Investment Highlights - April 2017

Was it Really a 'Trump' Rally?'

The 1st quarter of 2017 started out optimistically on the part of investors as the surprise “Trump Rally” paused and then resumed in hopes of (on the part of the stock market) deregulation and tax cuts. After a nice run, the S&P 500 peaked on March 1 and drifted lower into the end of the first quarter. Much of the blame for lower prices in March was placed on the inability of the Trump Administration to repeal and replace the Affordable Care Act. But we aren’t buying that. While it is true that hopes of a pro-growth legislative agenda probably sparked the rally, we do not think the rally was just a “Trump Rally”. We think that the reason the stock market continued its rally for more than a few weeks is because investors had (correctly) been anticipating the end of the earnings recession. We have written extensively that while the US economy never entered into a new recession, corporate earnings did. The S&P 500 peaked on May 21, 2015 at 2134.28. The index did not see that level again until July 11, 2016. The breakout in stocks that ended the volatile 14 month trading range occurred well before the election. Starting with the 1st quarter of 2015 (earnings for most companies would have been released in the 2nd quarter) GAAP earnings for the S&P 500 went on a six quarter streak of negative growth. We think that this rally has in large part been the result of earnings re-accelerating as the Fed driven market morphed into an earnings driven market. That re-acceleration started before the election.

It’s often been said that a picture is worth 1000 words. The chart below shows the downturn in GAAP earnings per share for the S&P 500 (bottom pane) turning down as the market (top pane) starts to flatten out. The second blue line shows the market making a new high well before the election, correctly anticipating the upturn in GAAP Earnings. In fact, a closer look reveals that the ultimate bottom in stock prices was actually in February of 2016, almost nine months before the election. Markets are typically forward looking discounting mechanisms except in the event of a surprise.

chart 2

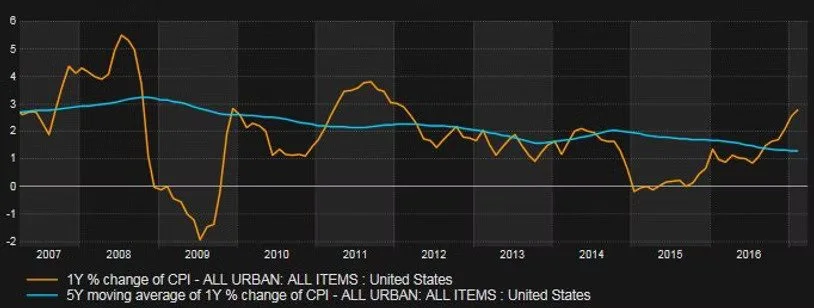

Going forward, stock market returns are likely to depend upon earnings growth as opposed to Federal Reserve Monetary Policy. A very accommodating Fed is what kept US Equities somewhat afloat during the earnings recession, in our opinion. While a 14 month nearly 20% wide trading range might not feel very buoyant to most investors, our mantra of “Don’t fight the Fed” proved useful. Without the Fed's accommodative stance, we think that stock market volaltility would have been much more severe. With the recent pickup in inflation (2nd chart) and the markets giving permission to the Fed to raise interest rates, we think that earnings growth is more important now more then ever so earnings must come through in order for the recent advances to continue. Having said that, we are still firmly in the camp that believes that US equities are in a Secular (long term) Bull Market. Depending upon how you measure them, secular bull markets have historically averaged 15 - 16 years with some obviously being shorter and some being longer. So for now, our advice continues to be to use dips to selectively buy quality stocks and enjoy the ride.