To Index or not to Index…..

…..is missing the point altogether. I’m very well aware of what many studies say but I don’t think those studies adequately address the concerns of real investors with real financial goals.

The returns for the S&P 500 for the previous five years are listed below:

2009 26.46%

2010 15.06%

2011 2.11%

2012 16.00%

2013 32.39%

2014 13.69%

Anybody who has been professionally managing money for any length of time knows that the value added, or to use industry jargon alpha, is typically created through proper risk management in down or sideways markets. Sometimes making wise desicions means leaving some basis points on the table. It’s kind of like paying your home owner’s insurance premium and not having your house burn down. Yes, the money is down the drain but irresponsible behavior will eventually catch up with you in the long run.

In the years 2009 through 2012 in particular, it seems to me as though most of Main Street didn’t have any real appetite for risk even though the markets were generally up. But it’s natural for people to become risk averse after experiencing the Tech Wreck of 2000 to 2003 and then watching the same movie again during the Great Recession. There was actually a television show out called “The New Normal” (I never actually saw the show) so to say that those years didn’t permeate the American psyche is naive. After the past five years some investors who have been properly diversified, using proper risk management strategies including Asset Allocation and Diversification and investing according to their risk tolerance are predictably asking themselves why not just fire the expert, throw the money into the S&P 500 Index Fund and save the fee. After all, they KNOW where the market will be next year or in five years or whenever they need their capital. Who would ever need risk management? And to be sure, they would never panic and sell out at the bottom of the market. All those liquidations in March of ‘09 must have been imaginary.

So here are the points I’m trying to make:

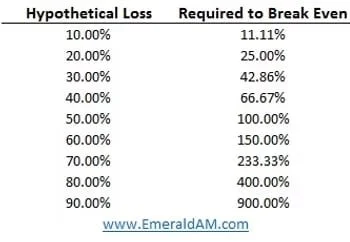

1) Nobody knows what the future holds so managing risk is of paramount importance. A 20% loss requires a 25% gain just to break even. A 50% loss requires a 100% gain to do the same. It’s not the average return that one earns but the volatility of and the order those returns that determines how much money will be accumulated over time.

2) Many amateur investors see the past and make investment decisions based on it. Studies document that Main Street tends to buy at the top and sell at the bottom. After the last five years is it any wonder that people wish they could travel back in time and buy the S&P 500 – or 45 days and sell it? Investor behavior is substantially more important than the ‘index or not’ question.

3) And the most important point I want to make is that index (aka ‘passive’) investing is not a strategy. Index Investing is a style of investing just as active management is a style of investing. Growth Investing is a style and Value Investing is a style. Small Cap Investing and International Investing are styles. At different points of the market cycle different styles out-perform others. There are pros and cons to every style. Here is the secret: there is no silver bullet that works best all the time or for all people or during all phases of the market cycle. However a well thought out asset allocation strategy can help investors meet their goals without requiring them to step too far out on the risk spectrum.

There is absolutely no reason that index investing should not be part of an overall asset

allocation strategy. I just don’t believe it should be the entire or the majority of the asset allocation for most investors. So my advice to those making investment decisions is to start the process by asking the right questions.

Just for the record, today (9/17/2015) the Fed chose not to raise interest rates. I think we are in the middle of a correction that still has to run its course. But I think it’s just a correction and the Secular Bull Market that started in 2009 is still alive and well. If you share my opinion though, we could both be wrong so make sure that you have a proper long term strategy in place and that you seek the help of an experienced professional.

For more on Risk Management click here.

Emerald Asset Management, Inc. is a Registered Investment Advisor. Advisory services are only offered to clients or prospective clients where Emerald Asset Management, Inc. and its representatives are properly licensed or exempt from licensure. This website is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Emerald Asset Management, Inc. unless a client service agreement is in place.