Because Investors Have Forgotten What a Stock Market Correction is......

Note: The comments below were sent to our clients on August 27th.

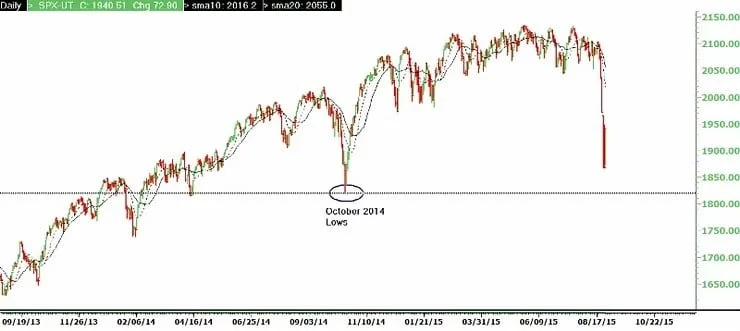

Over the course of five trading days U.S. Equities as measured by the S&P 500 Index have dropped by over 11%. From the all-time high on May 21st the same index has dropped by 12.55%, not counting dividends. The Value Line Geometric Index was down from its all-time high by just over 16%. The VLG Index is important because it gives us a better gauge of how the 'average' stock is behaving than the better known S&P 500 and the Dow Jones Industrial Average.

The excuse for the sell-off in equities is mostly being blamed on fears of a slowdown in global growth spilling over from The Great Fall of China. Barring a full-blown currency crisis or a major debt default somewhere (Greece?), we think we might have seen the lows out of the market for this cycle. In order to make this statement we have to have a framework within which to work. The process at Emerald Asset Management is to: 1) identify the trend, 2) trade in sync with the Fed and 3) pay attention to sentiment and valuations.

1) The trend in place since the bottom in March of 2009 has been broken...

.....But there is horizontal support about 2% below the recent lows. If the horizontal support fails then we could be in store for something more serious. Watch this level closely.

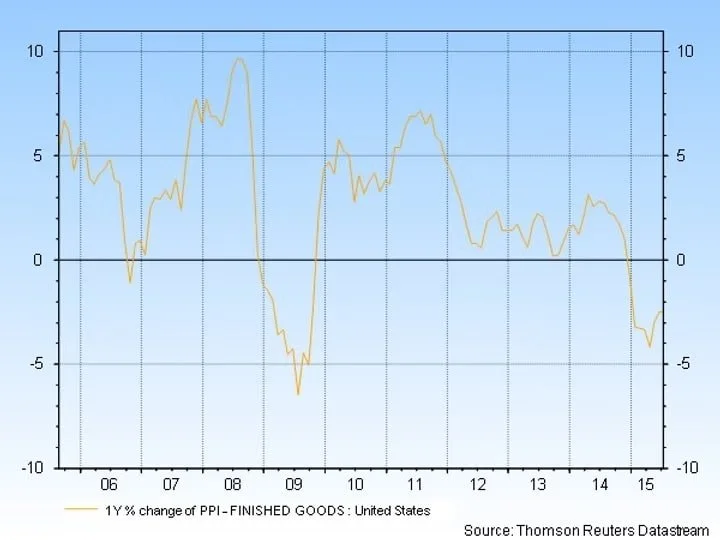

2) Inflation is subdued and central banks are providing liquidity to the capital markets globally.

3) Sentiment is getting to extreme levels that are often characteristic of market bottoms. One of our proprietary sentiment indicators is below.

Conclusion: It is important to note that the recent low in the S&P 500 is about 2% above the lows of last October. So while the markets are extremely oversold as of this writing, reaching the October 2014 lows is a real possibility. In the near term I expect some 'panic buying' as investors' moods change from fear of losing money to fear of missing the opportunity to buy. I do not think the initial bounce will be the real move because typically market breaks like this one take a while to repair themselves. So there should be multiple opportunities to buy stocks as the market forms a base from its ultimate lows. Traders and investors can use market strength to sell laggards and raise cash. Long term investors who can handle the volatility should use the overall weakness as an opportunity to selectively add to high quality names over the coming weeks or at least maintain their positions as long as the fundamentals are sound. Aggressive types need to wait for the market to prove itself before committing serious capital. Keep in mind that the historically seasonally weak months of September and the first half of October are just around the corner. We advise clients to play the odds and use this to their advantage.

For more on why we think we are still in a long term bull market and the volatility one should be willing to assume in order to invest in stocks click here. For more on how we manage risk at Emerald Asset Management click here. Hopefully by now our clients know that we take risk management very seriously and that we are sticking to our discipline. Please feel free to contact us if you would like to discuss your investment portfolio. We are here to answer your questions and provide advice when you need us.