Emerald Insights: Empowering You with Knowledge and Clarity

Timely guidance, educational tools, and curated content to support confident financial decisions.

How to Invest if You Think Stocks are Expensive & Interest Rates are Low

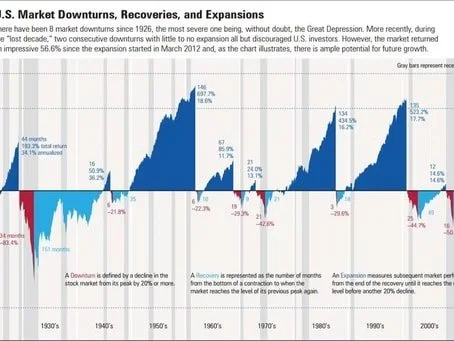

It’s taken me awhile to get here but I do believe that the Great Recession caused by the housing crisis of 2007 - 2009 is behind us and a new Secular Bull Market in U.S. and Global Equities is well under way.

Rising Dividends – A Strategy for Income or Growth

If you think dividends are boring, think again. According to Stocks for the Long Run, by Jeremy Siegel, about two thirds of the real (inflation-adjusted) returns from U.S. Stocks from 1871 to 1996 were attributable to dividends, and about one third of the (real) gains were attributable to capital appreciation.

Running with the Bulls

As the secular bull market that began in March of 2009 is starting to get a little age on it, naturally our phones are starting to ring a little bit (not a lot) with questions about how much life we think this bull market has left in it.

Playing the Odds

Over the years we’ve learned that there is no silver bullet to investing. If you are in this business long enough and have any courage at all, you absolutely will make market calls that turn out to be incorrect.

What is Active Share?

There is a relatively new investment industry buzzword that you might want to learn before your next cocktail party or investment club meeting.

Making the Most of Your 401k Distribution--A New Strategy

If you are planning to retire or change jobs and you have an investment in a qualified retirement plan like a 401k, the IRS might have just given you a gift. Or at least they might have made your life a little easier.

Nasdaq 5000 or Bust

On March 10, 2000, the Nasdaq Composite Index set an all-time record high at 5048.60. What followed was an unbelievable two year and seven month drop of 78% known today as the tech wreck.

Seven Steps to a More Secure Retirement

At Emerald Asset Management, we believe the foundation to building a more secure financial future begins with a plan. But how does one get started?