The Year of the Rat

On January 25th of 2020, the Chinese Zodiac Calendar flips to the year of the Rat, specifically Year of the Metal (Gold) Rat. I’m not sure why they call it the Year of the Rat, but from everything I have read on the internet, the Year of the Rat is supposed to be good for making money for those who are well prepared and work hard. Since this is the Year of the Metal Rat, let’s start by looking at what commodity prices are doing and the possible ramifications for investors.

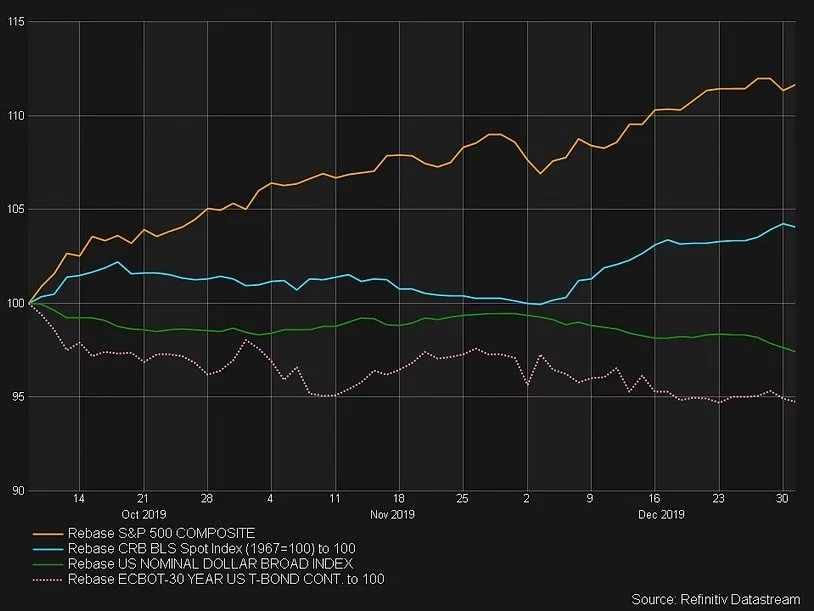

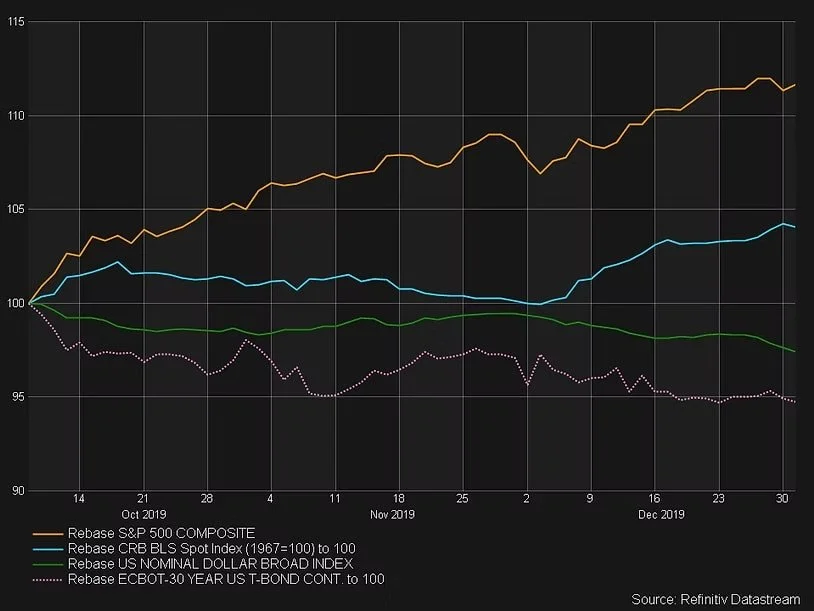

According to John Murphy and stockcharts.com, there are several key relationships between various markets that occur when markets are behaving “normally”. Stocks and commodities should be trending in the same direction, while there is usually an inverse relationship between commodities and bonds, stocks and bonds, and the US Dollar and commodities. The study of such relationships is known as intermarket analysis. In the chart above, one can see that stocks and commodities are both up over the last quarter and appear to be trending higher – check. While commodities and stocks appear to be trending higher, bonds and the dollar are down over the last quarter – check and check. Lastly, stocks and bonds are moving inversely of each other – check. Markets appear to be acting normally. These aren’t just casual observations. There is economic justification behind each of these relationships. For example, most commodity trades are denominated in US Dollars. Therefore, a weaker dollar can buy fewer units of a particular hard good than a stronger dollar. Therefore, the weaker dollar would translate into higher gold, oil and other commodity prices.

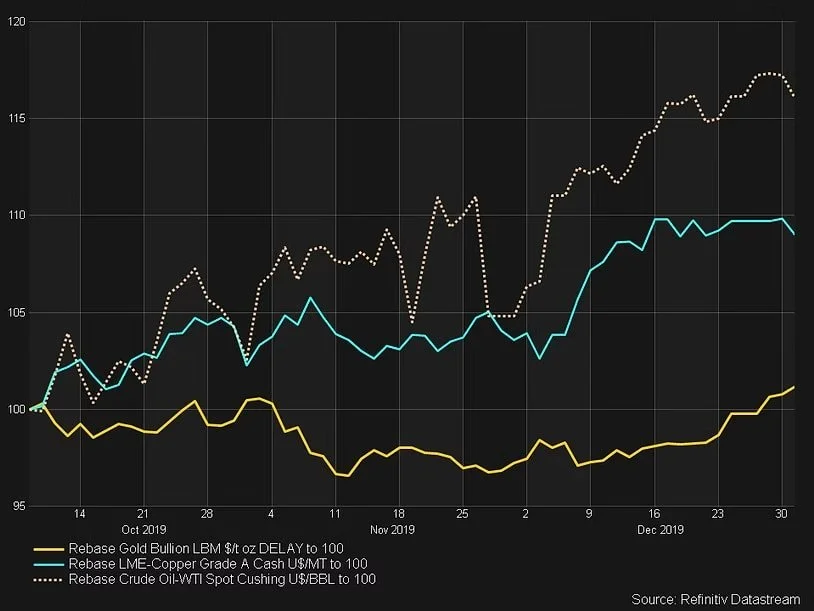

A quick glance at the chart below shows that gold, oil and copper are all higher over the last quarter. Higher commodity prices can indicate market expectations for higher economic growth. So, for those rats who are willing to look, the clues seem to be piling up. We still think that US stocks are in a long-term secular bull market. Hopefully commodities will join the party in a meaningful way.