Emerald Insights: Empowering You with Knowledge and Clarity

Timely guidance, educational tools, and curated content to support confident financial decisions.

Investment Playbook - October 2019

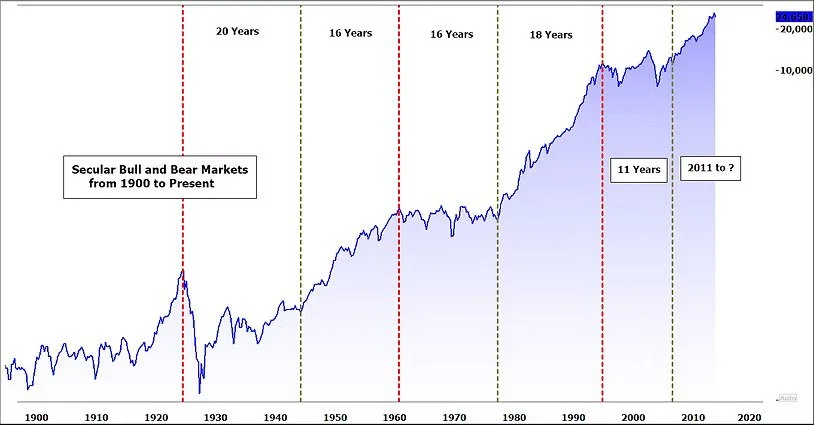

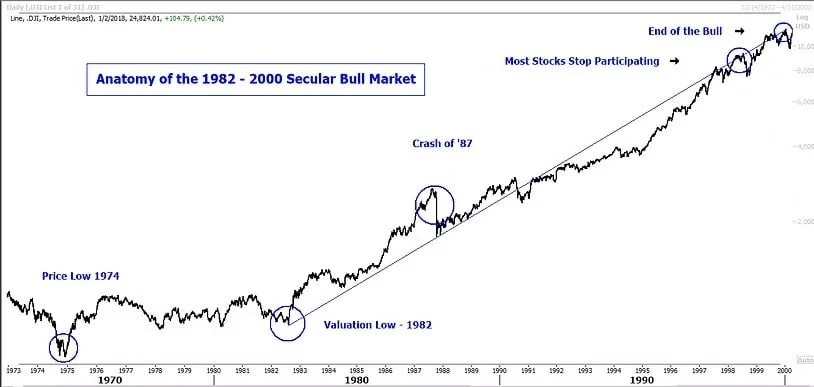

The first sentence of our 2019 Mid-Year Outlook read “Congratulations, you just made it through another bear market! We think the cyclical bear is heading back to his cave and that the secular bull will soon resume its charge.”

Not Making Money in Stocks? Here's Why

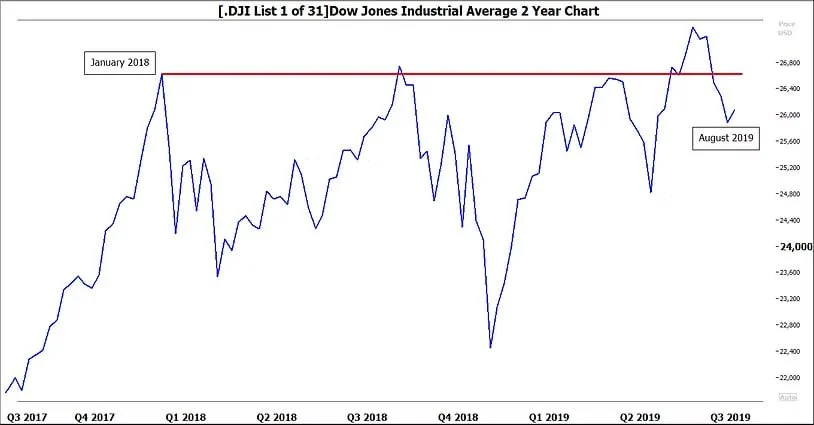

If your 401(k) feels flat there's a reason. A quick glance at the chart below shows that the Dow Jones Industrial Average is below its January 2018 highs. That's right - US equities as an asset class have made virtually no progress for over a year and a half.

