US Stock Market Second Quarter Review

When I first started playing and working on the Street of Dreams in 1991, the Dow Jones Industrial Average was trading around 3000. On January 26th of this year the Blue Chip Index peaked at 26,616.71 before dropping 3256.42 points to hit an intraday low of 23,360.29 on February 9th. Speaking strictly in terms of points, the Dow had dropped in about 10 days by more than its total value in points used to calculate its value when I started my journey down Wall Street. The reason I bring this up is because as the markets march forward, the large price movements tend to scare people, especially those new to investing. But it’s important to keep in mind that what seemed a like a huge drop was really only a 12.23% decline - albeit a rapid one. It’s important to understand that what stock market participants and observers are seeing is normal. Corrections are just part of the game and as of this writing, the correction that has been unfolding appears to be just that—a correction.

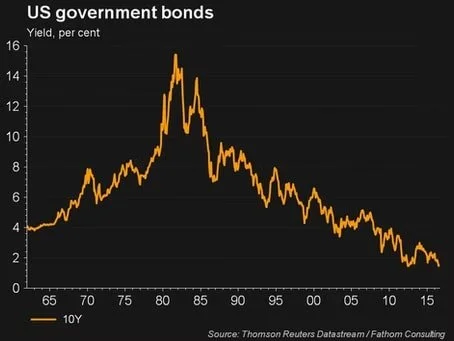

So what caused stocks to be worth 12% less on February 9th than ten days before? And will this correction morph into a bear market? First of all, excitement about tax cuts and deregulation probably caused stock prices to get a bit ahead of where they should have been trading. When this happens, corrections are necessary to bring prices back in line with some sort of reasonable valuation. Secondly, several concerns headline events gave investors an excuse to book some profits and look for opportunities elsewhere. The industrial, financial and even the technology sectors fell victim to profit taking while many of the previous years’ laggards like retail and utility stocks got a bounce. The two primary culprits that spooked investors were, first of all concerns about rising interest rates by the Fed on the short end of the curve and falling interest rates on the long end. When short term rates rise above long term rates then the yield curve is said to be inverted. An inverted yield curve has historically been a good early predictor of an impending recession. We have written about this phenomenon ad nauseum in the past and our conclusion has so far been the same—the yield curve has not inverted so as of now this fear is unfounded.

Secondly, and more concerning to us, is the possibility of recent tariffs escalating into a full blown trade war. While trade wars aren’t typically positive for stocks, the general consensus seems to be that most of the media hype is simply rhetoric and that real negotiations are taking place. So for now, the correction appears to us to be just that—a correction as opposed to the start of a more serious bear market. But...as the facts on the ground change, so will our advice so stay tuned!