What Rising Interest Rates Mean for Your Bond Investment Strategy

For over 40 years, falling interest rates helped fuel a historic bull market in bonds. But we believe that era is likely behind us. After decades of declining yields, we’ve entered a new chapter, one defined by more volatility and less predictability.

At Emerald Asset Management, we believe investors now need to approach fixed income differently. This article explores two core strategies, bond ladders and barbells, and why we think one is better suited for today’s environment.

Interest Rates Still Rule Bond Returns

No single factor drives bond performance more than interest rates. And for a long time, rates had only one direction: down. From the early 1980s until 2020, yields on 10- and 30-year Treasuries steadily declined. This helped bonds deliver strong total returns with relatively low risk.

That trend likely bottomed in 2020 when the 10-year Treasury yield briefly dipped below 0.4 percent at the height of the COVID crisis.

Our view is that the long bull market in bonds is over. We are now in a more volatile, range-bound environment where interest rates could stay higher for longer. In this setting, structure and strategy matter more than ever.

That brings us to two time-tested approaches investors often consider when managing bonds: the ladder and the barbell.

What Is a Bond Ladder?

A bond ladder is a structured way to build a fixed-income portfolio by spreading bond maturities evenly across a range of years. For example, an investor might hold bonds that mature annually from one to ten years, creating a rolling schedule of cash flows. As each bond matures, the proceeds are reinvested at current interest rates. This approach reduces the risk of reinvesting all funds at once, supports predictable cash flow, and aligns with long-term planning needs.

Ladders work well for investors who want predictability and are comfortable holding individual bonds to maturity. In a rising or uncertain rate environment, this structure can help investors take advantage of gradually increasing yields without requiring active timing decisions.

What Is a Barbell Strategy?

A barbell strategy takes a different approach. Instead of spreading maturities evenly, it concentrates them at both the short and long ends of the yield curve by, for example, holding a mix of 1-year and 30-year bonds with little in between.

This structure offers flexibility at the short end and higher yield potential at the long end. It can be effective when investors expect interest rates to fall or remain stable.

Because long-term bonds tend to gain the most when rates decline, a barbell strategy can outperform in falling-rate environments. But it also exposes investors to greater risk if rates rise, since longer maturities are more sensitive to rate increases.

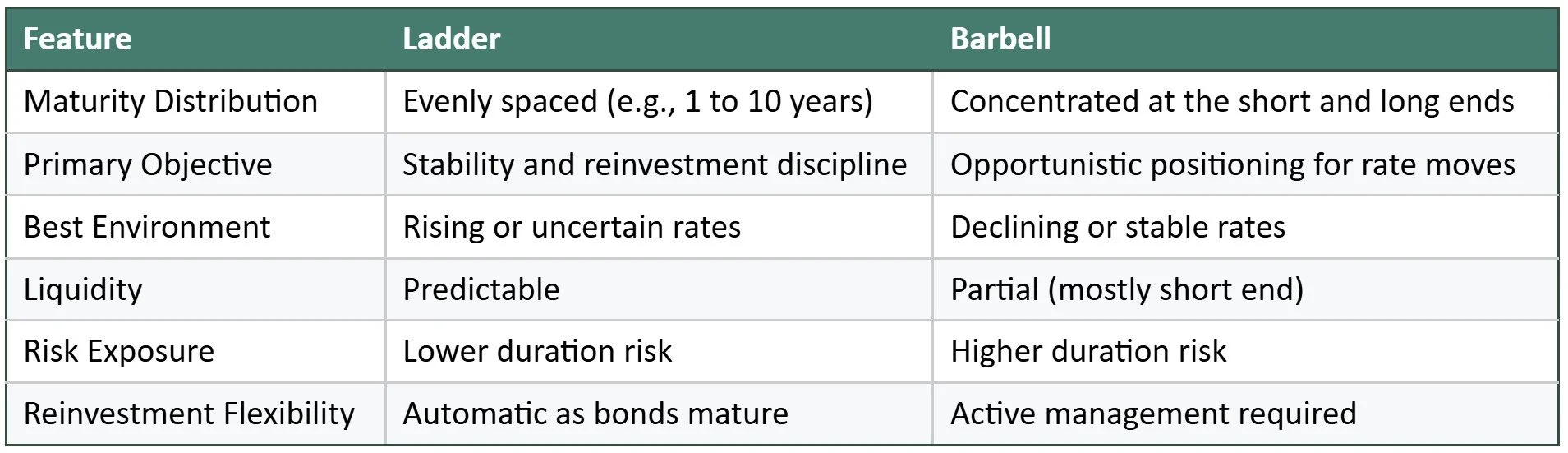

Comparing Laddered and Barbell Strategies

Both laddered and barbell strategies offer distinct advantages, depending on an investor’s goals and rate expectations. Here’s a side-by-side comparison to help clarify how they differ:

Emerald’s Perspective: Structure Over Forecasting

Today’s interest rate environment looks very different from it did just a few years ago. Yields are no longer near zero, and pressures like inflation, fiscal deficits, and shifting supply-demand dynamics suggest we’re unlikely to return to the ultra-low rates of the past anytime soon.

We believe the bond bull market that started in the early 1980s effectively ended in 2020. While we don't expect long-term rates to spike dramatically, we do think they are more likely to stay elevated than revert to their previous lows.

In this environment, discipline and structure matter more than rate predictions. That’s why we favor a laddered approach for most investors. It aims to offer:

A smoother ride through future rate changes

The ability to reinvest at higher yields if rates rise

Predictable cash flow for income needs, required minimum distributions (RMDs), or other liquidity events

The barbell strategy still has a place for investors who strongly believe rates will fall. But for those navigating uncertainty, we believe ladders provide a more resilient foundation.

Choosing a Bond Strategy That Fits

There is no one-size-fits-all answer when building a bond portfolio. The right strategy depends on your outlook for rates and your need for income, liquidity, and stability.

But in a world where the tailwind of falling rates is likely gone, structure, discipline, and diversification take center stage. A thoughtfully built bond ladder aligns income with your time horizon and helps you stay invested without needing to guess where rates are headed next.

If you're thinking about how this applies to your portfolio, we're here to help you explore what structure makes the most sense for your goals. Just reach out to our team — we're happy to talk it through with you.

Emerald Asset Management is an independent, boutique Registered Investment Advisory firm based in Rocky Mount, NC, serving successful executives, business owners, and high-net-worth individuals across Raleigh, Durham, and Chapel Hill. As a fiduciary-led firm with over 30 years of experience, Emerald provides research-driven investment management and strategic financial planning. The firm specializes in individually managed stock and bond portfolios, alternative investments, and risk management strategies. With a disciplined approach and a commitment to clarity, Emerald helps clients navigate complex financial decisions with confidence. They can be reached at (252) 443-7616 or on the web at www.emeraldam.com.

The information presented is based on sources believed to be reliable and accurate at the time of publication. This material is for educational purposes only and does not necessarily reflect the views of the author, presenter, or affiliated organizations. It should not be construed as investment, tax, legal, or other professional advice. Always consult a qualified professional regarding your specific situation before making any decisions.

Emerald Asset Management is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Emerald Asset Management's investment advisory services can be found in its Form ADV Part 2 and/or Form CRS, which is available upon request.