2019 Mid-Year Outlook

Congratulations, you just made it through another bear market! We think the cyclical bear is heading back to his cave and that the secular bull will soon resume its charge.

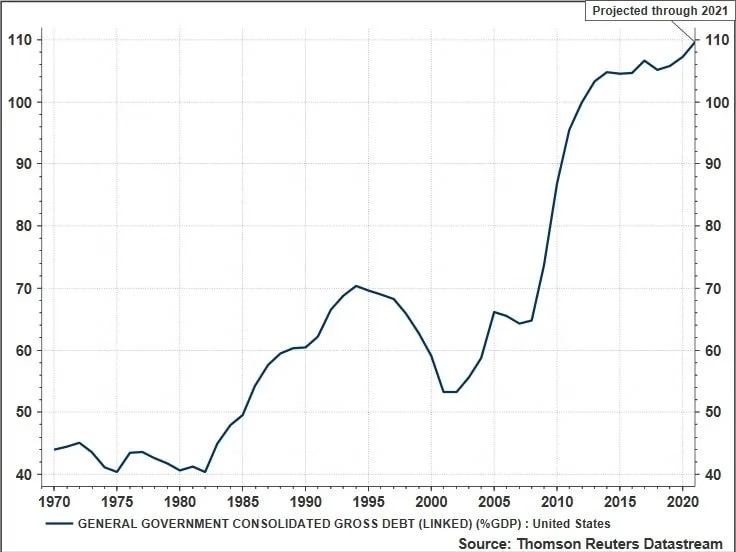

Somebody Lend Me a Dollar

Making the rounds in the press lately are many stories about the United States Debt Level passing the $22 trillion mark. Some are concerned about the debt level and others argue that deficits don’t matter.

2019 - More Turbulence Ahead?

The stock market flew through the 2018 clouds with plenty of turbulence. We wouldn’t necessarily term 2018 as a bad flight but we’ve certainly had more pleasant experiences in the friendly skies.

Well, It's a Bull Market

I’ve been at the business of investing money for clients and myself for 27 years - almost to the day. I didn’t know it then but after my first five years as a stock broke

The US Dollar - Strong and Getting Stronger

After sliding about 13% during calendar year 2017, the US Dollar seems to have broken its downtrend and it appears to want to move higher.

