Emerald Insights: Empowering You with Knowledge and Clarity

Timely guidance, educational tools, and curated content to support confident financial decisions.

Corona Virus Concerns Should Lead to a Buying Opportunity in US Equities

Today’s 1000 plus point drop in the Dow Jones Industrial Average is largely being attributed to increasing fears over the possibility that the Corona Virus could be the final straw that forces the US Economy into recession.

Investment Playbook - October 2019

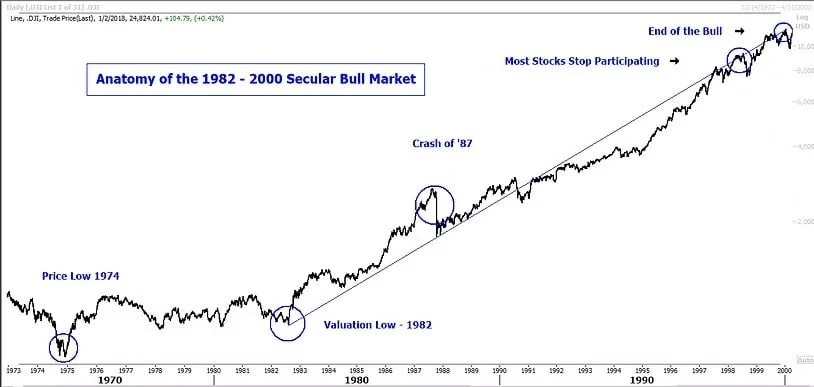

The first sentence of our 2019 Mid-Year Outlook read “Congratulations, you just made it through another bear market! We think the cyclical bear is heading back to his cave and that the secular bull will soon resume its charge.”

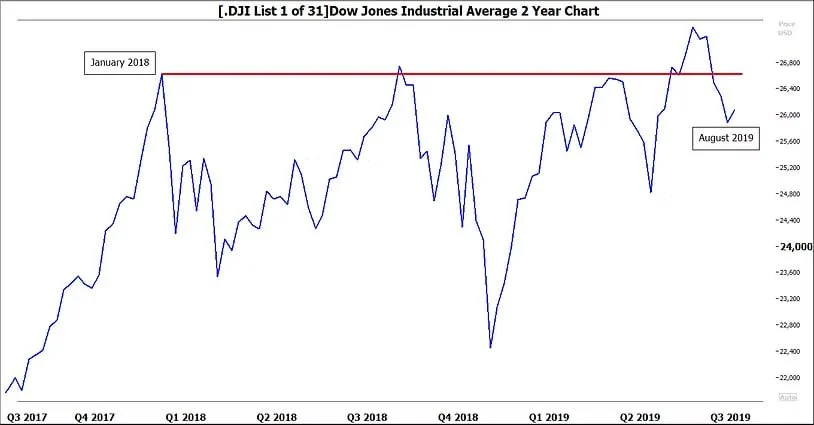

Not Making Money in Stocks? Here's Why

If your 401(k) feels flat there's a reason. A quick glance at the chart below shows that the Dow Jones Industrial Average is below its January 2018 highs. That's right - US equities as an asset class have made virtually no progress for over a year and a half.

2019 Mid-Year Outlook

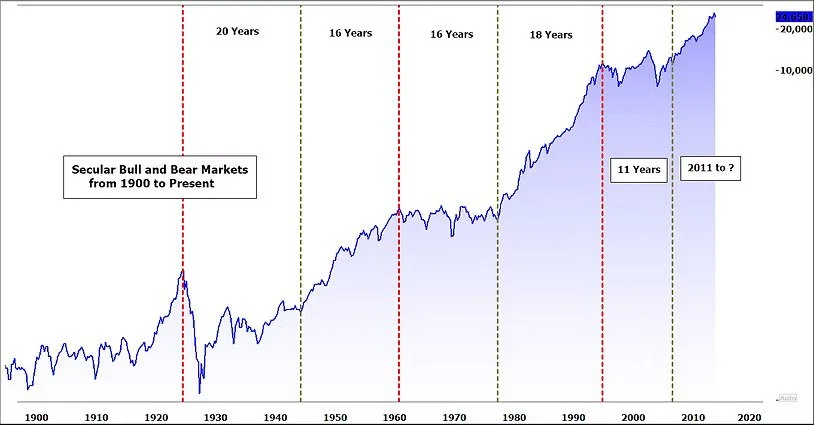

Congratulations, you just made it through another bear market! We think the cyclical bear is heading back to his cave and that the secular bull will soon resume its charge.

