A Primer on Fixed Income Investing

Since a bond is by definition a loan to an entity such as a government (U.S., agency or foreign), a corporation or a municipality, investors should want to know the risk of being paid back their principal investment and their interest payments in a timely manner before investing. The risk of not being paid back is known as credit risk. There are many factors that should be analyzed to determine credit risk like leverage and cash flow metrics as well whether the specific bond is a secured, senior, subordinated or insured issue. There are other factors and metrics as well but those are beyond the scope of this article.

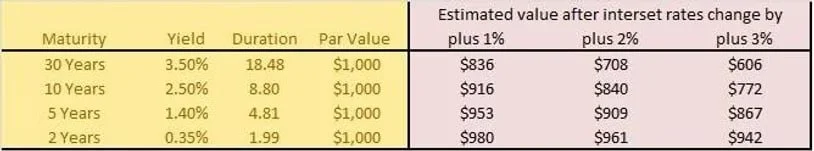

The second primary type of risk that investors face is called interest rate risk. Bonds with fixed coupons typically fluctuate in value inversely with interest rates. Therefore if a bond is sold before maturity then an investor could receive more or less than their original investment. Bonds with longer dated maturities tend to fluctuate in value more than bonds with shorter maturities. However, except in the event of default, the face value of the bond will be paid back at maturity.

An example of interest rate risk:

source: WFA

If you are a bond investor concerned about interest rate risk, one avenue for consideration is the Zweig Bond Model. For more on the Zweig Bond Model click here.