Emerald Insights: Empowering You with Knowledge and Clarity

Timely guidance, educational tools, and curated content to support confident financial decisions.

Wild Horses, Outer Banks, NC

What You Don't Know about Investing

I recently got around to watching The Big Short. I thought the movie was so good that I immediately downloaded the book to my Kindle. For anyone who hasn’t seen the movie or read the book I would certainly put both at the top of your summer list.

What's in Style on Wall Street

Whether your game is growth or value, momentum, low volatility or indexing, strategies with strong academic underpinnings generally work out if they are implemented properly and if they are given enough time.

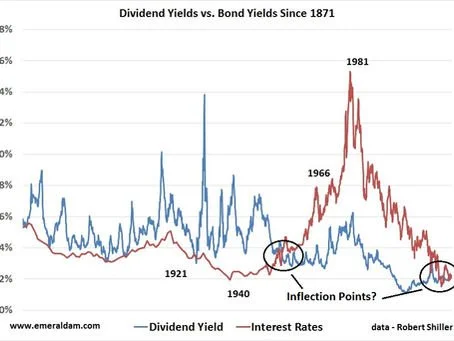

Better than Bonds

Some years back I used to enjoy reading a research report that was published periodically by Credit Suisse called “Better than Bonds”. The concept of the report was fairly straight forward as I remember it.

What to do if you see a Bear

It’s been well publicized that the month of January 2016 was not the worst January in history for US equities - it was the second worst. The interesting thing though, is how vocal the perma bear community has become - after the fact.

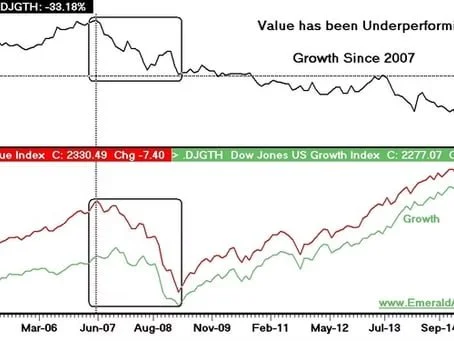

Why Value Investing is Under Performing Growth Investing

Nobody can predict the future with absolute certainty – nobody. However, in this business, we deal in probabilities, then we monitor and adjust. Therefore the astute analyst should be able to explain the situation on the ground and form an educated opinion about the future.

It Wasn't Raining When Noah Built His Ark

I can’t remember when I first heard the phrase that is the title of this article. But I’m fairly certain it’s been around for a while and was first used as an analogy relating investor behavior to the stock market.

Lessons from the 10th Hole

I started my career on The Street of Dreams in October of 1991 as a stock broker with one of those many great regional brokerage firms that used to exist. There are still a few of them left but most of the old investment companies that used to be household names are gone. In 2004 I earned my CFA Charter.

To Index or not to Index…..

…..is missing the point altogether. I’m very well aware of what many studies say but I don’t think those studies adequately address the concerns of real investors with real financial goals.

A Primer on Fixed Income Investing

Since a bond is by definition a loan to an entity such as a government (U.S., agency or foreign), a corporation or a municipality, investors should want to know the risk of being paid back their principal investment and their interest payments in a timely manner before investing.

The Art of Risk Management

Every good stock investor that I have ever met has some methodical, well thought out system for risk management that he or she can clearly articulate. Risk management is essential to successful portfolio management because nobody can predict the future.

How to Invest if You Think Stocks are Expensive & Interest Rates are Low

It’s taken me awhile to get here but I do believe that the Great Recession caused by the housing crisis of 2007 - 2009 is behind us and a new Secular Bull Market in U.S. and Global Equities is well under way.

Rising Dividends – A Strategy for Income or Growth

If you think dividends are boring, think again. According to Stocks for the Long Run, by Jeremy Siegel, about two thirds of the real (inflation-adjusted) returns from U.S. Stocks from 1871 to 1996 were attributable to dividends, and about one third of the (real) gains were attributable to capital appreciation.

Playing the Odds

Over the years we’ve learned that there is no silver bullet to investing. If you are in this business long enough and have any courage at all, you absolutely will make market calls that turn out to be incorrect.

What is Active Share?

There is a relatively new investment industry buzzword that you might want to learn before your next cocktail party or investment club meeting.