2019 - More Turbulence Ahead?

The stock market flew through the 2018 clouds with plenty of turbulence. We wouldn’t necessarily term 2018 as a bad flight but we’ve certainly had more pleasant experiences in the friendly skies.

Well, It's a Bull Market

I’ve been at the business of investing money for clients and myself for 27 years - almost to the day. I didn’t know it then but after my first five years as a stock broke

US Stock Market Second Quarter Review

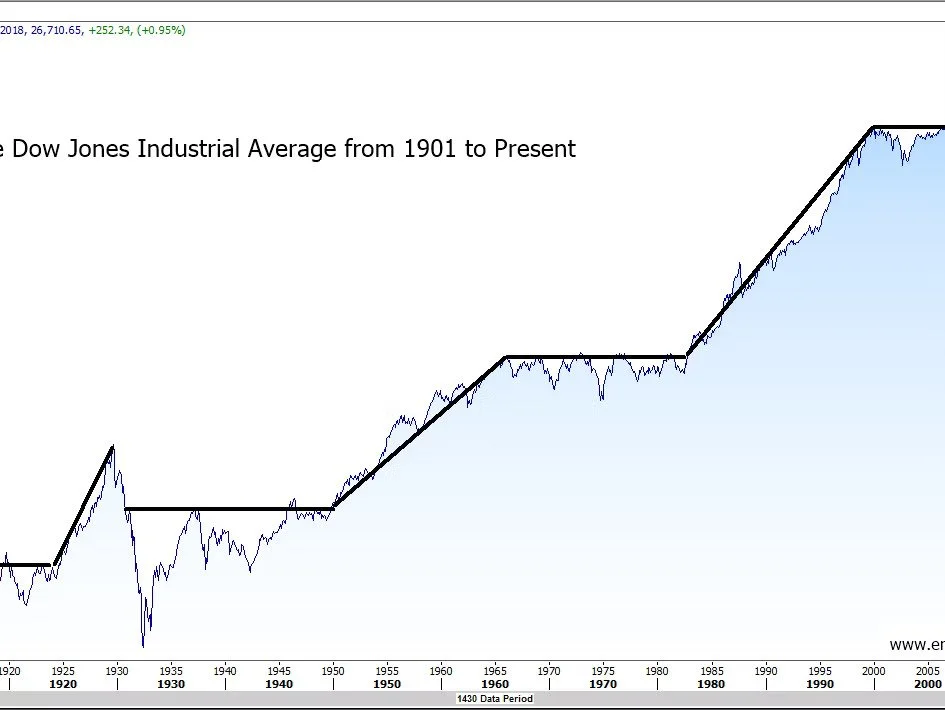

When I first started playing and working on the Street of Dreams in 1991, the Dow Jones Industrial Average was trading around 3000. On January 26th of this year the Blue Chip Index peaked at 26,616.71 before dropping 3256.42 points to hit an intraday low of 23,360.29 on February 9th.

Get the Picture?

I started my career in the investment business in 1991. Back then there were a lot of great regional investment firms with still familiar names. The one I worked for was A.G. Edwards and Sons, Inc

The Year of the Dog

In February of 2018 the Chinese Zodiac Calendar flips to the Year of the Dog, specifically the Year of the Brown Earth Dog.

Watching the FANGs for an Entry Point

According to Bespoke Institutional, stocks broke a 58 day streak of trading without a market move of over plus or minus 1% on August 10th. Since then stock market volatility has picked up some but not dramatically.

