First Under Statement of 2016 - January was Rough!

Current Outlook

If 2015 was flat and boring for investors, then 2016 has ushered in an unwelcome change to volatility and losses. We thought it might be helpful if our friends and clients could see the stock market through our eyes. While predicting the future is impossible, it is possible to calculate the preponderance of the evidence in order to stack the odds of success in our favor. Our primary interest is in the dominant trend of the stock market with a secondary interest in monetary policy and sentiment, which could influence the trend. By combining these factors into one model we can aspire to gain some understanding as to the prospects for profit in the stock market. Anything less would be operating on a hunch, or gambling. Right now there is substantial risk that the secular bull market that started in March of 2009 is coming to an end. However, it is still too early to make that call definitively. The bull market will not be over until it’s over.

Technical and Valuation Analytics

The EAM Market Model is a multifactor model that is designed to measure the trend of U.S. Equities, Monetary Policy and Market Sentiment. There are currently thirty-six factors used as inputs into the model. Right now the model would indicate that conditions are about as neutral as they get.

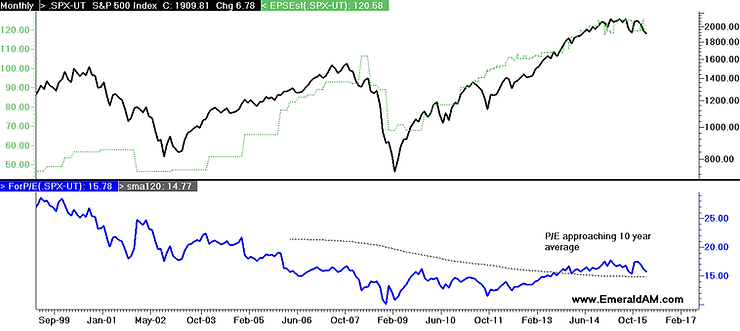

If 1820 on the S&P 500 fails to hold, support at the 38% Fibonacci retracement should offer the next line of technical support. That’s about a 5% drop from 1820 support.

If the S&P 500 reaches 1730 that would put the market trading at a forward P/E multiple of 14.41x which is slightly below its 10 year historical average of 14.77x based on forward 12 month estimate of $120.58 (Thomson estimates). That is certainly not overvalued – especially in light of the current low interest rate environment. Furthermore, that would make the peak to valley drawdown on the blue chip index about 19%. Dividends would have mitigated that. That’s not fun but it’s not 2008 either. It also hasn’t happened.