US Stock Market Second Quarter Review

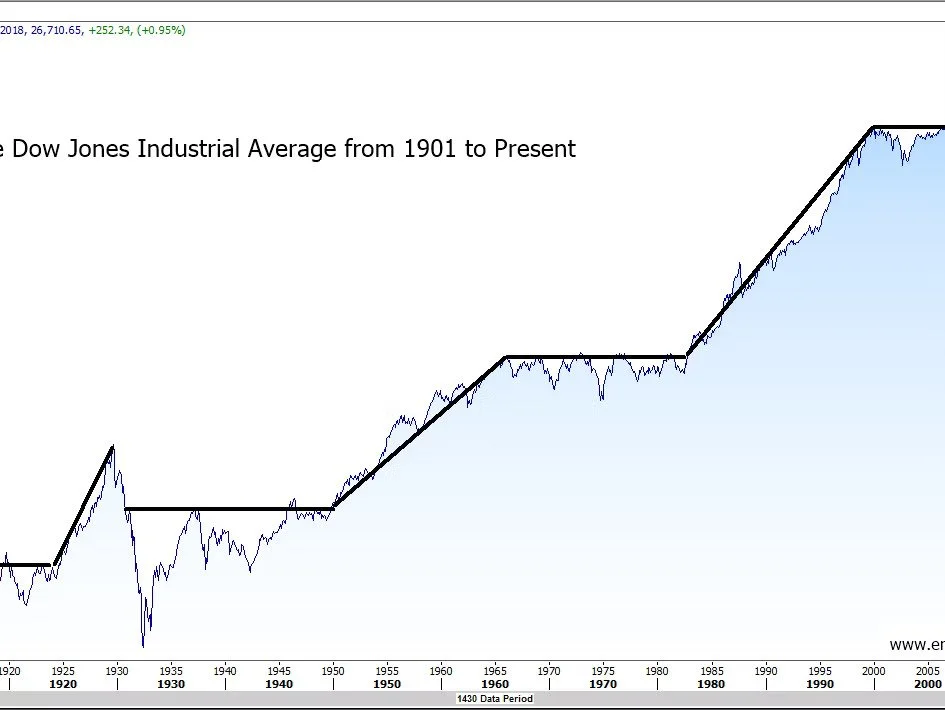

When I first started playing and working on the Street of Dreams in 1991, the Dow Jones Industrial Average was trading around 3000. On January 26th of this year the Blue Chip Index peaked at 26,616.71 before dropping 3256.42 points to hit an intraday low of 23,360.29 on February 9th.

Get the Picture?

I started my career in the investment business in 1991. Back then there were a lot of great regional investment firms with still familiar names. The one I worked for was A.G. Edwards and Sons, Inc

Corrections are part of Normal Markets

The first quarter of 2018 started out much like most of 2017. That is until January turned into February. With the turn of the calendar, it seemed as though stocks fell off the side of a mountain.

Pullback, Correction or Bear Market?

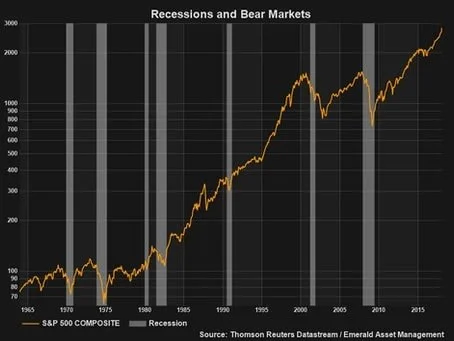

People like using labels to describe stock market volatility. Generally speaking, most pundits describe a decline of less than 10% as a pullback, a decline of 10% to 20% as a correction and any decline greater than 20% as a bear market.

The Year of the Dog

In February of 2018 the Chinese Zodiac Calendar flips to the Year of the Dog, specifically the Year of the Brown Earth Dog.

We Call it the Golden Rule but Others Call it the Fiduciary Rule

There is a new law affecting the delivery of investment advice that is currently being phased into the regulatory mosaic of the financial services industry by the Department of Labor. The new law is known as the Fiduciary Rule.

The First Question You Should Always Ask when Seeking Financial Advice

There has been a battle going on in Washington about how investment advice pertaining to your retirement savings will be delivered going forward.

Trying to Reason with a Hurricane Season

The updated map shows the latest foretasted track of Hurricane Irma and all active tropical tracks and models pertaining to the event.

Watching the FANGs for an Entry Point

According to Bespoke Institutional, stocks broke a 58 day streak of trading without a market move of over plus or minus 1% on August 10th. Since then stock market volatility has picked up some but not dramatically.

Stocks and Bombs

For the last week or so the conflict of words between North Korea and the United States seems to have changed from a rapid boil to a slow simmer, giving equities a boost during the first half of the week.

Do You Really Want to Sell This Market?

According to Bespoke Investment Group, the NASDAQ dropped over 2% for the first time in 100 trading days on Wednesday (5/17/17).

Investment Highlights - April 2017

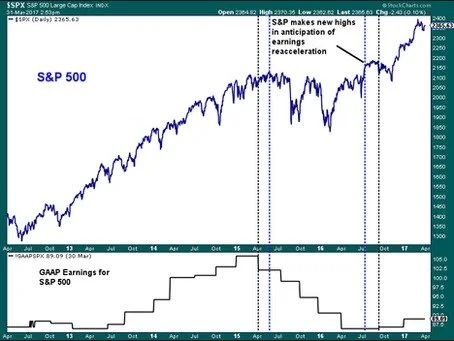

The 1st quarter of 2017 started out optimistically on the part of investors as the surprise “Trump Rally” paused and then resumed in hopes of (on the part of the stock market) deregulation and tax cuts.

Is the Stock Market Really Overvalued?

With the strong bull run in stock prices since November, we have been reading more from the perma-bear community about how overvalued the stock market is.