The Year of the Dog

In February of 2018 the Chinese Zodiac Calendar flips to the Year of the Dog, specifically the Year of the Brown Earth Dog. According to www.georgetangchineseastrology.com, “The 2018 year of the Brown Earth Dog is destined to be a good, upbeat and very positive year for Horse people.” This is especially good news for me because I am a Horse person. Having said that I don’t actually believe that anybody can consistently and accurately predict the future—even when armed with the Chinese Zodiac Calendar. I do believe though, that disciplined, meticulous research based on known facts can increase the odds of investment success over time. So let’s look at a few Core Beliefs held by Emerald Asset Management that we can use to size up the Year of the Brown Earth Dog.

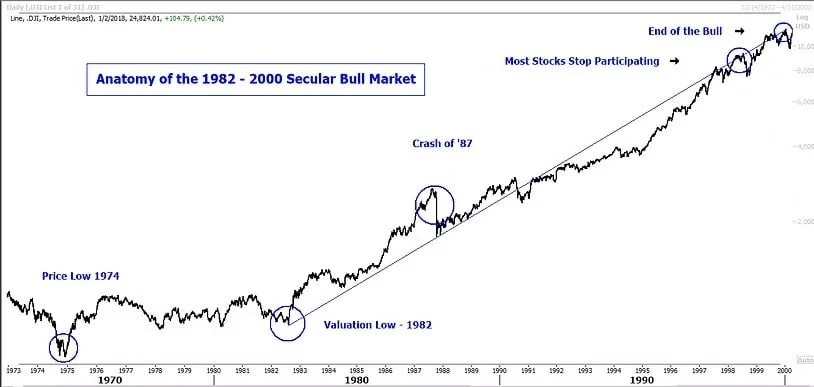

1) The U.S. Stock Market is in a long term secular bull market. The absolute price low for stocks during the last Secular Bear Market was March 9, 2009 and the valuation low was formed in August through October of 2011. Secular bull markets have historically lasted 15 to 16 years. So depending upon where you want to count the beginning of this bull market, it is roughly nine to eleven years old. Within the context of a secular bull market there have historically been cyclical bear markets. For example, the Crash of 1987 occurred in the middle of the 1982—2000 Secular Bull Market. But even that event wasn’t enough to start a protracted bear market. 2017 was a year in which the stock market experienced very little volatility. We do think it would be naive to expect stocks to keep up this pace without some sort a pause to refresh or a correction that could scare some of the dumb money away.

2) We don’t think it is wise to fight The Fed. But even though the Fed is starting to unwind its balance sheet and increase short term interest rates, we don’t think we’re ‘fighting the Fed’ just yet. There has been a historical tendency for stocks to correct after the last Fed Funds increase. While we don’t know if the Fed will be able to get the Fed Funds rate to 3%, 3% seems to be the general consensus for where they want rates to go. Rates are a long way from that right now.

3) We don’t see any real signs of a recession on the near-term horizon. There has been a lot of press about the yield curve inverting but that hasn’t happened. An inverted yield occurs when ten year treasury yields are below two year treasury yields. An inverted curve usually precedes a recession by 6 to 18 months. Therefore, even if the yield curve were to invert, it could be well in advance of a recession. The caveat though is that the stock market is also a leading economic indicator. As of this writing , the spread between the ten year and the two year treasury bond yields is 54.6 basis points so for now all is well by this widely watched indicator.

4) One of the biggest arguments that the bears love to throw out for fodder is that valuations are stretched. While there might be some merit to this argument, we believe that higher valuations are better used as a measure of risk in the event that something does go wrong like a war or a shock to price levels (inflation or deflation). It is our belief that while risk levels might be elevated, bull markets don’t typically die of high valuations or of old age.

5) Politics aside, lower corporate income taxes and less regulation should be good for stock prices.

So for 2018, we prefer stocks over bonds. Our favorite markets are the United States, India and Japan. We are taking note of the strength in oil and other commodity related equities. Hopefully the Year of the Brown Earth Dog will be prosperous for all. And remember, I am a Horse person so you should be in good hands in 2018.