Playing the Odds

Over the years we’ve learned that there is no silver bullet to investing. If you are in this business long enough and have any courage at all, you absolutely will make market calls that turn out to be incorrect. It’s okay to be wrong, but it’s not okay to stay wrong. That’s why we have stringent risk management procedures in place.

The general idea in investing, in our opinion, is to identify the long term market trends and stay with them while ignoring the short term noise of daily and weekly price fluctuations. Since nobody knows in advance when trends will reverse, we have developed investing models that are designed to help us weigh the evidence that we have at the time and invest capital when the odds of success are in our favor.

Our model is complex but it breaks down into three basic parts. First of all we want to determine the current trend of the stock market and the strength of that trend. Secondly we want to measure monetary policy (inflation and the Fed) and thirdly we want to measure sentiment levels to look for warning signs or potential opportunities.

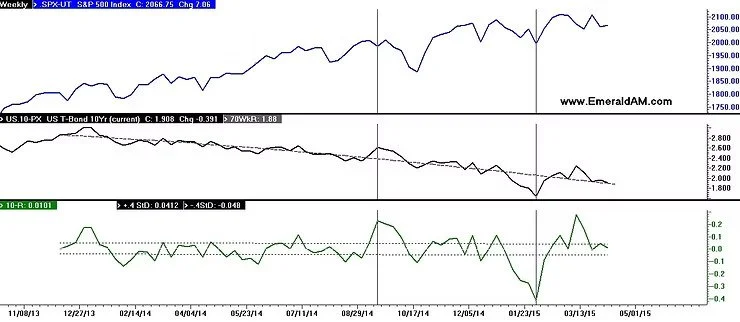

Since the question on everybody’s mind seems to be what the Fed will do and when they will do it, I thought an example of one of the monetary models that I use might be worth highlighting. The data and the concept illustrated in the model below are from the book Being Right or Making Money 6th Edition by Ned Davis. The chart and interpretation are by Emerald Asset Management, Inc. Keep in mind that this model is only one of about 50 inputs into my overall market model.

The model measures how far above or below the 70 week trend line 10 year treasury yield is. The first chart is the S&P 500. The second chart shows the yield on the 10 year US Treasury Bond relative to its 70 week trend line and the third chart measures the distance that the yield is from that trend line. The current reading on this indicator would be rated as neutral, in our opinion. High interest rates are bad for stocks and low rates are good for stocks—simple enough!