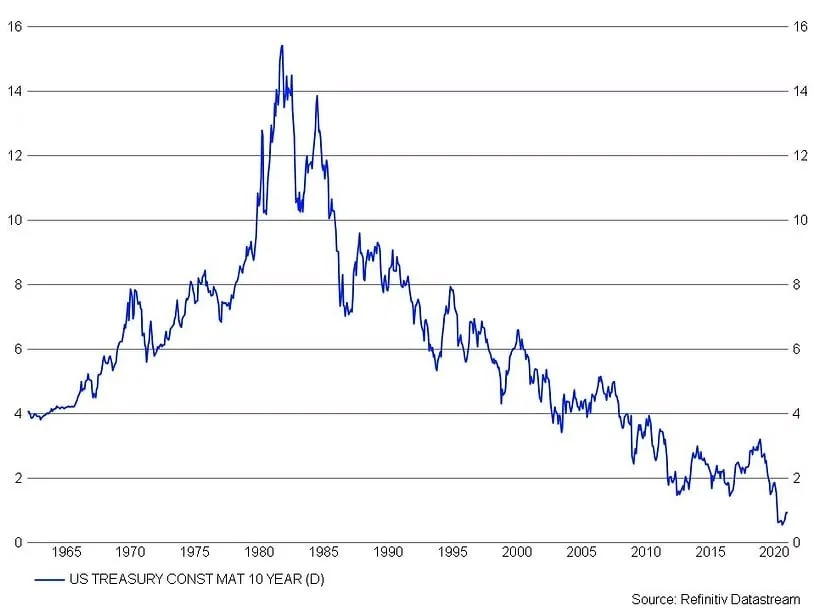

In the short term there are uncertainties and opportunities associated with the obvious events making news - social unrest, a new presidential administration and the reopening of the global economy post pandemic. But there is a larger change at play that I think is starting to emerge and it shouldn’t be ignored. In 1981 the yield on the 10-year treasury bond peaked at around 15.5% after rising since 1950. Since the early 1980’s interest rates have been falling until 2012 when rates seemed to find a floor at just below 1.50%. When the pandemic hit our shores in March of last year the US benchmark bond traded to a mind-numbing low yield of 0.39%. I think that the March low will prove to be THE low for interest rates. While interest rates can actually go negative, members of the Fed have publicly stated their belief that a negative interest rate environment is not in the best interest of the economy. The unprecedented fiscal and monetary stimulus should be the catalyst that reflates the economy and causes the interest rate tide to turn for the first time in forty years.

Since the interest rate cycle has historically been a multi-decade event, this is a multi-decade call. As interest rates start to rise, some of the winners from the recent past should start to underperform while new opportunities should present themselves. The first and most obvious implication of my long-term interest rate thesis is that treasuries and long duration fixed rate bonds in general face strong headwinds. The same goes for interest rate sensitive sectors of the US equity markets. I think investors should look to alternative asset classes like commodities and real estate to augment bonds as part of their equity diversification strategy. In the short term I think the reopening of the economy should be good for stocks. But the while the short term is trickier to get right, we stand strong in our belief that the long-term bull market in stocks that we have enjoyed since the end of the Great Recession is alive and well. Recently the bull market has been led by the large cap tech related names. While I am not yet reducing exposure to the sector, I do think other areas of the stock market should reassert themselves including small cap and emerging market shares. For now, we encourage investors to keep an eye on the bigger picture, ignore the noise and adapt to new opportunities that arise from the expected structural change in interest rates. In the 1950’s rising interest rates were associated with one of the best economies the US has ever experienced.