Better than Bonds

Some years back I used to enjoy reading a research report that was published periodically by Credit Suisse called “Better than Bonds”. The concept of the report was fairly straight forward as I remember it. At the time, dividend yields on many high quality stocks were the same as or greater than the yields on the same bonds. Therefore, if an investor was willing to buy a portfolio of the corporate debt of these financially sound companies, why not just buy the same stocks instead? The dividend yields on the stocks were higher than the yields on the bonds of the same companies and many companies had a good history of raising their dividend each year. Sure, stocks are considered to be riskier (more volatile) than bonds. And dividends aren’t guaranteed. But interest payments from corporate bonds aren’t guaranteed either. Bonds are higher up in the pecking order of the capital structure in the event of a bankruptcy but the concept was applied mainly to high quality blue chips and in the context of a diversified portfolio. Furthermore, stocks offer the potential for capital appreciation.

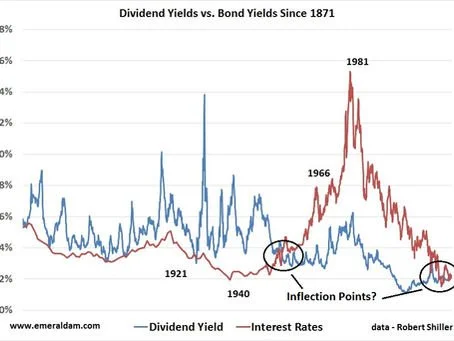

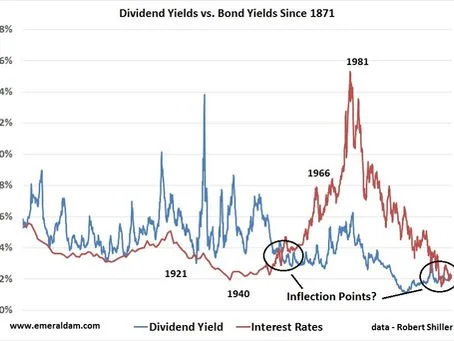

Up until the late 1950’s, dividend yields on stocks had generally been higher than interest rates on long term U.S. Government Bonds. So before the crossover occurred in 1957, bonds were generally purchased for safety of principle and stocks were purchased for growth, income or a combination of the two. It wasn’t until after this change in the relationship between dividend yields and interest rates that bonds become the investment vehicle of choice for income. The notion of stocks as a growth vehicle only grew during the great bull market of the 1980’s and 1990’s. Today it appears that history is repeating itself. Because of the low current interest rate environment and the benefits characteristic of high quality dividend paying stocks, we think that stocks are once again “Better than Bonds.”