Stocks and Bombs

For the last week or so the conflict of words between North Korea and the United States seems to have changed from a rapid boil to a slow simmer, giving equities a boost during the first half of the week.

Do You Really Want to Sell This Market?

According to Bespoke Investment Group, the NASDAQ dropped over 2% for the first time in 100 trading days on Wednesday (5/17/17).

Investment Highlights - April 2017

The 1st quarter of 2017 started out optimistically on the part of investors as the surprise “Trump Rally” paused and then resumed in hopes of (on the part of the stock market) deregulation and tax cuts.

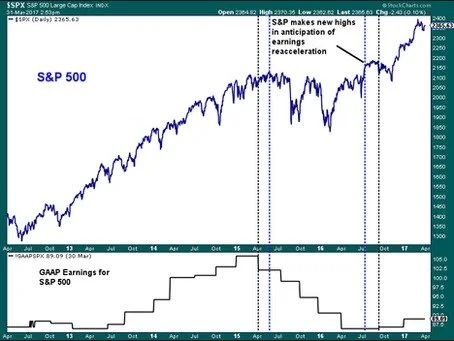

Is the Stock Market Really Overvalued?

With the strong bull run in stock prices since November, we have been reading more from the perma-bear community about how overvalued the stock market is.

2017 Outlook - Predictably Unpredictable

Anybody who has been in the investment business long enough knows the futility of forecasting financial events – especially when looking way out into the future.

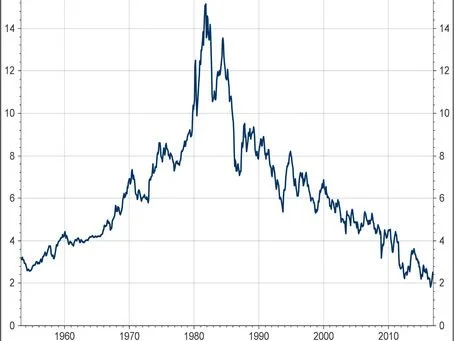

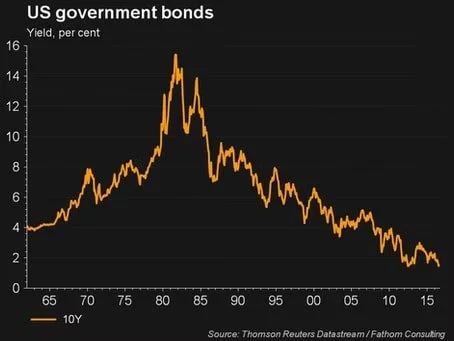

The Valuation Bears Have it Wrong

In today’s low return environment, investors are scrambling to find higher yielding investments in order to fund future or a current liabilities like retirement, the purchase of a second home, or a college education.

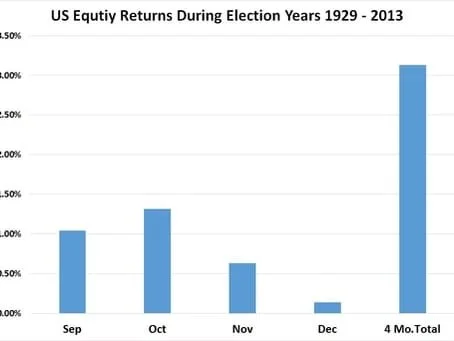

How the Election Could Affect Your Investment Portfolio

It seems that every election year the pundits bloviate on why this cycle is different than any other election year in history. It appears that the talking heads might be right this time.

What's in Style on Wall Street

Whether your game is growth or value, momentum, low volatility or indexing, strategies with strong academic underpinnings generally work out if they are implemented properly and if they are given enough time.

First Under Statement of 2016 - January was Rough!

If 2015 was flat and boring for investors, then 2016 has ushered in an unwelcome change to volatility and losses. We thought it might be helpful if our friends and clients could see the stock market through our eyes.

What to do if you see a Bear

It’s been well publicized that the month of January 2016 was not the worst January in history for US equities - it was the second worst. The interesting thing though, is how vocal the perma bear community has become - after the fact.