Stocks and Bombs

For the last week or so the conflict of words between North Korea and the United States seems to have changed from a rapid boil to a slow simmer, giving equities a boost during the first half of the week. Stocks did experience substantial weakness on Thursday followed by mild attempt at a rally on Friday. But military games on the Korean Peninsula are scheduled to begin on August 21st which is sure to turn the heat back up. Having said that, I wanted to take a look at past U.S. stock market reactions to previous military conflicts.

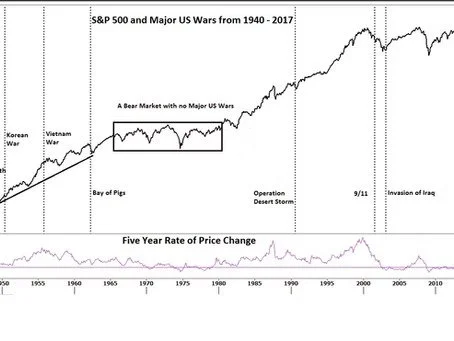

In the chart above I have marked major US military conflicts, leaving out smaller conflicts like Grenada, Panama, etc. There are two things that stand out to me. First of all, no major wars started during the secular (long-term) bear market of 1966 – 1982. It is true that the Vietnam War lasted from 1960 – 1975 but the bear market didn’t start until 1966 in the S&P 500 and 1968 for those using the Dow Jones Industrial Average to start the count of the bear. Military conflicts have begun in the middle of secular bull markets and in the middle of secular bear markets.

Secondly, a closer look over shorter time spans does show that military conflicts have often been associated with temporary stock market pullbacks. In secular bull markets these pullbacks haven’t tended to derail the secular bull in progress. But the pull backs related to geopolitical flash points weren’t always buying opportunities. For example, since a secular bull market was already underway for the S&P 500 going into 9/11, buying the dip proved costly. Since the preponderance of the evidence suggests to me that investors are still enjoying a secular bull market, I think any potential pullback related to the North Korean Situation could be viewed as an opportunity to buy high quality stocks on sale.

The chart above shows the month before the start of the Korean War in 1950 and the next five years. The S&P 500 experienced about a 10% decline that lasted only briefly. Five years later stocks were up about 119%. The index posted gains of over 10% just looking out one year.

Above - during the failed Bay of Pigs operation stocks demonstrated similar behavior. Below, similarities can be seen in the market action during Operation Desert Storm.